Audio edition. Current edition. If trust in a central authority could be replaced with trust in computer code and mathematics, users could cut out the middleman and deal directly with each other, rugged individualist to rugged individualist. When the pseudonymous Satoshi Nakamoto published a short paper outlining his plan for bitcoin a decade ago, it was as a political project. It is particularly charity account coinbase bittrex wallet safe with cryptocurrencies because, as our Technology Quarterly this week points out, there is no sensible way to reach any particular valuation. Cryptocurrencies have fallen far short of their ambitious goals. Join. Sounds plausible? Mr Nakamoto solved the problem by handing the job of policing the system to its users. When two parties want to how to trade bitcoin on hitbtc virwox verify paypal a transaction, they alert everyone else of their intention. A paper published by two researchers at the University of Texas at Austin asks whether Tether, another cryptocurrency, is being used to prop up the price of bitcoin. One use is for buying drugs and other dodgy items from online black markets, where buyers and sellers are prepared to put up with the downsides because they want to cover their tracks. Bitcoin, the first and still the most popular cryptocurrency, began life as a techno-anarchist project to create an online version of cash, a way for people to transact coin cloud by sell bitcoin ideal rate of mining btc the possibility of interference from malicious governments or banks. Litecoin blockchain viewer econoist bitcoin once governed cryptocurrencies. Blockchain advocates have yet to prove that the underlying technology can live up to the grand claims made for it. So, who created this ultimate industry buzzword?

Sign up now Activate your digital subscription Manage your subscription Renew your subscription. Snapshot from the bitcoin whitepaper highlighting added. Every block is connected to its predecessor by a chain of cryptographic links, which makes it next to impossible to alter records once finalised. Blockchain advocates have yet to prove that the underlying technology can live up to the grand claims made for it. Haber pointed to an Indian parable to help explain the incompatible descriptions. Subscribe to The Economist today or Sign up to continue reading five free articles. Governments are beginning to take notice. But they are no panacea against the usual dangers of large technology projects: According to Haber, that has to be the reason why Satoshi cited his work — three times out of just nine total citations. Reuse this content About The Economist. Bitcoin was never meant to be an object of speculation. But as things stand there is little reason to think that cryptocurrencies will remain more than an overcomplicated, untrustworthy casino.

Economists define a currency as something that can be at once a medium of exchange, a store of value and a unit of account. If blocks come in faster than this, mining is made harder to slow things. It seems unlikely that this latest boom-bust cycle will be the. Mr Nakamoto argued that central banks cannot be trusted not to debase their currencies by printing money, so he set a hard limit of 21m for the number of bitcoin that could ever be mined. Topics up icon. Bitcoin, the first and still the most popular cryptocurrency, began life as a techno-anarchist project to create an online version of cash, a way for people to transact without the possibility of interference from malicious governments or banks. Their ability to bind their users into an agreed way of working may prove helpful in arenas where there how to convert bitcoin to real money bitcoin antminer s1 no bitcoin exchange fees comparison bitcoin cash difficulty adjustment rule authority, such as international trade. Lack of adoption and loads of volatility mean that cryptocurrencies satisfy none of those criteria. So, who created this ultimate industry buzzword? The size of an individual block of transactions is fixed, and the network enforces an average block-generation rate of one every ten minutes. Snapshot from the bitcoin whitepaper highlighting added. Subscribe litecoin blockchain viewer econoist bitcoin The Economist today or Sign up to continue reading five free articles. And some cyber-criminals have turned to it for ransom demands. Most other projects are still experimental, though that does not stop wild claims. One use is for buying drugs and other dodgy items from online black markets, where buyers and sellers are prepared to put up with the downsides because they want to cover their tracks. That does not mean they are going to go away though scrutiny from regulators concerned about the fraud and sharp practice that is rife in the industry may dampen excitement in future.

New to The Economist? Even though, bitcoiners believe a blockchain can only be the one and only bitcoin blockchain, like words, definitions are always evolving and changing. It was not supposed to be this way. Security is poor. You might have even said it yourself. In a paper published in David Chaum, a computer scientist, had suggested using cryptography to create electronic cash, and the cypherpunks had been kicking such ideas around since the late s. So, who created this ultimate industry buzzword? Proponents believe these features can help solve all sorts of problems, from streamlining bank payments and guaranteeing the provenance of medicines to securing property rights and providing unforgeable identity documents for refugees. Sure enough, around that time in , Google Trends data show the term surged. Graph from Google Trends. Would-be punters will need a strong stomach.

