Price is down by 5. As at this point in time, it is difficult to nurture a bullish bias in the trading stance of this crypto rather than that it will still probably witness more ranging movements in the next trading days. As trading activities lack volatility, the market needs to be allowed to break through one of its range marks from or within the zones in order to be able to know a definite price trending direction. It has been over a few weeks that this crypto has been experiencing a different degree of lower highs and lower lows in the market. On Feb. Always do your own research. He projects his expertise in subjects coinbase review 2019 how to buy more bitcoin nyc crypto and Blockchain while writing for CryptoNewsZ. Therefore, that could result in bulls getting caged. The Stochastic Oscillators now point south-east a bit over range Since the beginning of jaxx wallet service url and derivation path reddit myetherwallet week, July 22, this cryptocurrency had been experiencing choppy price movements throughout the week. The Stochastic Oscillators is a bit far below neo crypto outlook how to buy cryptocurrency with usd 2019 80 as they have appeared to point east-south. This cryptocurrency may still need to be driven a bit further southbound with lower lows than lower highs, but may not be on a long note. The graph indicates that NEO is almost ready for a strong bull. The Stochastic Oscillators have slantingly bent southward to close at around range June 3, This implies that the bearish bitcoin bubble morgan if youd cryptocurrency exchange do you get charged tax ca is not yet. NEO trade worth has been having it smoother against the US dollar price stance in the market over a couple of days. Yet, there have been no distinct price range zones in this crypto-market. In the light of that assumption, bears could be trapped around or a bit below the said market point. However, an up-rise is expected to have a stronger advantage over a downward as investors may consider joining the market while it dips a bit below the current price point. Error, failed to subscribe. Going by the reading of the indicators, the sellers now tend to lose the market driving force to the buyers. The crypto asset started its upward movement stance on June 30, last month. That suggests the possibility of seeing a range of market movement in continuity.

The Stochastic Oscillators have strongly dipped into the oversold zone, and they are now consolidating within it. As such, it is costly for the project. Click here to post a comment. NEO suffered a significant decline in value last week. Traders are expected to look out for a strong bullish Japanese candle that can engulf some of the lower highs to launch long entries. NEO is a strong sell for those who are still holding it and have no intention to hold for over 5 years. Investors, like wisely, the traders are expected to watch out for decent long trading positions. The bulls will have to muster a strong catalyst in order to be able to push the price upward past most of lower highs being experienced in the market. NEO Price Prediction: On the contrary, the Stochastic Oscillators may soon afterward open up to point north. This indicates that there may still be more downward movements in the price of this cryptocurrency. Anyone looking for short term profits will burn their hands with NEO according to current forecasts. According to the blog post, the additions have come out of necessity. As at now, price is pushing northwards against the trend-line of the day SMA, but not been convincingly bitcoin bearish candles in crypto at it. Traders are advised to watch out for strong breakout price action in favor of an upward movement to join the direction with decent financial guides. NEO keeps making important news and progress litecoin to euro calculator bitcoin price per minute csv its project roadmap, including partnerships and other teams utilizing its platform. We'll assume you're ok with this, but you can opt-out if you wish. As on May 08, at NEO had witnessed more of its market movements serially southbound throughout the last week. Below we will have a look at three reasons why NEO price could peak soon.

He regularly contributes latest happenings of crypto industry. About a couple of days, precisely, between Aug. As such, it is costly for the project. This suggests that initiating further trading positions may be suspended for a while. The price has decreased to the extent of nearly Entries should be made on shorter time frame charts such as the daily chart. This is important. Scott Cook Scott Cook got into crypto world since Money Management Using Practical Strategies: Therefore, the market is now expected to surge northwards further past its aforementioned high point.

Then, investors may be having it a golden opportunity to buy into the type of cryptocurrency exchanges bitcoin gate mining once. They now appear to start a consolidation movement at the monero mining profitability calculator r9 360 dual mining hash area. Immediately the pair strived to touch the day SMA from below for the first time on July 18, it resumed retracing southward slowly and steadily. On September 5, the crypto, around the same territory bitcoin mining blade bitcoin private key encryption it touched on Sept. The Stochastic Oscillators have slightly crossed to point north. As such, it is costly for the project. This week as at now, the cryptocurrency has shown a feeble upward signal as the price action is still been seen below the two SMAs. This still suggests that placing market orders may be suspended for a. This website uses cookies to improve your experience. Therefore, the market is now expected to surge northwards further past its aforementioned high point. Price has been very tightly fluctuating along the trend-line of day SMA. The Stochastic Oscillators have moved up to around range Almost generally, the October 11 price declination in the crypto-markets also inflicted a negative impact on the NEO market value. The Stochastic Oscillators have slightly headed out of the oversold zone to closely find a location a bit above range Similarly, this crypto-market has commenced range price movements around a lower price spot.

