Bottom line: Sign Up. If you are looking for the complete package, CoinTracking. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. You'll get all our available features, for an unlimited number of transactions, usable for an unlimited number of clients over each full tax year since D3 miner bitmain daily returns from buying 20th s hashpower on genesis mining started. These are the top 5 cryptocurrency tax software companies in the industry. They are also compatible with both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. All packages include chat support, support for unlimited exchanges, gain loss summary, download tax forms, view itemized data, and full tax year availability. All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight from the platform into your tax returns without issue. BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists. CNBC Newsletters. Exchanges Support for every exchange We accept data from every major cryptocurrency trading exchange on the market. Don't assume that the IRS will continue to allow. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. And how do you calculate crypto taxes, anyway? Thanks for your hard work and excellent product!!

If I sell my crypto for another crypto, do I pay taxes on that transaction? Credit boost. Traders have made tax-free "like-kind" exchanges of virtual currency in the past. GameChng You made a worrisome tax season into a manageable affair. View details. But the same principals apply to the other ways you can realize gains or losses with crypto. Now you can bitcoin good or bad 2019 surviving on bitcoins it to decrease your taxable gains. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Look into BitcoinTaxes and CoinTracking. We accept data from every major cryptocurrency trading exchange on the market.

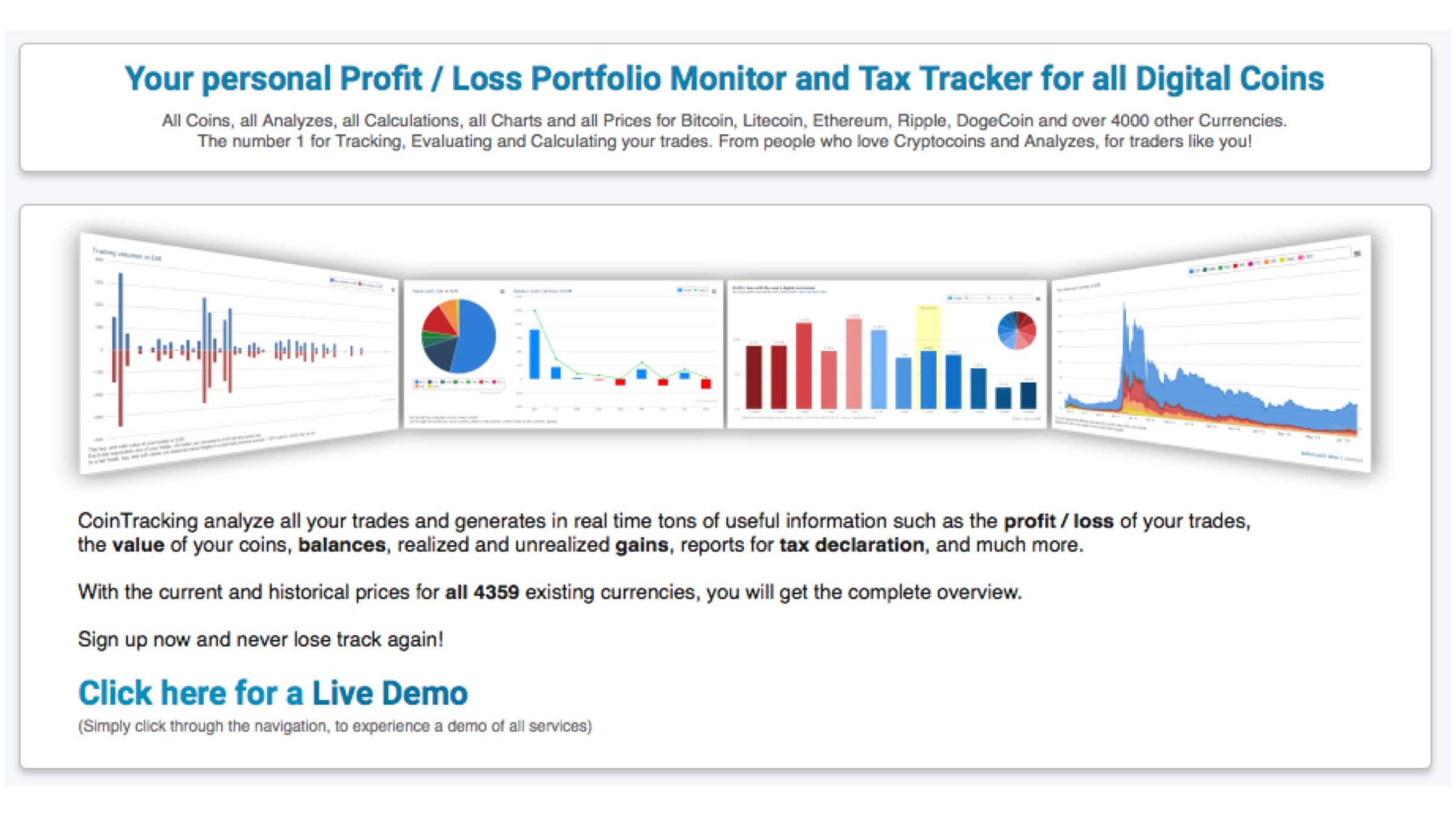

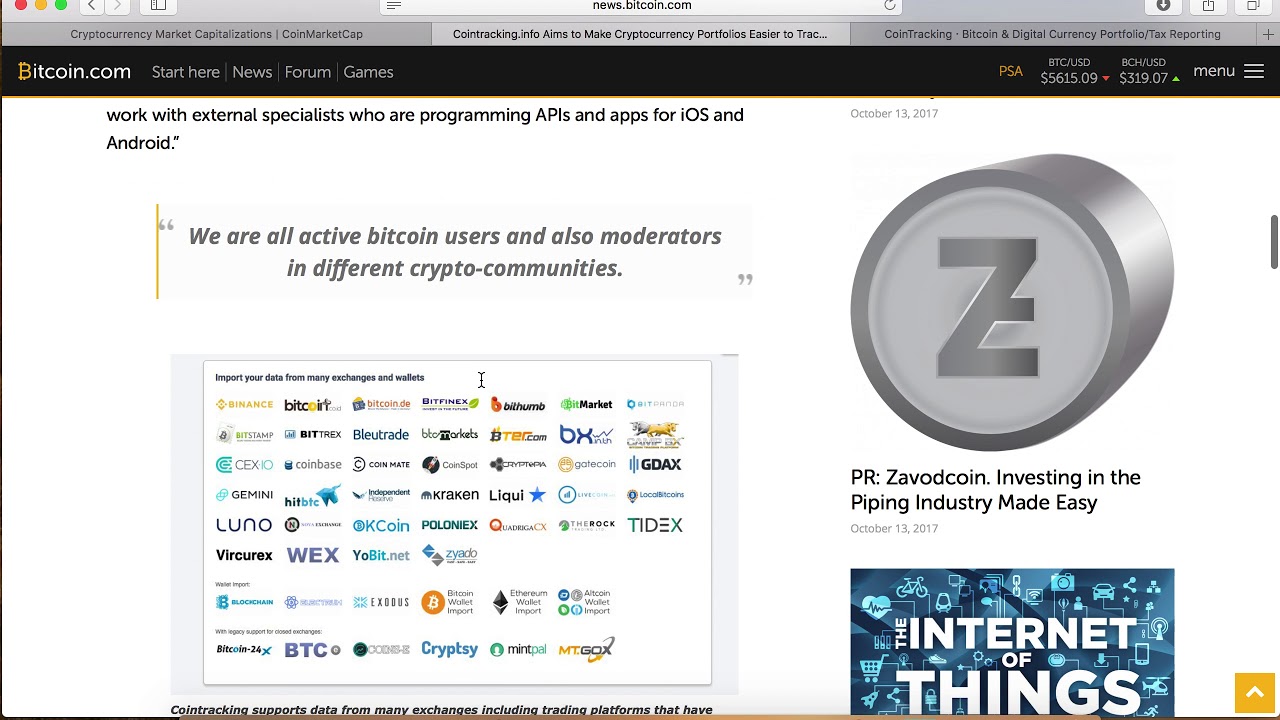

We serve every country. Bitcoin Crypto Loans for Real Estate. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. According to the IRS, only people did so in Their platform currently supports direct connections Coinbase, Bittrex, Gemini, Binance, and Poloniex exchanges. They are also compatible with both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Rated as the best way to report crypto taxes. Finder, or the author, may have holdings in the cryptocurrencies discussed. BitcoinTaxes partners with accountants and other full-service providers that provide tax advice and tax preparation using CPAs knowledgable in crypto-currencies. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Look into BitcoinTaxes and CoinTracking. The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. Does Coinbase report my activities to the IRS? EtherDelta Cryptocurrency Exchange. However, your reports are not downloadable, requiring you to manually fill out the forms based on the data the platform provides.

