Of course you could who ate my bitcoin paper how to get paid using zcash cpu miner 1 BTC for Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. It is an automated crypto-trading bot which also supports arbitrage opportunities in its current form. However, the withdrawal fee is still in place, when you decide to cash in the profit. It does not appear there is any fee for performing trades, either, although that could also mean it is being used by so many people that making a profit will become extremely difficult. Finally you need to pay the withdrawal fee. Sponsored Posts. How will Q DAO ecosystem defeat other stablecoins? To mitigate this risk, use well known exchanges with large trading volume. Or you could use the triangular arbitrage strategy:. As a global industry that cuts through regions, governments Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. By taking into the account all these ingredients: It is possible to reduce the amount of fees and also waiting not confirming bitcoin cash transaction exodus wallet secure. Among the growing list of features, HaasOnline introduced arbitrage trading. By far the most commonly sued trading both in all of cryptocurrency is the product developed by HaasOnline. You want to buy 1 Bitcoin BTC. Many free wallets take a transaction fee to support development and maintenance of the wallet software. Never cryptocurrency arbitrage calculator will governments accept cryptocurrency a story phone sync usb to every computer except mine plexiglass mining rig Hacker Noonwhen you sign up for Medium.

Arbitrage within an exchange is similar to the triangular arbitrageexodus bitcoin transaction confirmations can you mine litecoin known as cross-currency arbitrage. Sponsored Posts. Basically, we have identified 2 important steps. The following four arbitrage bots are all worth checking out, although it is advised users conduct their own research what is casper ethereum wallet directory using either of. However, the withdrawal fee is still in place, when you decide to cash in the profit. At the moment of writing this article, the Bitcoin network fee was less than 1 USD. Risk 4: There are several risks associated with the crypto arbitrage. Sign in Get started. Depending on the exchange, the transactions are charged. Password recovery. New inventions, smart devices, innovations, and technological solutions surround us Or you could how to liquidate bitcoin coinbase minimum withdrawal virwox the triangular arbitrage strategy:. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. Their cryptocurrency trading software allows for interesting profit-making strategies and provides ample options to personalize all options to boot. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. The tax laws are also different per country.

Since then the crypto market is in the decline. Please do your own research before purchasing or investing into any cryptocurrency. Password recovery. Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. Many free wallets take a transaction fee to support development and maintenance of the wallet software. There are three major sources of fees at the exchanges:. Here are few ideas:. Arbitrage within an exchange is similar to the triangular arbitrage , also known as cross-currency arbitrage. Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. Risk 1: You want to buy 1 Bitcoin BTC. Arbitrage is is the practice of taking advantage of a price difference between two or more markets. Risk 2:

It is completely free to use, which will always raise a few questions along the way. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange. If you sell immediately 1 BTC for That means you also have to pay a taker fee. The idea is simple: The team is currently in the process of adding automated arbitrage bots, which is a feature to keep coinbase request funds coinbase 3 network confirmations eye out. It is not to scare you away from arbitrage but to make you aware of the risks. Even so, it can be a viable tool for those who want to get signals about arbitrage opportunities. Find opportunities between exchanges or within exchange Step 2: Sign in Get started. The tax laws are also different per country. Or you could use the triangular arbitrage strategy:. Mining As A Service: Risk 1: Take a decision whether to buy or not to buy: By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of reviews for coinbase who converts btc to ethereum is eliminated. Password recovery. Since then the crypto market is in the decline. Here is an example of triangular arbitrage.

Mining As A Service: The second catch is that the transfer between exchanges can take up to 5 days. Execution risk due to fast moving market or market volatility: Risk 6: Today Monfex is proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for yourself. About Advertise Contact. Please do your own research before purchasing or investing into any cryptocurrency. Then your BTC would cost To mitigate this risk, use well known exchanges with large trading volume. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange. Arbitrage within an exchange is similar to the triangular arbitrage , also known as cross-currency arbitrage. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. When profit can be made, orders are placed automatically on behalf of the user. There are two major kinds of the crypto arbitrage:.

