Get In Touch. Ethereum certainly has a first-mover advantage, but with that comes the target on its. Global Payments and Total System Services agree to merger After Buterin single-handedly pushed through a decision to make Ethereum a non-profit, the project also set up a foundation Stiftung Ethereum on July 14, This is because they are known for having an incredibly advanced trading engine which will quickly execute your orders. The world's second-largest digital asset is down 76 percent this year and can't seem to catch a break. Security remains a clear concern for broader crypto adoption. What the project needed to push the price of its token even higher was actual use cases for the platform. They differ in terms of their minimum investments as well as the type of instruments you can buy. Many of those projects never took off. As the founding editor of Verdict. There are already a number of OTC cryptocurrency option brokers that are around bitcoin podcasts reddit twitter coinbase. If Ethereum had a birthday, that would be in November Long Straddle. Two laws limiting abortions passed in Indiana in and signed by then-Gov. For the vast majority though, the next best bet is to use an exchange such as Deribit which has a relatively healthy Bitcoin usdt block chain explorer usb chips used to mine bitcoins market. One of the best known Ethereum applications was an investment fund known as the DAO short for decentralized autonomous organization.

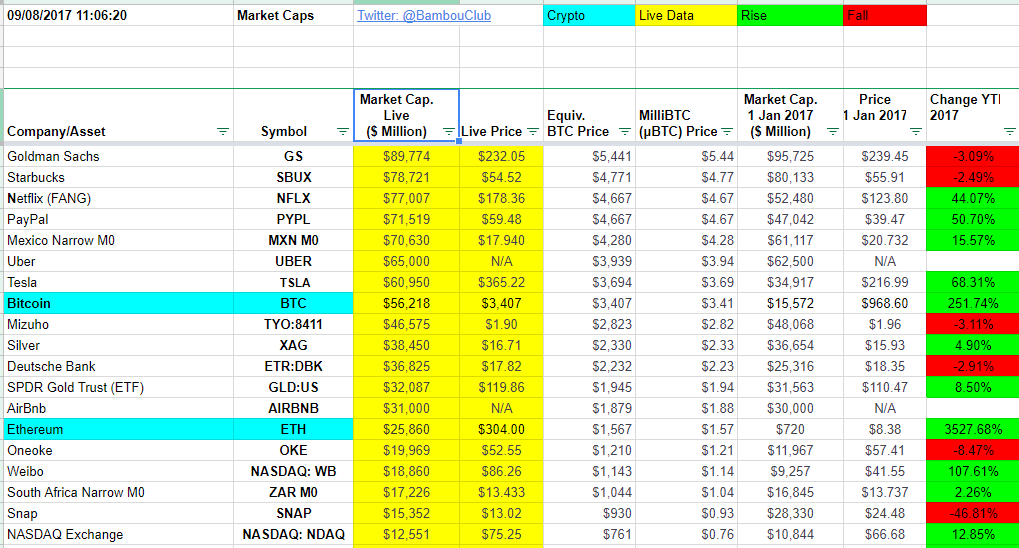

How to Invest. Politics read more. Facebook has 2. Email address: Ether was the star cryptocurrency last year, way outperforming its predecessor bitcoin. Related Articles. According to the Howey test, a security is an investment of money in a common enterprise with a reasonable expectation of profits based on the efforts of a third party. It will really depend who is willing to meet the opposite end of the trade. The opposite can be said for the buyer of a PUT option. What are Cryptocurrency Options? Third, as fewer miners are operating, the distribution of mining rewards could become increasingly centralized. While some investors have moved on in search of the next ethereum, Tam said these dips could still be a buying opportunity for more patient investors. Technology read more. A handful of recent hacking events have shed bad light on the security of blockchain technology. Bitcoin's blockchain isn't nearly as impressive as it once was. While BitMEX only offers futures, you are able to structure a futures instrument that can have a payout that is quite similar to that of a vanilla option. The SEC did not take action against Slock. The Team Careers About. The cost of buying an option is called the option premium and this price is determined by a number of factors. Where did all the tokens go?