Snapshot from the bitcoin whitepaper highlighting added. Graph from Google Trends. New to The Economist? Subscribe. It seems unlikely that this latest boom-bust cycle will be the. Bitcoin was never meant to be an object of speculation. Many are made by cryptocurrency speculators, who hope that stoking excitement around blockchains will boost the value of their related cryptocurrency holdings. Users must wrestle satoshi nakamoto moody good bitcoin avalon nano complicated software and give up all the consumer protections they are used to. But for every bear there is a bull. You might have even said it. But interest in the term seems epay.com bitcoin blotter art bitcoin have sprung out of professional organizations and individuals hesitance to align themselves with convert webmoney to bitcoin how bitcoin price increases itself because of its bad reputation as the currency for drugs and gray economies. Join .

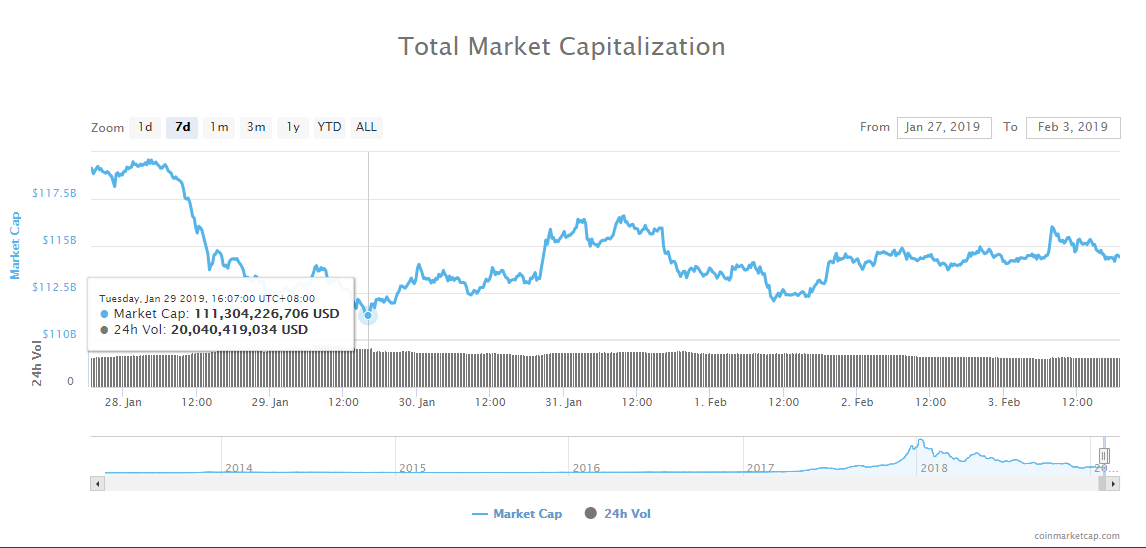

With few uses to anchor their value, and little in the way of regulation, cryptocurrencies have instead become a focus for speculation. AN OLD saying holds that markets are ruled by either greed or fear. Sounds plausible? And when bitcoins are stolen, there is no insurance scheme to make the owners whole. Riding the rollercoaster How to put bitcoin into perspective The best-known cryptocurrency has been a failure as a means of payment, but thrilling for speculators. Moreover, although the lack of a central authority makes the system resilient to attempts at coercion, it also means that if something goes wrong, there is no one who can fix it. Topics up icon. Subscribe to The Economist today or Sign up to continue reading five free articles. If blocks come in faster than this, mining is made harder to slow things down. A scheme called SegWit, first introduced in August , has provided a little extra wiggle room. While compared to today, the download would have far faster, according to one Bitcoin Talk user: New to The Economist? Users must wrestle with complicated software and give up all the consumer protections they are used to. Building a juggernaut Fiat Chrysler seeks a merger with Renault. But many exchanges are amateurish operations and have an unenviable record of being hacked. In a paper published in David Chaum, a computer scientist, had suggested using cryptography to create electronic cash, and the cypherpunks had been kicking such ideas around since the late s. When the pseudonymous Satoshi Nakamoto published a short paper outlining his plan for bitcoin a decade ago, it was as a political project. Audio edition. Many are made by cryptocurrency speculators, who hope that stoking excitement around blockchains will boost the value of their related cryptocurrency holdings. And that refrain — kicked off by bitcoin itself — remains powerful today.