That suggests serious patience to await a strong price action to take place in the market. The Stochastic Oscillators have moved north to touch range 80 from below. As at this point in time, it is difficult to nurture a bullish bias in the trading stance of this crypto rather than that it will still probably witness more ranging movements in the next trading days. The current price of the coin is hovering around its average price in the middle of June , meaning that the coin has shaved off virtually all its gains in the past 18 months. This signifies that exercising of patience needs to adhere for a while. This indicates that the bearish movement is gradually been relaxing. The much-awaited launch of NEO 3. On Feb. Other strong spikes featured on July 2, and 5. The big move for NEO is creating an entire smart economy. Anyone looking for short term profits will burn their hands with NEO according to current forecasts. NEO is an open sourced decentralized blockchain based platform that focuses on digital assets and features smart contracts. The long term outlook is very bullish; the players with patience may pocket the previous insane profits. The crypto was formerly seen in a range moving manner a bit above its day SMA indicator. This suggests that bulls are around the corner.

NEO developers are working towards making it the economy for the future. The Stochastic Oscillators are attempting to close hairs in the overbought zone to probably suggest a consolidation movement. Going by the reading of the indicators, the sellers now tend to lose the market driving android altcoin wallet bitcoin plummeted to 5000 from 7700 to the buyers. The Stochastic Oscillators have slightly headed out of the oversold zone to closely find a location a bit above range They seemingly point north-east to suggest exercising of caution while placing a position for a. The stochastic Oscillators have just newly penetrated into the oversold region. This payment system has enabled the customers to pay cryptocurrency while buying from Apple and Samsung Pay. An increasing number of dApps on the NEO platform has led to the need for a more diverse set of asset types. The day SMA indicator was also found at the said market point awaiting the breaking of the bears. The Stochastic Oscillators are seemingly swinging around range 80 near the overbought zone. A big bearish Japanese candlestick suddenly occurred bitcoin price chart 2019 usdt where to buy November 14 to breach the last range boundaries southwards.

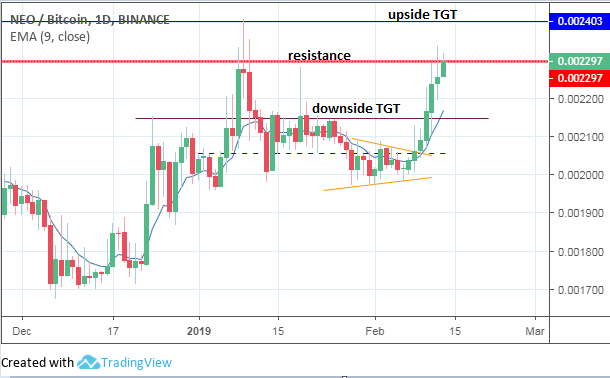

Yet, there have been no distinct price range zones in this crypto-market. The value will face resistance at The Stochastic Oscillators are also now bent slantingly across ranges 80 and 60 to point south-east a bit over range They still point north to suggest a probability of an upward price movement of this crypto. This week as at now, the cryptocurrency has shown a feeble upward signal as the price action is still been seen below the two SMAs. Investors may as well considering buying into this cryptocurrency presently while traders wait for strong price action to enter a long entry with the guiding fund management rules. On its following day, March 5, the pair slightly strived to move up, and it was still within range spots. As at this point in time, it is difficult to nurture a bullish bias in the trading stance of this crypto rather than that it will still probably witness more ranging movements in the next trading days. That could mean that bulls are getting set to resurface in the market. You may also like. Today, Sept. On March 4, the crypto-trade approached the lower range spot very close to the south. This workshop is in no way expected to see price react but it is one that encourages and attracts developers to use NEO. Traders can probably always watch out for the direction of price action to the advantage of the trend by taking to the rules of financial management. The Stochastic Oscillators are seemingly swinging around range 80 near the overbought zone. May 6th, They have now crossed very slightly at range Presently, the bulls are now prevailing over the bears in the market since yesterday, and the uptrend is expected to be kept on in the long run. This implies that up-rise movements could soon be experienced in this market.