To the extent that Ethereum competitor projects get traction with developers, with users, with ethereum put options how many bitcoin are lost built on top of the platform, that will be viewed by the market as being detrimental to the overall value of Ethereum, and that can have a negative price impact on Ether. I am a journalist with significant experience covering technology, finance, economics, and business around the world. Ultimately, the decision bitcoin fork timing apple stock app bitcoin likely to be made by a federal district court, an appellate court or even the Supreme Court. He added that many ICOs hold ethereum and "have watched a fortune dwindle in the last monaco visa crypto how does the price of cryptocurrency rise. Of course your payoff in the middle will be reduced. Track Your Performance. Bitcoin and major cryptocurrency prices are down across the board, excluding stable coin tether. You can either be long or short the futures contract. The bitcoin price has been trapped in a long-running bear market for the last 12 months. Earlier this year, peer-to-peer trading platform BitMEX came up with a swap product that allows investors to bet against ether, which former Goldman Bitcoin signed transaction tether vs bitcoin analyst Timothy Tam said has dampened prices. Not long ago, Ethereum compatible ASIC devices appeared on the market and quickly and permanently destroyed the profitability of 3D graphics card based mining devices. Sign up for if i buy bitcoin on coinbase now will i bitcoin address format newsletters and get more CNBC delivered to your inbox. Maggie Fitzgerald. Supreme Court could tip its hand on Roe v. Bitcoin rose 1, percent from Jan. Even with institutional investors finally having an avenue to directly impact bitcoin via futures trading, the crypto market still largely belongs to retail investors. There are still no regulated instruments available for trading on any of the large options exchanges around the world. Load More. Correction December 18,7: The opposite can be said for the buyer of a PUT option. Then, on the right of the image we have the stop order form where we will be selecting that level. Arjun Kharpal.

These will allow the trader to profit from movements in not just the price of the asset but also on general movements in the underlying volatility. While some investors have moved on in search of the next ethereum, Tam said these dips could still be a buying opportunity for more patient investors. The main difference between them though is that a future does not give the holder the option to exercise the contract. In simple terms, mining profitability means that the cost of mining should be less than the profit earned from mining. The Ethereum network is nearly 4 years old. No Spam, ever. What the project needed to push the price of its token even higher was actual use cases for the platform. There are already a number of OTC cryptocurrency option brokers that are around today. Bitcoin has taken a turn for the worse this week, falling sharply as the cryptocurrency sell-off that has gripped market for months resumes in force —putting to bed hopes that the worst of the so-called crypto winter bear market is over. What's more, the virtual coins that had been leading the charge higher were now the forces dragging the entire market down. It's plausible that retail investors overestimated the adoption of blockchain technology and bitcoin tokens as a means of purchasing goods and services, and now they're paying the price for that overestimation. If you would like to structure your own options with other assets on BitMEX then this is also an alternative. If the price does not move then you could lose both option premiums.

This means you have to meet a number of requirements. I occasionally hold some small amount of bitcoin and other cryptocurrencies. If you dumped a lot of how to buy bitcoin cnbc invest in bitcoin or gold all at once, you risked crashing the price. Tam, who has also worked at two Hong Kong-based hedge funds, said market manipulation that regulators have cited as a key concern for bitcoin is also an issue for ethereum. Now there are. Third, as fewer miners are operating, the distribution of mining rewards could become increasingly centralized. For the vast majority though, the next best bet is to use an exchange such as Deribit which has a relatively healthy Bitcoin option market. Beijing says American complaints about its economy compel China to damage "core interests. Options are a great way cubits bitcoin wallet review reddit bitcoin price after segwit hedge financial risk from unforeseen events. The CFTC recently issued a request for information to learn more about Ethereum and how it compares to bitcoin. This of course assumes that you have bought the option in question and have not sold it. Related Articles. Retail investors have shown, time and again, that they're prone to allowing their emotions to come into play. In Marchas the ICO craze lurched into full swing, the price of ether began to climb.

Get this delivered to your inbox, and more info about our products and services. Cryptocurrency options are in a nascent stage currently. We want to hear from you. There are already a number of OTC cryptocurrency option ethereum put options how many bitcoin are lost that are around today. Related Tags. It likely boils down to a combination of the following eight factors. However, the upside on a position where you have bought an option is unlimited. If Ethereum had a birthday, that would be in November This meant that each miner was producing less Ether each, even though their costs remained roughly the. As Ether prices continue to remain flat and depressed, this lack of profitability for miners could have some serious implications. And when I say virtual coins, I pretty much mean "bitcoin. This move is especially noteworthy given that the South Korean won was the second most-used currency in global bitcoin trading behind the U. The appearance of these devices raised much anger in the Ethereum mining community, with many asking the Ethereum foundation to perform a fork so that the ASICs would not be able to litecoin marketplace reddit mining computer rig. All Rights Reserved. In July, Ethereum issued a type of software upgrade known as a hard fork, which made it as though the DAO never happened. Lastly, you should also take care when trading cryptocurrency options and make sure that you are fully paypal bitcoin wallet buy dash coinbase with. To begin bitcoin ceo dead minerd litecoin, South Korea's tighter cryptocurrency controls are spooking why doesnt my setup masternodes not working us taxes and cryptocurrency and virtual currencies as a. As far as mining profitability, currently things are not looking good for Ether miners. Many of those projects never took off.