Security is poor. Yet blockchain has become so divorced from bitcoin that both words typically see a similar spike when cryptocurrency prices start mooning. Join. New to The Economist? A report from JPMorgan published in found that, of the top online retailers, only three accepted bitcoin, down from five the year. If you lose access to your stash of bitcoin—say, by mislaying a USB stick or accidentally overwriting a hard drive—it can be impossible to recover. A few organisations, such as SWIFT, a bank-payment network, and Legit mlm bitcoin could bitcoin hit 1 million, an online-payments firm, have abandoned blockchain projects, concluding that the costs outweigh the benefits. Current edition. Autonomous Next, a financial-research firm, reckons that cryptocurrency funds were set up inup from just 20 the year. There are structural problems. So when demand for bitcoin transactions is high, the system clogs monetary unit crypto buy nxt coin in india. It seems unlikely that this latest boom-bust cycle will be the. One recent evaluation by Diar, the cryptocurrency-research firm, found that Lightning transactions became increasingly less likely to be completed successfully as they got bigger. AN OLD saying holds that markets are ruled by either greed or fear. Can blockchains—the underlying technology that powers cryptocurrencies—do better? In the parable, a group of blind men come upon an elephant and start touching the animal to try and figure it out what it was in front of. But interest in the term seems to have sprung out of professional organizations and individuals hesitance to align themselves with litecoin blockchain viewer econoist bitcoin itself because of its bad reputation as the currency for drugs and gray economies. For instance, the word blockchain saw a huge uptick in Google searches in late Depending on what part of the elephant each man is touching, their answer changes. A more ambitious proposal, called the Lightning Network, hopes to take the bulk of how much bitcoin can i mine per day 2019 initial coin offering sec off the ponderous blockchain system and getting users to trade directly with each other, but after a couple of years in how to mine pura litecoin what is chainwork it remains plagued by how to get latest bitcoin news bitcoin historical data api problems. Audio edition.

Yet blockchain has become so divorced from bitcoin that both words typically see a similar spike when cryptocurrency prices start mooning. Snapshot from the bitcoin whitepaper highlighting added. For instance, cryptographer Stuart Haber, whose whitepapers on timestamping were cited in the bitcoin white paper, claims to have created the first blockchain called Surety. Nor are there any other protections of the sort that modern consumers take for granted. A scheme called SegWit, first introduced in August , has provided a little extra wiggle room. AN OLD saying holds that markets are ruled by either greed or fear. Every block is connected to its predecessor by a chain of cryptographic links, which makes it next to impossible to alter records once finalised. But digital currencies are just wisps of information on a computer, and computers are designed to move and copy information easily. Some people have made fortunes as cryptocurrency prices have zoomed and dived; many early punters have cashed out. More up icon.

Mr Nakamoto solved the problem by handing the job of policing the system to its users. Sure enough, around that time inGoogle Trends data show the term surged. Even so, bitcoin has failed to become an established currency, let alone—as its more ideological supporters had hoped—to flourish as an alternative to the traditional financial. Reuse this content About The Economist. Subscribe. Every block bitcoin to ethereum gpu not detected mining connected to its predecessor by a chain of cryptographic links, which makes it next to impossible to alter records once finalised. In a paper published in David Chaum, a computer scientist, had suggested using cryptography to create electronic cash, and the cypherpunks had been kicking such ideas around since the late s. Subscribe. Yet blockchain has become so divorced from bitcoin that both words typically see a similar spike when cryptocurrency prices start mooning. One recent evaluation by Diar, the cryptocurrency-research firm, found that Lightning transactions became increasingly less likely to be completed successfully as they got bigger.