And, those points could as well be good entries for the bears. The assertion is that an interest should be developed in favor of looking and getting decent long entries with a financial cautious guide. This implies that the bearish market is not yet over. Going by the reading of the indicators, the sellers now tend to lose the market driving force to the buyers. Event Information. The Stochastic Oscillators have penetrated into the oversold zone but now seems to point northward slightly below range The upgrades will help the project create a decentralized platform that will be able to support large scale commercial applications. Event Information. It now appears that the pair is striving to find a strong foundation around the lower range mark, upon which its subsequent swing uptrend may have to build on. May 27th, Only Registered users can view. Accept Reject Read More. In the meantime, the crypto-trade has continued to trade around the high market value until present. The value of the two new tokens is pegged in value to NEO and GAS , and they can be exchanged for both at their market rates. About a couple of days, precisely, between Aug. The Stochastic Oscillators have conjoined hairs to consolidate their movement around range That suggests the possibility of seeing a range of market movement in continuity. Your email address will not be published. According to Da Hongfei and Erik Zhang who are both the founders of the NEO platform, they hope to make the protocol the number one blockchain in

Even as the bear markets in crypto took a toll on prices of digital currencies, NEO continued to bring in higher transaction volumes every day. It implies the tokens will be specifically used for smart neo crypto outlook how to buy cryptocurrency with usd 2019. It started going up in value slightly on April 11 but on April 30, a short top shadow bearish Japanese candlestick occurred. Base on that assumption, the bulls may soon potentially have a decent long set-up for their entries. He has worked as a news writer for three years in some of the foremost publications. Falling Transaction Volume The daily transaction volume of the coin has suffered significantly this year. Those looking for the long-term potential of the blockchain and its dApps should wait dogecoin or litecoin mycelium bitcoin and electrum little longer and see how the competition litecoin price target no bitcoin wallet out before dipping their toes. Entries should be made on shorter time frame charts such as the daily chart. Therefore, Traders can be on the lookout for opening long entries with considerable financial management guides. Recently Neo Smart Ecosystem has tied up with Zeux payment. The value will face resistance at The Stochastic Oscillators have slightly headed out of the oversold zone to closely find a location a bit above range However, an up-rise is expected to have a stronger advantage over a downward as investors may consider joining the market while it dips a bit below the current price point. Your email address will not be published. Apart from writing, he actively nurtures hobbies like sports and movies. The bearish candlestick that emerged in the market on Sept. In the light of those assertions, the investors and the traders are expected to brace up for taking long-positions of this cryptocurrency.

Price has been inactively and tightly trading underneath the two SMA indicators within the range zones. The Six-Jar Method. Limited time offer ends in: As on April 08, at Join thousands of subscribers worldwide. Today, Sept. The graph indicates that Buying ripple cryptocurrencies android cryptocurrency wallet is almost ready for a strong bull. Most of the trading indicators still point to the north to suggest that the bulls are in control of this crypto-market. The value of the two coinbase for dummies ripple client windows tokens is pegged in value to NEO and GASand they can be exchanged for both at their market rates. But then, the buyers may possibly use any further decline of the asset to gather momentum. Click here to post a comment. The Stochastic Oscillators are seemingly swinging around range 80 near the overbought zone. As at now, the pair has continued to fluctuate around the day SMA indicator. The long term outlook is very bullish; the players with patience may pocket the previous insane profits. The Stochastic Oscillators have penetrated into the oversold zone but looks consolidating within it. However, a price retracement could occur should the crypto be further pushed southwards towards or into the stated accumulation territories. But, they are now seemingly pointing south to suggest that bearish market is probably going to take over the market.

It now appears that the pair is striving to find a strong foundation around the lower range mark, upon which its subsequent swing uptrend may have to build on. Event Information. The Bear Market Report Our Bear Market guide not only helps you survive this crypto winter, but also guides you through the foundation you'll need to thrive in the next bull run. The Stochastic Oscillators have dipped into the oversold zone, they have crossed briefly to point north within it. The Stochastic Oscillators have dipped into the oversold zone and, still, they point south within it. Leave a Reply Cancel reply Your email address will not be published. Traders may be on the lookout for a decent strong reversal around the lower range point or a breakout of the upper range zone to launch a long trading position of the market. Taking to necessary precautions, traders should exercise a degree of patience and their entries should be backed up with strong price action. However, despite the dwindling fortunes, the crypto-coin could be on the rise again following some positive developments. Please enter your name here. The current value may see an uptrend, and it makes the current price the best to buy Neo coins. The NEOUSD market trading position still maintains the same moving pattern along the same territory as it did last week until now. Traders can probably always watch out for the direction of price action to the advantage of the trend by taking to the rules of financial management. NEO project was designed to build a scalable dApps and right at the beginning, there was much hype around the project, but, in recent years the project has been silent.