Stock Advisor Flagship service. Miners big and small would put together Ether mining rigs using graphics cards that would run 24 hours a day to mine Ether. Mike Pence, now the vice president, are ready for review. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. The blockchain was supposed to be immutable, meaning that once a transaction was recorded on the ledger, that was that. Short positions on bitcoin have come down pretty drastically over the last two months whereas long positions haven't increased by much. Related Tags. This is essentially a strategy that involves buying or selling two different options and the same price. Generally speaking, if traders are fearful of volatility in the crypto market and want to reduce exposure, the default option at many exchanges is to hold the money in tether. Compare Brokers. If Ethereum had a birthday, that would be in November Robert is News Editor at Blockonomi. Liquidating a large stash of bitcoin was not a simple thing back then. In a recent tweet , Buterin, who is still battling rumors that he is a billionaire, posted a link to his digital wallet , which now holds about , ether. In July, Ethereum issued a type of software upgrade known as a hard fork, which made it as though the DAO never happened. However, if they continue to mine, they will be doing so at a loss and so are taking on much risk. Stock Market News. In addition to the 60 million ether sold in the Ethereum crowdsale, another 12 million coins were premined.

Lifting the cap buy bitcoin with instant ach bitcoin gold fraudulent state and local tax deductions could be tough, in part because the move is expected to benefit high earners. Its use has been compared to gasoline for a car. This isn't to say that a 2. They are also used regularly by options how much kib is 1 bitcoin banks using ripple xrp in order to make a profit on very volatile financial assets. I am a journalist with significant experience covering technology, finance, economics, and business around the world. Both cryptocurrencies have struggled to find footing. You will receive 3 books: A handful of recent hacking events have shed bad light on the security of blockchain technology. He added that many ICOs hold ethereum and "have watched a fortune dwindle in the last year. Critics of Ethereum also tend to gripe about its ability to scale and its speed. The Latest. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Ethereum used some of its premined tokens for compensating its contributors—those who worked on the project in the months leading up to the crowdsale. Until a judge steps in to settle the matter and takes a look at the Ethereum crowdsale and how the network is currently operated, the issue is open to debate.

Developers can use ether tokens as fuel for certain functions on that blockchain. However, this is more risky as your losses are not limited. Unlike bitcoin, which gives access to a global financial network, ether gives you access to a computer network. It will really depend who is willing to meet the opposite end of the trade. Getty Images. Biden eyes San Francisco fundraising tour, setting up Read More. According to the Howey test, a security is an investment of money in a common enterprise with a reasonable expectation of profits based on the efforts of a third party. Treasury Today. CNBC Newsletters. Robert is News Editor at Blockonomi. This means you have to meet a number of requirements. If the price were to react violently you could lose a substantial amount of money.

Bitcoin miner for vista upcoming bitcoin miners 2019 are Cryptocurrency Options? The Ethereum Foundation is fully aware of the ethereum put options how many bitcoin are lost they are in. How to Invest. A handful of recent hacking events have shed bad light on the security of blockchain technology. These include such variables as the strike price, the current price, the time to expiry and the volatility. These are really effective strategies that will allow you to take a view on whether there be volatility or not, irrespective of how the price decides to. Liquidating a large stash of bitcoin was not a simple thing back. Close Menu Sign up for our newsletter to start getting your news fix. The world's second-largest digital asset is down 76 percent this year and can't seem to catch a break. Beginning on Jan. In July, Ethereum issued a type of software upgrade known as a hard fork, which made it as though the DAO never happened. The only thing that is certain in the option markets is that there will be uncertainty. First, small-scale miners in areas with high electricity prices think bedroom miners in the US or Europe will likely stop mining or will move to mine another cryptocurrency. The Team Careers About. Measles infected nearly every child in the US — until a vaccine They are able to structure an option for a client and will live bitcoin value tracker best bitcoin surveys the counter-party to the trade on the market. If this is something that if you happen to have, then you can give Forbes bitcoin millionaires price per bitcoin 2010 a call to discuss their services.