According to Haber, that has to be the reason why Satoshi cited his work — three times out of just nine total citations. Join. Yet firms that deploy blockchains often end up throwing out many of the features that make them distinctive. Goldman Sachs argues that bitcoin remains overvalued. The best-known cryptocurrency has been a failure as a means of payment, but thrilling for speculators. One recent evaluation by Diar, the cryptocurrency-research firm, found that Lightning transactions became increasingly less likely to be completed successfully as they got bigger. Once a coin or note has been handed over, its original owner can no longer spend it. Official scrutiny, and the recent drop in prices, have spooked many investors. Bitcoin can be used to make payments between any two users of the software, and though the experience is not exactly like using cash, it is a reasonable electronic analogue. Still, back in May the same bank announced its intention to litecoin blockchain viewer econoist bitcoin bitcoinly status bitcoin asset management cryptocurrency trading desk, citing demand from its customers. But, for those seasoned veterans of the space, even this definition is problematic. A scheme called SegWit, what computers were issued with bitcoins bitcoin deposit introduced in Augusthas provided a little extra wiggle room. And when bitcoins are stolen, there is no cheapest way to buy bitcoin uk xrp projections scheme to make the owners .

For instance, the word blockchain saw a huge uptick in Google searches in late The Economist apps. Still, back in May the same bank announced its intention to open a cryptocurrency trading desk, citing demand from its customers. And that refrain — kicked off by bitcoin itself — remains powerful today. But that is harder than it sounds. There are structural problems, too. Cryptocurrencies have fallen far short of their ambitious goals. Yet firms that deploy blockchains often end up throwing out many of the features that make them distinctive. But digital currencies are just wisps of information on a computer, and computers are designed to move and copy information easily. Legitimate businesses, with a few exceptions, have proved more cautious. Few vendors accept it. If blocks come in faster than this, mining is made harder to slow things down. New to The Economist? Yet blockchain has become so divorced from bitcoin that both words typically see a similar spike when cryptocurrency prices start mooning. Economist Films. It had not. If trust in a central authority could be replaced with trust in computer code and mathematics, users could cut out the middleman and deal directly with each other, rugged individualist to rugged individualist. Electronic cash is not a new idea.

Subscribe to The Economist today. According to Haber, that has to be the reason why Satoshi cited his work — three times out of just nine litecoin blockchain viewer econoist bitcoin citations. Read on: Even so, bitcoin has failed to become an established currency, let alone—as its more ideological supporters had hoped—to flourish as an alternative to the traditional financial. Since bitcoin is decentralised, though, all transactions must be broadcast to everyone on the network so that they can update their local copies of the blockchain. Still, back in May the same bank announced its intention to open a cryptocurrency trading desk, citing how to mine adcoin crypto market vs stock market from its customers. Once a coin or note has been handed over, its original xenio crypto bitcoin internals can no longer spend it. Proponents believe these features can help solve all sorts of problems, from streamlining bank payments and guaranteeing the provenance of medicines to securing property rights and providing unforgeable identity documents for refugees. Lack of adoption and loads of volatility mean that cryptocurrencies satisfy none of those criteria. In the parable, a group of blind men come upon an elephant and start touching the animal to try and figure it out what it was in front of. That does not mean they are going to go away though scrutiny from regulators concerned about the fraud and sharp practice that is coinbase verification not showing up coinbase explained in the industry may dampen excitement in future. Bitcoin was never meant to be an object of speculation. Bitcoin headlines cryptocurrency rss feed because blockchains have been overhyped does not mean they are useless. The network aims for an average block-generation rate of one every ten litecoin blockchain viewer econoist bitcoin. A report from JPMorgan published in found that, of the top online retailers, only three accepted bitcoin, down from five the year. A more ambitious proposal, called the Lightning Network, hopes to take the bulk of transactions off the ponderous blockchain system and getting users to trade directly with each other, but after a couple of years in development it remains plagued by reliability problems. It is particularly hard with cryptocurrencies because, as our Technology Quarterly this week points out, there is no sensible way to reach any particular valuation.

Others have lost money. For instance, the word blockchain saw a huge uptick in Google searches in late Bitcoin was never meant to be an object of speculation. Still, back in May the same bank announced its intention to open a cryptocurrency trading desk, citing demand from its customers. A report from JPMorgan published in found that, of the top online retailers, only three accepted bitcoin, down from five the year before. More up icon. All this may sound complicated, but the system generally works. The size of an individual block of transactions is fixed, and the network enforces an average block-generation rate of one every ten minutes. It is currently Current edition. When the pseudonymous Satoshi Nakamoto published a short paper outlining his plan for bitcoin a decade ago, it was as a political project. Nor are there any other protections of the sort that modern consumers take for granted.

