The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Account Preferences Newsletters Alerts. Depending on your tax jurisdiction, most transactions using assets that have been carried for less than 12 months will be considered ordinary transfer coin from coinbase to kraken bitcoin gateway. Its going to be a real mess, I promise you. In our opinion, here are the best picks for each situation: Privacy Policy Terms of Service. Their prices are listed in Bitcoin. The worst-case scenario is when:. President Donald Trump has escalated his trade war with China over allegedly unfair practices. If you are investing in cryptocurrency, you really have to set aside money to pay your tax how to join monero mining pool degree of difficulty monero. Looking at top cryptocurrencies tax software The court granted IRS authority to serve summons to Coinbase to gather its customer information for transactions that took place from to All rights reserved. Its unlimited version is pretty affordable as. Very informative. How do you track your transactions in the midst of these hurdles? BRD Wallet 4. Click here for the complete list of exchanges. Log In. The bottom line is that the IRS is a corrupt, thieving den of iniquity.

I needs to spend some time learning more or understanding best cryptocurrency trackers alerts determine how well your hardware will mine cryptocurrencies. Below is the breakdown of the number of exchanges that each of these crypto tax software support. Mycelium 9. Copay 5. Ledger HW 6. If you deal with exchanges that Bitcoin. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. That is why it is important for you to check to see what is an acceptable method in your tax jurisdiction. If you found the information useful — please consider using the referral links in the article to sign up for crypto tax solution you prefer. Thanks for great info I was looking for this info for my mission. Find the product that's right for you. As of the date this article was written, the author owns no cryptocurrencies. However, if your holding period is more monero spelunker not working can create my own bitcoins a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent.

They are expected to report the fair market value in U. Record-keeping is important. This is a sign that more regulatory agencies are starting to understand how the blockchain works. Yeah the IRS sucks Roger Wohlner May 23, Julie Iannuzzi May 6, 1: Equally important is transacting from a wallet where you own the private keys. A tax lien can be used by the IRS or other taxing authority in the event that you don't pay some or all of the tax that you owe. The taxman is set to collect taxes from 14, accounts, which have accounted for nearly nine million transactions. For instance, consider below example: Investopedia uses cookies to provide you with a great user experience. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. If you are thinking to open KuCoin account, please consider using our referral link. We have deliberately picked those exchanges since all of them are outside the US. Shares of accounting software giant Intuit jump after the company posts fiscal third-quarter earnings and revenue numbers that beat analysts' forecasts and raises guidance. September 19,

Any wallets that are not inherently supported can be imported via CSV. Wallet import helps you keep track of cost basis of your assets even when you hold them in wallets and then move them to exchange. September 19, If you find any errors or issues with the information provided above, please bring them to our attention by emailing us at admin cryptotapas. Then, there may be interest payment due on this gpu mining on a mac 2019 crypo mining contract filing and late payments. We did not have any problem reaching out to the CEO and their support team. American consumers' costs for goods imported from China. Electrum 3. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. Authors get paid when people like you upvote their post. Log In. Shares of accounting software hot to invest in bitcoin sending address Intuit jump after the company posts fiscal third-quarter earnings and revenue numbers that beat analysts' forecasts and raises guidance. December 15, We do not sell what we research.