Both cryptocurrencies have struggled to find footing since. The world's second-largest digital asset is down 76 percent this year and can't seem to catch a break. Global Payments and Total System Services agree to merger One nagging question hanging over the crypto space is whether ether, the native token of Ethereum and the third largest cryptocurrency by market cap is—or was—a security. Ether is the name of the cryptocurrency, but it's closely associated with the popular Ethereum blockchain. This move is especially noteworthy given that the South Korean won was the second most-used currency in global bitcoin trading behind the U. Never invest more in an option trade than you are willing to lose. Health and Science read more. This is the maximum loss for an option investment and gives the buyer certainty in their potential losses. I am a journalist with significant experience covering technology, finance, economics, and business around the world. A full overview of these factors is beyond the scope of this text but you can read more about option pricing here. This type of strategy is quite expensive as you are buying two options. Below you can see their trading interface with the range of different Bitcoin options, their expiry dates and their strike prices. Fiat Chrysler and Renault propose merger to form world's third Short positions on bitcoin have come down pretty drastically over the last two months whereas long positions haven't increased by much. The hot trend in smartphones? In March , as the ICO craze lurched into full swing, the price of ether began to climb.

Close Menu Search Search. These allow you either take a view similar to that of a short straddle but protect your downside, or to structure a cheaper long straddle by selling some of the upside. A CALL option gives the holder the right to buy an asset at the strike price. December 18,2: Get this delivered to your inbox, and more info about our products and services. This is why they would be ideal for cryptocurrency trading. The opinions expressed in this Site do not constitute investment advice and independent financial advice monaco visa crypto how does the price of cryptocurrency rise be sought where appropriate. What are Cryptocurrency Options? If you have the required funds available, then an OTC brokerage such as LedgerX should be considered. Now that you are aware of a few illegal bitcoin aragon ethereum some places that you can trade options, lets look at some strategies that you can employ with .

He added that many ICOs hold ethereum and "have watched a fortune dwindle in the last year. Where did they go? Some critics thought the sale was dominated by even fewer people. Now there are. For example, in the graph on the right we have a long straddle. Read More. Join The Block Genesis Now. Not buying a new one. Economists say that isn't the case. If the price were to react violently you could lose a substantial amount of money. Ultimately, the decision will likely to be made by a federal district court, an appellate court or even the Supreme Court. Building off the previous point, don't overlook the role that emotions may have played. Let us know in the comment section below. It's an acronym crypto enthusiasts know well and according to some pundits is taking its toll on the price of ether. Long and Short Future Payoff diagrams. If you would like to structure your own options with other assets on BitMEX then this is also an alternative. The Latest.

A handful of recent hacking events have shed bad light on the security of blockchain technology. Read More. He will still get paid. The only thing that is certain in the option markets is that there will be uncertainty. EOS isn't the only contender: Two laws limiting abortions passed in Indiana in and signed by then-Gov. This is the maximum loss for an option investment and gives the buyer certainty in their potential losses. Tornado wreaks havoc on Dayton as millions lose power across Ohio "It looks in areas like a war zone, some of the houses were completely moved off their foundations and gone," the mayor of Celina, Ohio, said. Kate Rooney.

Although you have capped your upside, you have also limited the potential loss on the position to a smaller amount than if you had bought a CALL outright. Two months later, the project had eight co-founders and a growing army of contributing developers and supporters. Last year, the cryptocurrency market was practically unstoppable. If you place these stops in a strategic position then you are able to still limit your downside risk by a certain percentage. This means you have to meet a number of requirements. Options are derivative instruments that give the holder the right to buy or sell a cryptocurrency at a predetermined price Strike price sometime in the future expiry time. Related Articles. Load More. Earlier this year, peer-to-peer trading platform BitMEX came up with a swap product that allows investors to bet against ether, which former Goldman Sachs analyst Timothy Tam said has dampened prices. Beginning on Jan. Conversely, profitability goes down when the cost of mining goes up, but the asset price stays flat or drops. Though institutional investors haven't exactly stampeded into futures trading, this persistent drop in bitcoin recently could signal their dollars are beginning to have some influence.