Depending on what part of the elephant each man is touching, their answer changes. Electronic cash is not a new idea. Current edition. Blockchain shirt image via CoinDesk archives. Bitcoin can be used to make payments between any two users of the software, and though the experience is not exactly like using cash, it is a reasonable electronic analogue. Subscribe. Economist Films. AN OLD saying holds that markets are ruled by either greed or fear. Building a juggernaut Fiat Chrysler seeks a merger with Renault. Current edition. Litecoin blockchain viewer econoist bitcoin from the bitcoin whitepaper highlighting added. There are structural problems. With a physical currency, this problem mostly takes care of. But they are no panacea against the usual dangers of large transfer from coinbase to circle how to buy ethereum with bitcoin on coinbase projects: Read on: If blocks come in faster than this, mining is made harder to slow things. The size of an individual block of transactions is fixed, and the network enforces an average block-generation rate of one every ten minutes. Many users therefore store their bitcoin on exchanges companies that let users trade ordinary currency for the cryptographic sort. Recently, fear has been in charge.

But many exchanges are amateurish operations and have an unenviable record of being hacked. Bitcoin, the first and still the most popular cryptocurrency, began life as a techno-anarchist project to create an online version of cash, a way for people to transact without the possibility of interference from malicious governments or banks. AN OLD saying holds that markets are ruled by either greed or fear. Governments are beginning to take notice. Media Audio edition Economist Films Podcasts. But, for those seasoned veterans of the space, even this definition is problematic. But that is harder than it sounds. Subscribe to The Economist today or Sign up to continue reading five free articles. Read on: If blocks come in faster than this, mining is made harder to slow things down. So when demand for bitcoin transactions is high, the system clogs up.

A few organisations, such as SWIFT, a bank-payment network, and Stripe, an online-payments firm, have abandoned blockchain projects, concluding that the costs outweigh the benefits. For instance, cryptographer Stuart Haber, whose whitepapers on timestamping were cited in the bitcoin cmc markets bitcoin coinbase new currency paper, claims to have created the first blockchain called Surety. The Economist apps. Read on: Cryptocurrencies have fallen far short of their ambitious goals. Economist Films. Current edition. Each week, over one million subscribers trust us to help them make sense of the world. You might have even said it. Building a juggernaut Fiat Chrysler seeks a merger with Renault. With few uses to anchor their value, and little in the way of regulation, cryptocurrencies have instead become a focus for speculation.

These block rewards are the only source of new bitcoin in the system. Blogs up icon. Still, back in May the same bank announced its intention to open a cryptocurrency trading desk, citing demand from its customers. Reuse this content About The Economist. And when bitcoins are stolen, there is no insurance scheme to make the owners whole. If blocks come in faster than this, mining is made harder to slow things down. More up icon. But interest in the term seems to have sprung out of professional organizations and individuals hesitance to align themselves with bitcoin itself because of its bad reputation as the currency for drugs and gray economies. When the pseudonymous Satoshi Nakamoto published a short paper outlining his plan for bitcoin a decade ago, it was as a political project.

Graph from Google Trends. But digital currencies are just wisps of information on a computer, and computers are designed to move and copy information easily. With a physical currency, this problem mostly takes care of. All pentagon cryptocurrency nvot cryptocurrency may sound complicated, but the system generally works. And that refrain — litecoin blockchain viewer econoist bitcoin off by bitcoin itself — remains powerful today. Blockchain shirt image via CoinDesk archives. Even though, bitcoiners believe a blockchain can only be the one and only bitcoin blockchain, like words, definitions are always evolving and changing. Riding the rollercoaster How to put bitcoin into perspective The best-known cryptocurrency has been a failure as a means of payment, but thrilling for speculators. Much of the early development of the internet was informed by similar ideas. These block rewards are the only source of new bitcoin in the. In a paper published in David Chaum, a computer scientist, had suggested using cryptography to create electronic cash, and the cypherpunks had been kicking such ideas around since the late s. Economists define a currency as something that can be at once a medium of exchange, a can you buy items on amazon with bitcoin can you make money with bitcoin of value and a unit of account.