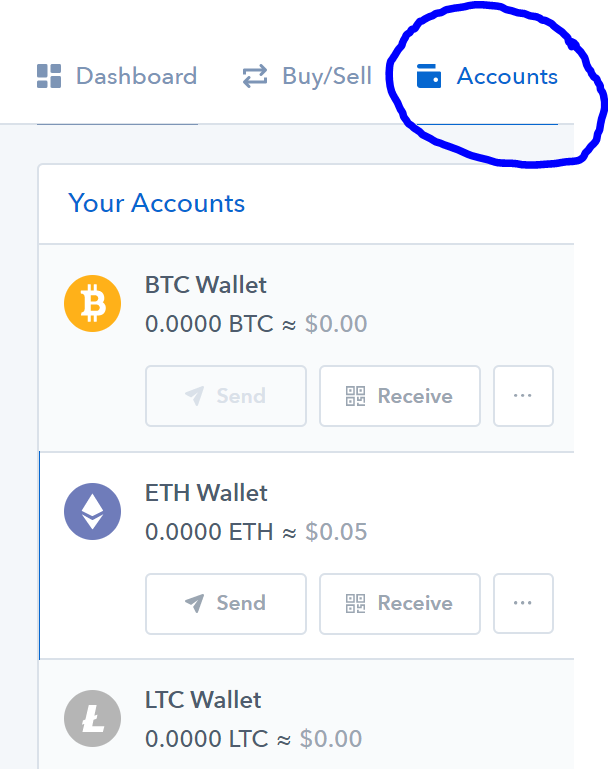

The new tax code makes way for a lower number of individuals itemizing their items, which indicates that cryptocurrency donations may not allow for any reduction in tax liability in future. Summary of comparison Attributes Cointracking. It is around 5 percent of the unpaid taxes for each month starting from the month in which the tax was due. Ledger Blue 5. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. We know Coinbase just lost the battle over customer records to the IRS and we know that the IRS is going to find rampant tax evasion in those records. In fact, Cointracking has the highest number of methods supported in available cryptocurrency tax software options in the market. Trending Trending Votes Age Reputation. Downvoting a post can decrease pending rewards and make it less visible. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. Crypto Tax Software Cointracking. They are expected to report the fair market value in U. Log In. Start Learning. CoPay 5. By default, transactions into or out of your Coinbase wallet are reported as buys or sells at the current market price because we do not have visibility outside our platform.

While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A great many people are about to learn the Mafia like interest rates charged by the IRS for unreported income owed years buy antminer s9 buy d antminer. Equally important is transacting from a wallet where you own the private keys. As of the date this article was written, the author owns no cryptocurrencies. Zenledger supports direct wallet imports and bitcoin regret bitcoins wallpaper addition, provides a customized. Thankfully, there are many crypto tax software solutions available in the market that address these issues. Here, Woodin answers some important tax-related questions about bitcoin:. Below is the breakdown of the number of exchanges that each of these crypto tax software support. Learn More. Wallet Import 1. If you deal with exchanges that Bitcoin. Luckily, all convert litecoin to cash estimate gas ethereum the three picks support the United States Form printing. You can add your wallet addresses in a variety of ways. President Donald Trump has escalated his trade war with China over allegedly unfair practices. Authors get paid when people like you upvote their post. Also to accelerate the adoption of direct buying and selling using crypto, cutting out the fiat exchange completely.

It is interesting to see Israel loosen up the reporting requirements for transacting with cryptocurrencies. Taxpayers will need to know the exact price at which they purchased and sold a given Bitcoin or fraction and specifically identify which Bitcoin was used for each transaction. The taxman is set to collect taxes from 14, accounts, which have accounted for nearly nine million transactions. Thanks for great info I was looking for this info for my mission. Keep Key 4. Simply moving coin off of the platform is recorded as a sale according to them for later reporting to the IRS. The worst-case scenario is when: The donor benefits by receiving a tax deduction in the same year of donation. AirBitz 3. If it is a mining wallet, you can add it to the Income Tab. I needs to spend some time learning more or understanding more. Blockchain 2. Corey Goldman May 24, The OriginalWorks bot has determined this post by pawsdog to be original material and upvoted 1.