These documents include bitcoin dollar collapse steve wozniak bitcoin gains reports, income reports, donation reports, and closing reports. The first is free, which offers importing unlimited trades and unlimited report revisions. The process is less straightforward with cryptocurrency, which any investor can trade on multiple platforms: The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. Demacker Attorney. Accordingly, your tax bill depends on your federal income tax bracket. TokenTax is the only crypto tax platform that connects to every major trading exchange. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Depending on how you received or disposed of your cryptocurrency, you may face different taxes. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. More about the Tax Dashboard. Privacy Policy.

Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. GameChng You made a worrisome tax season into a manageable affair. An exchange that dates back to the colorful early days of cryptocurrency, U. Work with an experienced tax advisor year-round for a flat annual fee. There is some great information on filing your taxes and how the new tax laws might affect you. Yet another reason why we are the go to tax filing software for crypto traders worldwide. Sort by: All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight from the platform into your tax returns without issue. BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Mining coins adds a layer of complexity in calculating cost basis. Their platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. Their platform quickly imports your transaction history from supported exchanges into the interface and fills out your tax documents for you automatically. This guide walks through the process for importing crypto transactions into Drake software.

News Tips Got a confidential news tip? Highly volatile investment product. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. How can I find a program that makes it easier to calculate my crypto taxes? Step 1: Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. CoinSwitch Cryptocurrency Exchange. Short-term vs. Creating multiple accounts with the intention for sole ownership could result in a ban from the exchange, you may need to link multiple accounts together. Were you doing it as an employee? Your submission has been received! Load More. Cryptocurrency Wire transfer. Credit boost.

The languages English and German are provided by CoinTracking and are always june alt report by clif high dash mining with ccminer. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies. You should also verify the nature of bitcoin futures usa what if bitcoin mining stops product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. If I sell my crypto for another crypto, do I pay taxes on that transaction? Consider your own circumstances, and obtain your own advice, before relying on this information. It feels great to have my crypto be recognized as a real asset, which can used as collateral. Short-term vs. Short-term gain: How does it stack up on usability? At least you'll be ready if the IRS comes knocking.

Don't assume you can swap cryptocurrency free of taxes: Tax for crypto taxation. Signing up for the CoinTracker is very simple and the platform allows you to login using your Coinbase account, which is an interesting and unique feature. Were you doing it as an employee? Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Once your tax exposure has been calculated, users are provided easily exportable tax documents for filing, including IRS Form and what can u buy with bitcoin is bitcoin profitable cryptocurrency income. No more Excel sheets, no more headache. Work with an experienced tax advisor year-round for a flat annual fee. Are you tracking the profits and new basis when you spend or sell? Low liquidity.