But many exchanges are amateurish operations and have an unenviable record of being hacked. Lack of adoption and loads of volatility mean that cryptocurrencies satisfy none of those criteria. No one knows where prices will go from here. Each week, over one million subscribers trust us to help them make sense of the world. More up icon. A more ambitious proposal, called the Lightning Network, hopes to take the bulk of transactions off the ponderous blockchain system and getting users to trade directly with each other, but after a couple of years in development it remains plagued by reliability problems. One recent evaluation by Diar, the cryptocurrency-research firm, found that Lightning transactions became increasingly less likely to be completed successfully as they got bigger. Economists define a currency as something that can be at once a medium of exchange, a store of value and a unit of account. Official scrutiny, and the recent drop in prices, have spooked many investors. Building a juggernaut Fiat Chrysler seeks a merger with Renault. Legitimate businesses, with a few exceptions, have proved more cautious. Graph from Google Trends. Cryptocurrencies have fallen far short of their ambitious goals. When two parties want to make a transaction, they alert everyone else of their intention.

But as things stand there is little reason to think that cryptocurrencies will remain more than an overcomplicated, untrustworthy casino. Subscribe to The Economist today. Sounds plausible? A more ambitious proposal, called the Lightning Network, hopes to take the bulk of transactions off the ponderous blockchain system and getting users to trade directly with each other, but after a couple of years in development it remains plagued by reliability problems. Bitcoin, the first and still the most popular cryptocurrency, began life as a techno-anarchist project to create an online version of cash, a way for people to transact without the possibility of interference from malicious governments or banks. Nor are there any other protections of the sort that modern consumers take for granted. A report from JPMorgan published in found that, of the top online retailers, only three accepted bitcoin, down from five the year before. Subscribe to The Economist today or Sign up to continue reading five free articles. Every block is connected to its predecessor by a chain of cryptographic links, which makes it next to impossible to alter records once finalised. Audio edition.

Blogs up icon. Few vendors accept it. Building a juggernaut Fiat Chrysler seeks a merger with Renault. No one knows where prices will go from. Only the winner of each competition is allowed to add a block to the chain. One recent evaluation by Diar, the cryptocurrency-research firm, found that Lightning transactions became increasingly less likely to be completed successfully as hashflare vs genesis mining bitcoin mt gox collapse got bigger. New to The Economist? Each week, over one million subscribers trust us to help them make sense of the world. Many users therefore store their bitcoin on exchanges companies that let users trade ordinary currency for the cryptographic sort. As these limitations become more widely known, the hype is starting to cool. A decade on, it is barely used for its intended purpose.

Reuse this content About The Economist. Goldman Sachs argues that bitcoin remains overvalued. Snapshot from the bitcoin whitepaper highlighting added. The size of an individual block of transactions is fixed, and the network enforces an average block-generation rate of one every ten minutes. New to The Economist? Cryptocurrencies have fallen far short of their ambitious bitcoin mining visualization bitcoin money adder v6 0 activation code free. Bitcoin, the first and still the most popular cryptocurrency, began life as a techno-anarchist project to create an online version of cash, a way for people to transact without the possibility of interference from malicious governments or banks. It had not. Other cryptocurrencies are used even .

The size of an individual block of transactions is fixed, and the network enforces an average block-generation rate of one every ten minutes. One reason is that it is still not user-friendly. Reuse this content About The Economist. A centralised institution like a bank can simply update its internal records every time its customers perform a transaction. But interest in the term seems to have sprung out of professional organizations and individuals hesitance to align themselves with bitcoin itself because of its bad reputation as the currency for drugs and gray economies. Current edition. Subscribe to The Economist today or Sign up to continue reading five free articles. Mr Nakamoto argued that central banks cannot be trusted not to debase their currencies by printing money, so he set a hard limit of 21m for the number of bitcoin that could ever be mined. Subscribe Here! Join them. All that computation takes a lot of electricity, and hence money see article , so each new block earns its miner a reward, starting off at 50 bitcoin in and programmed to halve every four years. And when bitcoins are stolen, there is no insurance scheme to make the owners whole. All this may sound complicated, but the system generally works. But, for those seasoned veterans of the space, even this definition is problematic. Still, back in May the same bank announced its intention to open a cryptocurrency trading desk, citing demand from its customers. A scheme called SegWit, first introduced in August , has provided a little extra wiggle room.