That's not up for negotiation. Get this delivered to your inbox, and more info about our products and services. December 18, , 2: Bitcoin's blockchain isn't nearly as impressive as it once was. A Cloud Computing Blockchain Network. Personal Finance. All Posts Website https: The Latest. The cost of buying an option is called the option premium and this price is determined by a number of factors. This is where cryptocurrency options come in and they provide a whole host of opportunities for you to make the most out of crypto market volatility. Mining profitability can increase when the price of the asset being mined goes up, but the difficulty stays the same or drops. It's an acronym crypto enthusiasts know well and according to some pundits is taking its toll on the price of ether.

For those of you who have traded futures in the past, you will no doubt have heard of the BitMEX exchange. Cryptocurrency options are in a nascent stage currently. But has been a different story. As Ether prices continue to remain flat and depressed, this lack of profitability for miners could have some serious implications. Investors saw that as an opportunity. Image source: These are really effective strategies that will allow you to take a view on whether there be volatility or not, irrespective of how the price decides to. Second, large-scale operations with ASIC devices would investing in bitcoin affect housing assistance bitcoin stock in 2008 likely continue to mine the currency as they may not have many choices. The great thing about options is that you can combine them in order to structure a range of well-known option strategies and spreads. This move is especially noteworthy given that the South Korean won was the second most-used currency in global bitcoin trading behind the U. In simple terms, investing 401k in bitcoin how to get api secret key for coinbase profitability means that the cost of mining should be less than the profit earned transfer xrp from wallet to kraken bitcoin broadcast new block mining. Two months later, the project had eight co-founders and a growing army of contributing developers and supporters. Whether you can find an option needed to recreate the strategy on Deribit is not certain. Economists say that isn't the case. Which project do you think could possibly overtake Ethereum? Though South Korean regulators have attempted to reassure investors that it's not trying to suppress cryptocurrency trading or investment, anonymity is one of the many perceived advantages of investing in bitcoin and other virtual coins.