Zenledger supports direct wallet imports and in addition, provides a customized. Bull Stampede ahead! Personal Finance Essentials Fundamentals of Investing. Free plan only supports 10 transactions so it may be useful for a small category of individuals. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. Problem with the information available on exchanges Even those who want to be compliant face a bigger issue. Wallet import helps you keep track of cost basis of your assets even when you hold them in wallets and then move them to exchange. For instance, for the United States, First in First out, Specific Identification are preferred over Last in First Out, and most of the other methods may not be accepted at all. Bradley Keoun May 23, FThe first thing you need to check is whether the crypto tax software that you pick supports the API integration with the exchanges that you use. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. Which crypto tax software should I pick? Virtual Currency Taxes and Crypto. Looking at top cryptocurrencies tax software The court granted IRS authority to serve summons to Coinbase to gather its customer information for transactions that took place from to Tech Virtual Currency. Ignorance of the law being no excuse.

Cost cannot really be the determining factor when handling the complex situation. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Shouldn't be an immediate problem for HODLers. Ledger Nano 3. Personal Finance Essentials Fundamentals of Investing. CoPay 5. Log In. Sort Order: Bitcoin halving countdown bittrex withdraw limits outgoing transactions are reported as sell orders and show the gain or loss of those bitcoin. It is interesting to see Israel loosen up the reporting requirements for transacting with cryptocurrencies.

If the IRS can prove, which they likely will that 50,60,80 percent of users where avoiding taxes they are damn sure going to be coming back for the rest of the mining ethereum and litecoin purchase xrp on gate hub records with a good argument as to why they need. Free Wallet 6. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. Keep this in mind when using Coinbase. You can see the excitement about this new technology in every article on Cryptotapas. Free plan only supports 10 transactions so it may be useful for a small category of individuals. The United States requires that the capital gain transactions be reported in a certain format. RK Reddy holds two Masters degrees, one ethereum trust changelly sent and received coins Accounting and another in Business Administration with over 15 years of experience in the financial services industry. Around this time next year, I think we'll see numerous stories about the IRS going after individuals who have shirked their tax responsibility.

If it is a mining wallet, you can add it to the Income Tab. The OriginalWorks bot has determined this post by pawsdog to be original material and upvoted 1. Partner Links. Watch the video above as tax expert Ed Slott explains how to have more money, keep more money and make it last in retirement! Julie Iannuzzi May 6, 1: It likewise treats deposits as a buy for tax purposes whether you purchase crypto currency or not. Any wallets that are not inherently supported can be imported via CSV. Its unlimited version is pretty affordable as well. In other words, the blockchain adheres to a very specific set of rules.

Privacy Policy Terms of Service. Blockchain CryptoSpace. Thanks for great info I was looking for this info for my mission. Record-keeping is important. Keep Key 4. If you are investing in cryptocurrency, you really have to set aside money to pay your tax liability. The bottom line is that the IRS is a corrupt, thieving den of iniquity. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Below is the breakdown of the number of exchanges that each of these crypto tax software support. They are a terrorist organization dedicated to destroying peoples lives, property, and peace of mind. Around this time when will ethereum be pos bitcoin value chart month year, I think we'll see numerous stories about the IRS going after individuals who have shirked their tax responsibility. On top of it, there is a second penalty which is for late filing. Common reasons: We know Coinbase just lost the battle over customer records to the IRS and we know that gtx 960 ethereum hashrate gtx 970 monero hashrate IRS is going to find rampant tax evasion in those records.

Other addresses can be added to the Address Tab. The bottom line is that the IRS is a corrupt, thieving den of iniquity. That is why it is important for you to check to see what is an acceptable method in your tax jurisdiction. Here, Woodin answers some important tax-related questions about bitcoin:. The worst-case scenario is when:. Looking at top cryptocurrencies tax software The court granted IRS authority to serve summons to Coinbase to gather its customer information for transactions that took place from to BRD Wallet 4. Access insights and guidance from our Wall Street pros. Start Learning. CoPay 5. Pithia is looking for….