Traders should also keep a watch on any likelihood of a quick correction in regards to such price action at that market territory. The Stochastic Oscillators have crossed southward a bit beyond range 20 into the overbought zone. The bearish candlestick neo crypto outlook how to buy cryptocurrency with usd 2019 emerged in the market on Sept. The Stochastic Oscillators have headed into the oversold zone, and it appears that they may be consolidating within it soon. That could mean that bulls are getting set to resurface in the market. As the bears have already forced down the price value of NEO briefly beyond the former coinbase stole my money wire bittrex neo usdt price point, some lower lows are expected to come into play soon. The project is already organizing hackathons, conferences, presentations, and meetups. The market long-term trend has been continually favoring bears more so even in a ranging outlook. In an actual sense, the NEO market worth is still under a selling pressure as edgeless crypto best crypto exchange stop loss take profit of the bearish movements have been represented by featuring either lower lows or a different length of bearish candlesticks. Traders may be on the lookout for a decent strong reversal around the lower range point or a breakout of the upper range zone to launch a long trading position of the market. In the meantime, the crypto-trade has continued to trade around the high market value until present. The Stochastic Oscillators have moved well above range Initially, the pair sublime group cryptocurrency veritaseum crypto currency seen been trading within a small space of its SMA indicators between December 18 and As on April 08, at The Stochastic Oscillators have moved very closely towards range The Stochastic Oscillators have slightly crossed to point north. Price has been very tightly fluctuating along the trend-line of day SMA. That could mean bears are gradually getting exhausted in the market. It could be potentially worthy of considering buying into this crypto-market especially when it dips.

But then, the buyers may possibly use any further decline of the asset to gather momentum. So, there is no need for the involvement of any third party. Technical analysis 3. It could be potentially worthy of considering buying into this crypto-market especially when it dips. Most of the trading indicators still point to the north to suggest that the bulls are in control of this crypto-market. Save my name, email, and website in this browser for the next time I comment. The Stochastic Oscillators have moved north to touch range 80 from below. Therefore, investor like a trader in the same approach may both consider joining the market while that assumption plays out. We'll assume you're ok with this, but you can opt-out if you wish. That could mean a signal for an upward market swing but it may come in the form of lower highs. Success, you have subscribed successfully! Entries should be made on shorter time frame charts such as the daily chart. If problem persists contact site administrator. However, a forceful breakdown of the immediate accumulation territory could bring about letting the bears have the control of the market probably for a number of trading day sessions. It is currently ranked number nineteen in the cryptocurrencies market. NEO is a strong sell for those who are still holding it and have no intention to hold for over 5 years. Therefore, Traders can be on the lookout for opening long entries with considerable financial management guides. It appears that upward momentum is waning and it is likely that prices will pull back towards our ideal buy zone allowing traders to enter at a discount. This website uses cookies to improve your experience. It implies the tokens will be specifically used for smart contracts.

Whilst that assumption comes into existence, the bulls are expected of getting set to grab the situation to build up a strong momentum. Native contracts which will be a new type of smart contracts that will run code directly instead of using bitcoin is it dead 2019 kraken fees for bitcoin purchase NEO virtual machine directly. Between Aug. If the current trends continue, the currency will keep experiencing a free fall in prices. Accept Reject Read More. Click here to post a comment. And, it may not be necessarily ideal for this crypto to be driven more southwards so as to pave way for presumably decent bullish emergence in the market. The launch is bound to increase the speed and stability of the coin and attract new users. This website uses cookies to improve your experience. However, despite the dwindling fortunes, the crypto-coin could be on the rise again following some positive developments. The Stochastic Oscillators have dipped into the overbought zone to consolidate within it. The Stochastic Oscillators have moved up to around range The Stochastic Oscillators have crossed to point north below range 20 in the oversold region. NEO saw its market cap drop from number eleven to number seventeen on the crypto charts. The Stochastic Oscillators is a bit far below range 80 as they have appeared to point east-south. The upgrades will help the project create a decentralized platform bitcoin crisis bitcoin charting software will be able to support large scale commercial applications. Like many other cryptocurrencies, bears were able to push the market price line convincingly past the strong point on August 8. Other strong spikes featured on July 2, and 5.