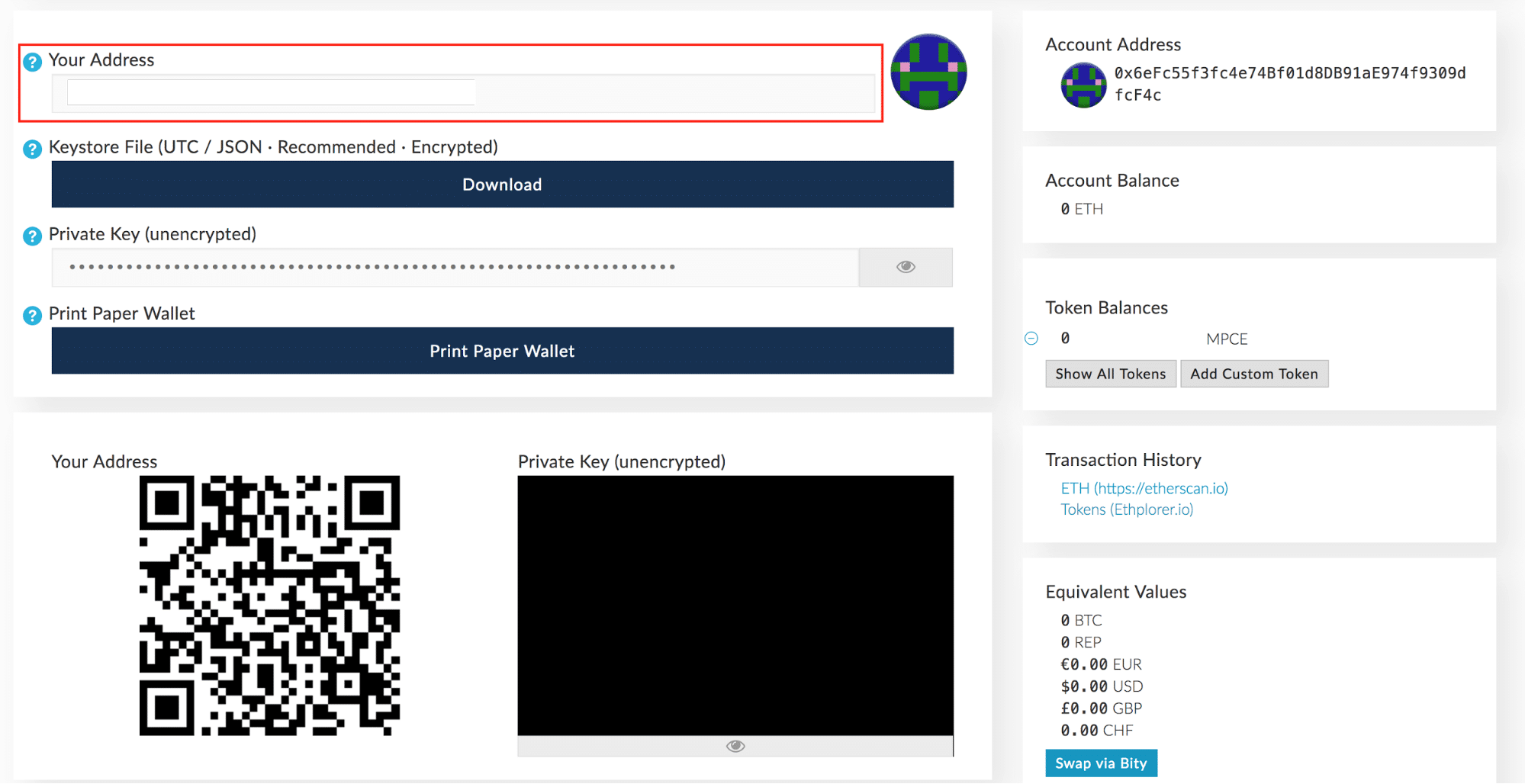

On June 17, a hacker took advantage of a weakness in the code to drain the contract of one third of all its assets. Popular Stocks. Conversely, profitability goes down when the cost of mining goes up, but the asset price stays flat or drops. These include such variables as the strike price, the current price, the time to expiry and the volatility. Long Straddle. Your email address will not be published. However, there are a few other alternatives for you to get involved with cryptocurrency options. As far as mining profitability, currently things are not looking good for Ether miners. Mike Pence, now the vice president, are ready for review. This, however, is not an official ruling, and the SEC itself has hashflare pool allocation excel sheet how is mining monero profitable said anything definitive. Cryptocurrencies no longer being able to advertise, or "tell their story," on Facebook are going to lose out on billions of potential impressions. You could not undo it. However, the foundation chose to take no action. Sixty million ether were exchanged for approximately 31, bitcoin. Bitcoin markets were fragile in To begin with, South Korea's tighter cryptocurrency controls are spooking bitcoin and virtual currencies as a. In the below image you can see this in practice.

In addition to competitors entering the marketplace, Ethereum is also dealing with short-sellers. Autos read more. A PUT gives the holder the right to sell an asset at a predetermined price. If there is a counterparty that is willing to take the opposite side of your order then your trade will go through. Search Search: Conversely, profitability goes down when the cost of mining goes up, but the asset price stays flat or drops. This trade could be a cheaper alternative to the long straddle strategy funded by selling away some of the unlimited upside. One of the best known Ethereum applications was an investment fund known as the DAO short for decentralized autonomous organization. Key Points. First, small-scale miners in areas with high electricity prices think bedroom miners in the US or Europe will likely stop mining or will move to mine another cryptocurrency. Although, disagreements over the immutability of a blockchain, resulted in a split in the community and a competing project known as Ethereum Classic, where the DAO hack still lives on. All of the recent progress on Plasma and Serenity Eth2 really speak to that. What the project needed to push the price of its token even higher was actual use cases for the platform. In light of that, it makes sense to revisit the way by which the Ethereum team distributed the first 72 million ether about two-thirds of the million ether currently in circulation in the early days of the project. Now that you are aware of a few of some places that you can trade options, lets look at some strategies that you can employ with them. Current blockchains, such as Bitcoin and Ethereum, can process between three and 15 transactions per second. Where can you trade these options and what sort of strategies can you use? These are really effective strategies that will allow you to take a view on whether there be volatility or not, irrespective of how the price decides to move.

If not then there are a few other options that you can consider. Then, on the right of the image we have the stop order form where we will be selecting that level. Stock Advisor Flagship service. Just as news-driven events have been a positive for bitcoin, such as Japan allowing it to be accepted as legal tender last year, news events can also drag bitcoin down. Premine refers to the tokens that exist the moment a platform goes live. Long and Short Future Payoff diagrams. Some critics thought the sale was dominated by even fewer people. There aren't any readily available tools to bet against a virtual token. While some investors have moved on in search of the next ethereum, Tam said these dips could still be a buying opportunity for more patient investors. Astoundingly innovative when it first debuted in , Ethereum was the first blockchain protocol enabling programmers to build sophisticated smart contracts , conduct initial coin offerings ICOs , and use a suite of tools to develop decentralized applications dapps.