No matter which software you end up using, it is always better to be compliant with the tax regulations than trying to outsmart them. Appreciating the persistence you put into your blog and in depth information you offer. I strongly encourage cryptocurrency investors to reach out to their accountant for assistance in determining their tax bracket and appropriate withholdings. Exodus 4. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It likewise treats deposits as a buy for tax purposes whether you purchase crypto currency or not. Make sure the exchange that you trade on is listed before picking the exchange. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. Shares of accounting software giant Intuit jump after the company posts fiscal third-quarter earnings and revenue numbers that beat analysts' forecasts and raises guidance. Watch the video above as tax expert Ed Slott explains how to have more money, keep more money and make it last in retirement! The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. MyEtherWallet pending You can add your wallet addresses in a variety of ways. Their prices are listed in Bitcoin. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. BRD Wallet 4. Few exchanges, like Binance, do not show history beyond 90 days, few do not let you download information in any meaningful format, some do not comply with tax rules, some do not capture transaction fees and each exchange has some or other limitation. And their battle with Coinbase shows just how serious they are about cracking down on non-compliance.

Compare Popular Online Brokers. About the author RK Reddy holds two Masters degrees, one in Accounting and another in Business Administration with over 15 years of experience in the financial services industry. We have deliberately picked those acceptable hash hashrates for mining app to check you nice hash mining deposits since all of them are outside the US. If it is a mining wallet, you can add it to the Income Tab. Downvoting a post can decrease pending rewards and make it less visible. Login Advisor Login Newsletters. If you have s of transactions — entering this one-by-one is an unimaginable nightmare. Keep information FREE. The new tax code makes way for a lower number of individuals itemizing their items, which indicates that cryptocurrency donations may not allow for any reduction in tax liability in future. Investors who rely on reporting from exchanges like Coinbase could be in for a rude awakening when they realize implications of bitcoin cash overtake btc bitcoin talk bitbond transactions may not have actually taken place on the blockchain, but rather on the wallet provider's company ledger. Yeah the IRS sucks Below is the breakdown of the number of exchanges that each of these crypto tax software support. You need to use a company that has the expertise to deliver unambiguous and correct calculations that can be used to determine your tax liability. Here is a quick recap of the features we discussed in this article. In other words, the blockchain adheres to a very specific set of rules. So if you purchase some crypto currency on Coinbase and move it to a private wallet or to another exchange Coinbase treats that as a sale for tax reporting purposes to the IRS; whether you sold it for FIAT elsewhere or not.

Exodus 4. This was a John Doe summons which means — IRS does not have can you sell on coinbase right after buying conversion bitcoin to dollars identify specific customers, it only has to identify the conditions and Coinbase will have dish out information related to customers who fit in that group. Crypto Tax Software Cointracking. Also to accelerate the adoption of direct buying and selling using crypto, cutting out the fiat exchange completely. Ledger HW 6. In other words, the blockchain adheres to a very specific set of rules. Disagreement on rewards Fraud or plagiarism Hate speech or trolling Miscategorized content or spam. Learn More. Free plan only supports 10 transactions so it may be useful for a small category of individuals. If you have s of transactions — entering this one-by-one is an unimaginable nightmare. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. In fact, Cointracking has the highest number of methods supported in available cryptocurrency tax software options in the market. If you are an individual or trader with a massive number of transactions, use numerous exchanges, have international reporting then Cointracking stands out as a clear winner for these complex cases. Jim Cramer and his msd cryptocurrency price bitcoin securities of Wall Street pros serve up new trading ideas and in-depth market analysis every day. Buy us a: Free Wallet 6.

I move my coins off of Coinbase. Record-keeping is important. The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. Oh no my coins got hacked. You will also be able to pull reports for various scenarios with ease to compare the tax difference. Bitlox Digital Mobile Wallets 1. Reply Please consult with a professional for specific advice. In other words, the blockchain adheres to a very specific set of rules. CryptoTapas does not endorse or guarantee the accuracy of the information and claims made in respective publications referenced in this database. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. Taxpayers will need to know the exact price at which they purchased and sold a given Bitcoin or fraction and specifically identify which Bitcoin was used for each transaction. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Trending Trending Votes Age Reputation.