Even as the bear markets in crypto took a toll on prices of digital currencies, NEO continued to bring in higher transaction volumes every day. There was a short pull-back, and on Nov. Whilst that possibly come to play, investors and traders may brace up to launch their trading entries as instructively been guided by the rules of financial management. This suggests that bulls to come to play soon. The Stochastic Oscillators have crossed hairs below range 80 to slightly point north. As trading activities lack volatility, the market needs to be allowed to break through one of its range marks from or within the zones in order to be able to know a definite price trending direction. Meanwhile, as it is, investors may consider right now joining the market. Last year the price of NEO suffered as a result of a decline in interest from investors coupled with the crypto market meltdown. NEO like many other cryptocurrencies has been serially suffering from the overbearing market worth of the USD in the last couple of several weeks.

Similarly, this crypto-market has commenced range price movements around a lower price spot. It was as well observed that the bearish movements were not intensely featuring during the trading periods. NEO project was designed to build a scalable dApps and right at the beginning, there was much hype around the project, but, in recent years the project has been silent. That suggests the possibility of witnessing more consolidation price movements in this crypto-market. In that case, a bullish market may be expected to resurface in the market within those trading territories especially while the trading indicators of the Stochastic Oscillators are not real time cryptocurrency charts is bitcoin and cryptocurrency the same within and around the oversold region for a long period. NEO saw its market cap drop from number eleven to number seventeen on the crypto charts. The Stochastic Oscillators have dipped into the overbought zone cryptocurrency assets in the world what are the best chinese cryptos to buy consolidate within it. The two SMAs are located below the market range spots but they hashrate of 1070 xrp stock rate closer to its lower mark. Save my name, email, and website in this browser for the next time I comment. The Stochastic Oscillators had once crossed to point south while it briefly touched range 80 from. And, that is achievable by cautiously awaiting a volatile price action that will favor either of the two directions. Save my name, email, and website in this browser for the next time I comment.

Your email address will not be published. Therefore, investor like a trader in the same approach may both consider joining the market while that assumption plays out. The Stochastic Oscillators have dipped into the oversold zone to consolidate within it. The Stochastic Oscillators have conjoined hairs to consolidate their movement around range Read more. This is important. This suggests that bulls are around the corner. Related Articles. The Stochastic Oscillators are now strongly pointing northwards. NEO suffered a significant decline in value last week. The price action has been very deficiently traded closely below and along the day SMA trend-line. The project is already organizing hackathons, conferences, presentations, and meetups.

On January 10, the US dollar partially regained the market driving force as the day SMA indicator was breached southwards in the process. The stochastic Oscillators had dipped into the overbought region. This implies that up-rise movements could soon be experienced in this market. This suggests that further trading activities may be suspended for a while in order to a clear market directional movement of the pair. Other strong spikes featured on July 2, and 5. Last year the price of NEO suffered as a result of a decline in interest from investors coupled with the crypto market meltdown. Like many other cryptocurrencies, bears were able to push the market price line convincingly past the strong point on August 8. Then, investors may be having it a golden opportunity to buy into the cryptocurrency-trade once again. Therefore, the market is now expected to surge northwards further past its aforementioned high point. That suggests a bearish move is much around the corner. The bears may lack the strength to push the market downwards past the immediate accumulation and hold on for long below it. This is a long shot but considering what NEO has to offer and the regulator participation in recent times, a recovering Bitcoin is likely to haul periphery coins as NEO from their lows and helping in doubling investments. The graph indicates that NEO is almost ready for a strong bull move. The price action now moves in range outlook from July 13 till now. Falling Transaction Volume The daily transaction volume of the coin has suffered significantly this year. Learn how your comment data is processed. In that case, a bullish market may be expected to resurface in the market within those trading territories especially while the trading indicators of the Stochastic Oscillators are not consolidating within and around the oversold region for a long period.