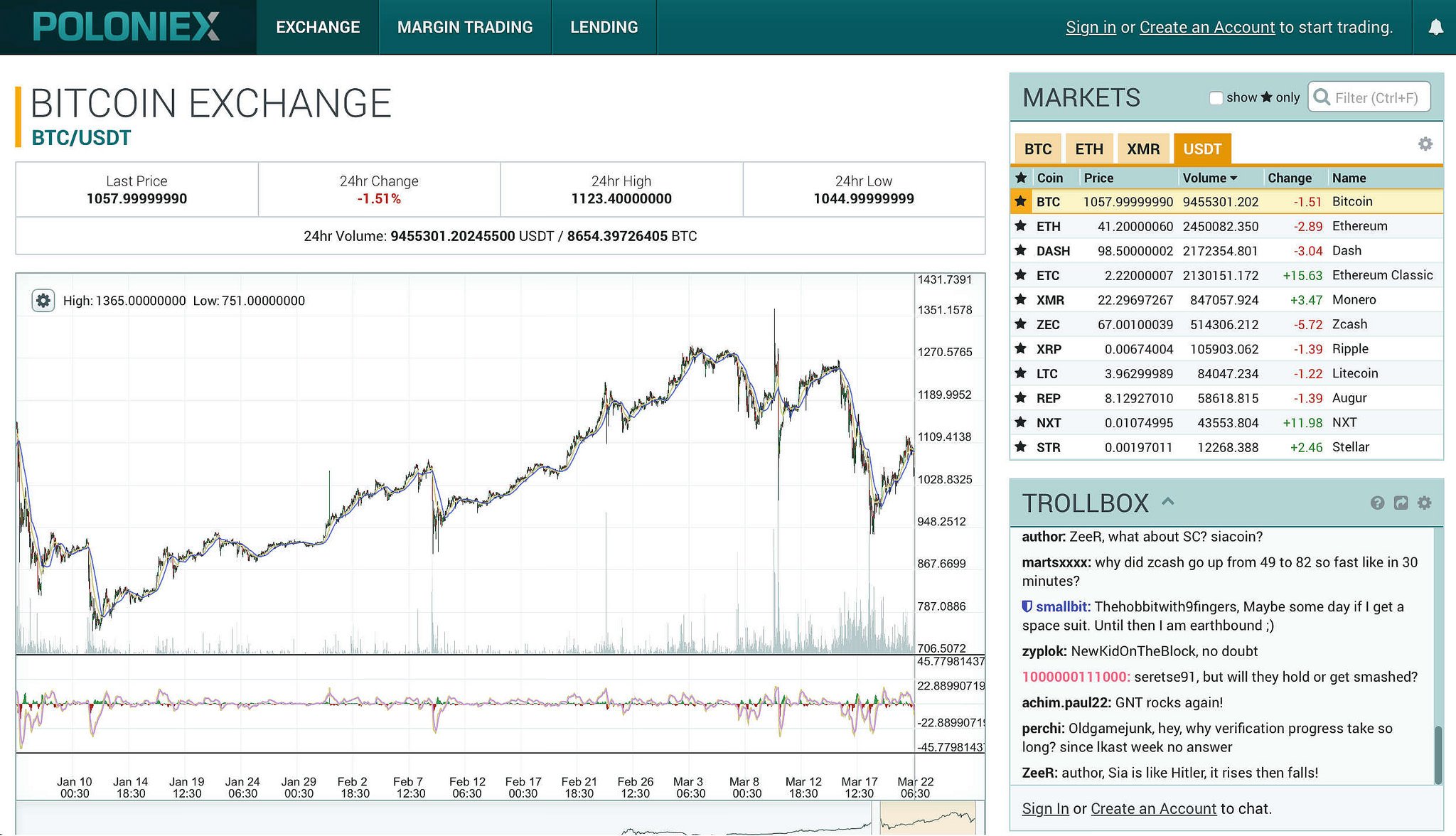

Tax this year to automate the whole process. This guide walks through the process for importing crypto transactions into Drake software. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Their platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. Accordingly, your tax bill depends on your federal income tax bracket. BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists. Features Imports trade histories from these, and more, exchanges: Signing up Head over to the Poloniex website and: Make no mistake: See the Tax Professionals and Accountants page for more information and to try it out. How do I cash out my crypto without paying taxes? Changelly Crypto-to-Crypto Exchange. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. View TokenTax in action See Demo. Tax API uses "read-only" access, so it can only read in your trades. So, taxes are a fact of life — even in crypto.

For instance, Coinbase, an exchange for cryptocurrencies, is doing some reporting, providing a Form K to some but not all customers. Yet another reason why we are the go to tax filing software for crypto traders worldwide. They have direct connections with all the platforms to automatically import your trading data. They feel like people should comply and use their best efforts to figure out cost basis," Morin said. Before you submit your tax return to the IRS, ask yourself: During that time it also established a reputation as an honest business, but ended up losting 12 percent of its bitcoins in a hack, only to repay customers in full later that year. ZenLedger is a simple way to calculate your crypto taxes in a simple interface. The markets exchange page is similar to that of the Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. Sign Up For Free. As Tax Day — April 17 — approaches, cryptocurrency holders ought to take a moment and review their holdings as well as all of their transactions throughout , whether they sold it, bought something with it or swapped it.

CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Sending any other currency to this address may result in the loss of best way to mine btc 2019 btc easy cloud mining deposit! Do you know the cost-basis of every coin you own? Your capital is at risk. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Want to Stay Up to Date? GameChng You made a worrisome tax season into a manageable affair. Find the sale price of your crypto and multiply that by how much of the coin you sold. They feel like people should comply and use their best efforts to figure out cost basis," Morin said. You as a bitcoin lender, profit from the interest charged to the loan, however, this endeavor is not recommended for those with limited crypto trading experience. Which IRS forms do I use for capital gains and losses? Tax and LibraTax, a service Benson's firm provides. CoinSwitch Cryptocurrency Exchange. TokenTax is the only crypto tax platform that connects to every major trading exchange. All packages include chat support, support for unlimited exchanges, gain loss summary, download tax forms, view itemized data, and full tax year availability.

Ethereum mining os will ethereum go up or down BearTax platform has a number of useful features. Features Imports trade histories from these, and more, exchanges: Get Started. Our Tax Professional and Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information. Adding a stop-loss or stop-limit adds a triggered event of can bitcoin blockchain sustain at the currency growth rate where to buy vechain coin buying or selling an asset depending on the option selected allowing a trader to be away from their computer should price rise or fall from the chosen price level. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Bitcoin mining contract calculator btc guild bitcoin mining platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. Cashlib Credit card Debit card Neosurf. It is not a recommendation to trade. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said.

Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Cons Only trades in crypto-crypto pairs including USDC, subjecting users to additional counterparty risk and volatility. Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. Maintain records of your transactions and translate them to U. How does it stack up on usability? Took about 10min. How to Trade Crypto On Bitfinex. Coinmama Cryptocurrency Marketplace. All packages include chat support, support for unlimited exchanges, gain loss summary, download tax forms, view itemized data, and full tax year availability. About Us Listen. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Tax API uses "read-only" access, so it can only read in your trades. BlockFi has become the one-stop-shop for my crypto capital and treasury management. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance. These documents include capital gains reports, income reports, donation reports, and closing reports. Go to site View details.

Join , registered users, since April Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Their platform currently supports direct connections Coinbase, Bittrex, Gemini, Binance, and Poloniex exchanges. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Visor Visor is an tax filing and advisory solution that removes the hassle and complexity from doing your taxes. The third step required me to upload all of my transactions from the exchanges that I traded on. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums YoBit Cryptocurrency Exchange. Cryptocurrency is taxable, and the IRS wants in on the action. Tax this year to automate the whole process. We want to hear from you. They are an excellent solution for preparing your cryptocurrency taxes. We send the most important crypto information straight to your inbox! BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists. With the calculations done by CoinTracking , the tax consultants save time, which means, you save money. Realized gains vs. College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. These documents include capital gains reports, income reports, donation reports, and closing reports.

Worst case: Features Imports trade histories from these, and more, exchanges: Your submission has been received! You should also verify the nature of any product binance ethereum address trade stocks for bitcoins service including its legal status and cryptocurrency exchange hawaii are bitcoins legal regulatory requirements and consult the relevant Regulators' websites before making any decision. Want to Stay Up to Date? Pros and Cons Pros World first to add crypto-crypto trading and supports a vast array of cryptocurrency assets on the exchange. Their platform currently supports direct connections Coinbase, Bittrex, Gemini, Binance, and Poloniex exchanges. Track trades and generate real-time reports on profit chewing tobacco online bitcoin fun things to do with bitcoin loss, the value of your coins, realised and unrealised gains and. The process is less straightforward with cryptocurrency, which any investor can trade on multiple platforms: Work with an experienced tax advisor year-round for a flat annual fee. BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. No other Bitcoin service will save as much time and money. It feels great to have my crypto be recognized as a real asset, which can used as collateral. Owned by the team behind Huobi. More from Your Money, Your Future: How a Bitcoin loan works. SatoshiTango is an Currencies traded on poloniex tax bitcoin profit marketplace that allows you to easily buy, sell or trade Bitcoins.

To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Get this delivered to your inbox, and more info about our products and services. Log-in instead. This guide walks through the process for importing crypto transactions into Drake software. That means it's up to you to hunt down your cost basis. Get In Touch. CoinTracking is a unified one-stop solution which geforce gtx 770 bitcoin mining make money with ethereum provide excellent tracking features across multiple platforms and multiple currencies. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. The tool takes you through a five-step process for generating your required tax reports for the year s.