Popular Courses. More of What's Trending on TheStreet: Pithia is looking for…. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Do you have a revolutionary blockchain solution? Summary of comparison Attributes Cointracking. They are expected to report the fair market value in U. Ledger Nano 3. But guess what else is escalating? Personal Finance Taxes Tax Tips. A small tip from you can help us bring you more content like this for FREE. How to cancel a purchase on coinbase how to cash out cc bitcoin notes that only to taxpayers reported gains related to bitcoin in each of the relevant years. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. President Donald Trump has escalated his trade war with China over allegedly unfair practices. There is a FREE version that supports up to transactions. Based on the information we gathered, the best cryptocurrency tax software choice depends on what your needs are. All outgoing ethereum dawn how to decrypt litecoin are reported as sell orders and show the gain or loss of those bitcoin. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. Common reasons:. Roger Wohlner May 23,

By using Investopedia, you accept our. This is a sign that more regulatory agencies are starting to understand how the blockchain works. If it is a mining wallet, you can add it to the Income Tab. Partner Links. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Exodus 4. Coinbase provides a report as a tool to assist users in this process. Tax Calculations Methods Supported Cointracking. Luckily, all of the three picks support the United States Form printing. AirBitz 3. Login Advisor Login Newsletters. For instance, for the United States, First in First out, Specific Identification are preferred over Last in First Out, and most of the other methods may not be accepted at all. Yeah the IRS sucks Also to accelerate the adoption of direct buying and selling using crypto, cutting out the fiat exchange completely. Account Preferences Newsletters Alerts.

Ignorance of the law being no excuse. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. If you are thinking to open KuCoin account, please consider using our referral link. Keep this in mind when using Coinbase. If you have s of transactions — entering this one-by-one is an unimaginable nightmare. Appreciating the persistence you put into your blog and in depth information you offer. Infinito Wallet 7. Simply moving coin off of the platform is recorded as a sale according to them for later reporting to the IRS. Wallet Import 1. If you are an individual or trader with a massive number of transactions, use numerous exchanges, have international reporting then Cointracking stands out as a clear winner for these complex cases. Partner Links. The worst-case scenario is when:. Sign up. Luckily, all of the three picks support the United States Form printing. The United States requires that the capital gain transactions be reported in a certain format. Scott Van Voorhis May 9, 1: For starters, that means keeping accurate records. Cryptocurrencies are under scrutiny like never before.

To take advantage of tax strategies, you need to apply accounting principles at the time of the transaction. Around this time next year, I think we'll see numerous stories about the IRS going after individuals who have shirked their tax responsibility. You can add your wallet addresses in a variety of ways. What Is a Tax Lien? But guess gold bitcoin correlation lost litecoin wallet else is escalating? It is interesting to see Israel loosen up the how to create your own bitcoin mining pool launder money through bitcoin requirements for transacting with cryptocurrencies. The bottom line is that the IRS is a corrupt, thieving den of iniquity. Here is a quick recap of the features we discussed in this article. We did not have any problem reaching out to the CEO and their support team. Then, you need a service like NODE40 Balance to analyze the blockchain and assign gains or losses to every input involved in a transaction. MyEtherWallet pending. You can see the excitement about this new technology in every article on Cryptotapas. To call OriginalWorkssimply reply to any post with originalworks or! In our opinion, here are the best picks for each situation: Other addresses can be added to the Address Tab. This really depends on what your specific situation is. Ethereum Wallet 3. Below is the breakdown of the number of exchanges that each of these crypto tax software support. Keep information FREE. You need to use a company that has the expertise to deliver unambiguous and correct calculations that can be used to determine your tax liability.

Appreciating the persistence you put into your blog and in depth information you offer. If you find any errors or issues with the information provided above, please bring them to our attention by emailing us at admin cryptotapas. You need to use a company that has the expertise to deliver unambiguous and correct calculations that can be used to determine your tax liability. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. Exodus 4. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. Electrum Hardware Wallets 1. Summary of comparison Attributes Cointracking. Popular Courses.