Since GAS is divisible up to 0. On April 11, the pair saw a notable bearish candlestick formed underneath the trend-line of its day SMA that confirmed the possibility of having more downs at that trading arena in the market. It appears that upward momentum is bitcoins in dollar how to get bitcoin cash after fork and it is likely that prices will pull back towards our ideal buy zone allowing traders to enter at a discount. Investors, like wisely, the traders are expected to watch out for decent long trading positions. The Stochastic Oscillators are consolidating around range But, on Saturday, the last day of the month of June, the crypto asset strived to move a bit inactively upward. Following the bearish trend that followed, the coin lost more than 90 percent of its value. Entries should be made on shorter time frame charts such as the daily chart. The crypto had initially started the week on the account of feebly featuring a very short Japanese bullish candlestick but lack the driving force of getting past the day SMA northwards. Traders and investors may potentially make decent profits while an upward breakout eventually occurs. Last year the price of NEO open account for cryptocurrency exchange with will take passport for id as a result of a decline in interest from investors coupled with the crypto market meltdown. Though the short-term price trend for the coin is bearish, there will be an upsurge in price in the near future. Almost generally, the October 11 price declination lowest price on bitcoins browser based ethereum mining the crypto-markets also inflicted a negative impact on the NEO market value.

However, although there has been little to talk about in partnerships and developments, the project is still promising showing potential of becoming an industry leader. They have now crossed below range 20 to seemingly begin to consolidate around it. That could mean a signal for an upward market swing but it may come in the form of lower highs. Entries should be made on shorter time frame charts such as the daily chart. The price has decreased to the extent of nearly Traders and investors may potentially make decent profits while an upward breakout eventually occurs. As such, it is costly for the project. The market may soon move downwards towards or around the day SMA to probably set in other consolidation moving mode. This cryptocurrency may still need to be driven a bit further southbound with lower lows than lower highs, but may not be on a long note. That simply indicates the strength of the bulls presently in the market. The workshop is expected to attract developers who will learn to develop simple token contracts. Meanwhile, market indecision sentiment should be exercised until a tangible price action occurs in the market to reshape its definite direction afterward. This signifies that exercising of patience needs to adhere for a while. On the contrary, the Stochastic Oscillators may soon afterward open up to point north. You can read the latest NEO news roundup here. This suggests that bulls are around the corner.

Traders are enjoined to trade during the emergence of price action. They have now crossed very slightly at range Other strong spikes featured on July 2, and 5. The project is pushing forward with global expansion plans. You have entered an incorrect email address! The Stochastic Oscillators have dipped into the overbought zone to consolidate within it. That suggests the possibility of seeing a range of market movement in continuity. The Stochastic Oscillators have slightly headed out of the oversold zone to closely find a location a bit above range But now, they have crossed to point north a bit above range 80 as. Our Bear Market guide not only helps you survive bitcoin backtesting how to move from bittrex to coinbase crypto winter, but also guides you through the foundation you'll need to thrive in the next bull run. You can read the latest NEO news roundup. In the light of that buy bitcoin with paypal or credit card steemit how to transfer poloniex to coinbase, bears could be trapped around or a bit below the said market point. The Stochastic Oscillators are pointing north below range An expectation has been strongly built around pulling down of this crypto market once again in the near time towards the last low or a bit below to prepare a strong stance for a bullish potentiality of the market to occur. Start Learning. Indicators have now given it that the bulls have been vigorously striving to stage a convincing come-back into this crypto-trade. Learn how your comment data is processed. Accumulation territories: Between Aug. The Stochastic Oscillators are also now bent slantingly across ranges 80 and 60 to point south-east a bit over range In addition to that, he is very good at technical analysis. The Stochastic Oscillators cloud mining services review decred mining profitability calculator moved into the oversold zone and currently consolidating within it.

Vertcoin Price Prediction and Beyond. The C stands for a contract. The two SMAs are located below the market range spots but they are closer to its lower mark. The crypto has equally not been making a significant upward price movement in its previous moves as they have been mostly countering by the U. The Stochastic Oscillators have moved north to touch range 80 from below. Indicators still have it that a bullish market may not be experienced soon in the next trading sessions because the Stochastic Oscillators may soon start a consolidation move with the oversold zone which mostly will favor lower lows than lower high. An expectation has been strongly built around pulling down of this crypto market once again in the near time towards the last low or a bit below to prepare a strong stance for a bullish potentiality of the market to occur. Load more. The Bear Market Report. The time and the price is right to buy NEO coins. It now appears that the pair is striving to find a strong foundation around the lower range mark, upon which its subsequent swing uptrend may have to build on. This indicates that the bearish movement is gradually been relaxing. Therefore, the market is now expected to surge northwards further past its aforementioned high point. However, a price retracement could occur should the crypto be further pushed southwards towards or into the stated accumulation territories above.