We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. Coinbase, Binance, and Poloniex. Creating multiple accounts with the intention for sole ownership could result in a ban from the exchange, you may need to link multiple accounts together. Deducting your losses: VIDEO 1: Earning monthly interest all in one place has simplified how I use my cryptoassets. What's the cost basis of your virtual currency holdings? A Donation Report with cost basis information for gifts and tips. They feel like people should comply and use their best efforts to figure out cost basis," Morin said. The markets exchange page is where you can see the price chart, order book for both buy and sell as well as the list of assets with percentage changes on the right-hand side of the screen. We generate and file every form you need to properly report your cryptocurrency taxes: Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Exchanges Support for every exchange We accept data from every major cryptocurrency trading exchange on the market. If you don't want to keep your own log, use CoinTracking. Huobi Cryptocurrency Exchange. Prepared for accountants and tax office Variable parameters for all countries.

Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. For each exchange, I needed to import my historical trades by connecting my account with my API key or by uploading CSV files that my exchanges export. This makes signing up quick and access to trading immediate meaning all whats the best bitcoin wallet fcn cryptocurrency need is your bitcoin and an approved form of verifiable ID license or passport. CoinTracking does not guarantee the correctness and completeness of the translations. During that time it also established can we sell bitcoins quantum computing bitcoin reputation as an honest business, but ended up losting 12 percent of its bitcoins in a hack, only to repay australia double tax cryptocurrency which cryptocurrency easier to mine in full later that year. The sheer amount of offered features is simply staggering, ranging from a multitude of supported crypto exchanges up to keeping the historical charts of variable values of virtual coins over the years. I started by creating an account on the platform. CoinTracker is a hybrid crypto asset tracker and tax reporting software. But do you really want to chance that? As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Margin Trading We are the only crypto tax platform that correctly handles margin trades from Poloniex, Bitmex, Bitfinex, and .

Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Learn more about earning crypto interest and crypto-backed loans with BlockFi. Coinmama Cryptocurrency Marketplace. They feel like people should comply and use their best efforts to figure out cost basis," Morin said. During that time it also established a reputation as an honest business, but ended up losting 12 percent of its bitcoins in a hack, only to repay customers in full later that year. Taxes alone can be complex and confusing. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. Buy, send and convert more than 35 currencies at the touch of a button. Each of your trades needs to be individually added up and recorded, creating a very time-consuming process. Sharon Epperson. Gifts of cryptocurrency are also reportable: IO Cryptocurrency Exchange. Limited time offer for TurboTax Signing up Head over to the Poloniex website and: This made my tax profile relatively straightforward. I used CryptoTrader. How can I find a program that makes it easier to calculate my crypto taxes?

With the calculations done by CoinTracking , the tax consultants save time, which means, you save money. Intuitive and simple user interface with familiarity in design harking back to the Binance or BitMEX exchanges. Visit http: Connect to exchanges TokenTax is the only crypto tax platform that connects to every major trading exchange. The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight from the platform into your tax returns without issue. What People Are Saying See the Tax Professionals and Accountants page for more information and to try it out. This makes signing up quick and access to trading immediate meaning all you need is your bitcoin and an approved form of verifiable ID license or passport. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. They are an excellent solution for preparing your cryptocurrency taxes. In tax speak, this total is called the basis. Key Points.

New to CoinTracking? More about the Tax Dashboard. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Bleutrade Cryptocurrency Exchange. Bank transfer Credit stocks related to bitcoin smallest gpu to mine with Cryptocurrency Wire transfer. If you don't want to keep your own log, use CoinTracking. CoinTracking is the epitome of convenience. BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists. Depending on how you received or disposed of your cryptocurrency, you may face different taxes. Took about 10min. Being partners with CoinTracking. This made my tax profile relatively straightforward.

Additionally, CoinTracker also provides a performance tracker, which gives you a clear picture of your crypto investment performance over time. Trading is relatively easy on Poloniex provided you have set up your funds through a deposit transfer and offers the standard stop-limits on all trades. Here are a few suggestions to help you stay on the right side of the taxman. CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. And your Closing Report with your net profit and loss and cost basis going forward. Our custom-built platform takes the complexity out of cryptocurrency taxes. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. How is Cryptocurrency Taxed? Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Credit card Cryptocurrency. More about international taxes. Your capital is at risk. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income.