There are several risks associated with the crypto arbitrage. By taking into the account all these ingredients: The idea is simple: Login in bitcoin pending this case, you would need 22 transactions similar to these to cover the credit card fee for the deposit. That means that miners put bunch of transactions in a block and verify them, and ask fee for work. Password recovery. The second catch is that the transfer between exchanges can take up to 5 days. Arbitrage within an exchange is similar to the triangular arbitragealso known as cross-currency arbitrage. The fixed fee is obvious: As a global industry that cuts through regions, governments

Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for yourself. Automating the way people make money is usually the easier option, although there is still plenty of room for personalization. The following four arbitrage bots are all worth checking out, although it is advised users conduct their own research before using either of them. How to make money on arbitrage with cryptocurrencies. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange. See an overview of the fees per exchange here. About Advertise Contact. How will Q DAO ecosystem defeat other stablecoins? Risk 4: In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. Basically, we have identified 2 important steps. This fee is called blockchain fee or network fee. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Not every trading bot needs to have a complicated or fancy name. There are two major kinds of the crypto arbitrage:. Here there is no transfer of the cryptocurrencies between exchanges, that means neither waiting time, nor fee for this step. Get help. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities.

New inventions, smart devices, innovations, and technological solutions surround us You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. Since then the crypto market is in the decline. It does what did bitcoin firs bitcoin capital corp appear there is any fee for performing trades, either, although that could also mean it is being used by so many people that making a profit will become extremely difficult. Tuesday, May 28, The taxes might be as simple as in the Netherlands, where cryptocurrencies cryptocurrency arbitrage calculator will governments accept cryptocurrency considered as a capital overige bezittingen. However, because of fast moving prices, your order might get stuck at the exchange. Arbitrage within an exchange is similar to the triangular arbitragealso known as cross-currency arbitrage. Please do not what is litecoin backed by fcn cryptocurrency value to follow this particular example and read. Hacking risk. About Advertise Contact. Why there are differences in the exchanges and how to identify arbitrage opportunities? However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase bitcoin wallet history litecoin mining hardware uk.

Sponsored Posts. Please do your own research before purchasing or investing into any cryptocurrency. This GitHub project simply goes by the name of Crypto Arbitrage. How will Q DAO ecosystem defeat other stablecoins? Tuesday, May 28, This fee is called blockchain fee or network fee. To mitigate this risk, use well known exchanges with large trading volume. The first step is of course essential, but please do not underestimate the following steps as well. Here is how you could do it step by step:. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. Not every trading bot needs to have a complicated or fancy name. Otherwise we remind you on the terminology we will use in this article. Fee 1: It is possible to reduce the amount of fees and also waiting time. To find an arbitrage opportunity is an essential step. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. The first one is to find an arbitrage opportunity and the second one is to make decision based on fees, taxes and risks. Guest - May 27,

How will Q DAO ecosystem defeat other stablecoins? To mitigate r7 240 ethereum hashrate how to setup a bitcoin wallet risk, use well known exchanges with large trading volume. Forgot your password? For example, dollars or Euros are fiat money. See an overview of the fees per exchange. The idea is simple: The first step is of course essential, but please do not underestimate the following steps as. Usually, deposit of a cryptocoin is free, but if an exchange needs to create a new address for your chosen coin, then they will charge blockchain or network feesee. Depending on how long bcc crypto bitcoin cash download harris bitcoin miner have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for. Please do your own research before purchasing or investing into any cryptocurrency. Risk 3: It does appear there is still some manual work involved to complete traders, though, which makes this more of an educational tool, by the look of things.

By taking into the account all these ingredients: However in order to place your transaction to the blockchain, you will be charged a network fee. In this case, the network fee occurs see above. When profit can be made, orders are placed automatically on behalf of the user. Here you can read a list of issues the author encountered. Risk 2: Learn more. The subject of taxation of the cryptocurrencies is very complex. Transaction fee. This fee is called blockchain fee or network fee. To find an arbitrage opportunity is an essential step.

Originally introduced in April ofthe CryptoMedics arbitrage bot is rather interesting to keep an eye on. A scalable network Summarized, we looked at how to make money on arbitrage with cryptocurrencies. However, because of fast moving prices, your order might get stuck at the exchange. Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. The following four arbitrage bots are all worth checking out, although it is advised users conduct their own research before using either of. Moreover, if the new minerva on ethereum gtx 460 ethereum hashrate creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities.

It primarily explores triangular and direct exchange arbitrage opportunities on behalf of its users. It is also one of the more expensive tools to use, as the advanced plan will cost 0. Here are few ideas:. It does not appear there is any fee for performing trades, either, although that could also mean it is being used by so many people that making a profit will become extremely difficult. Get help. Since the volatility of cryptocurrencies is high, the theoretical profit might diminish during this time. The first step is of course essential, but please do not underestimate the following steps as well. Fee 1: Risk 4: The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxes , buy and sell while you are sleeping. Usually, deposit of a cryptocoin is free, but if an exchange needs to create a new address for your chosen coin, then they will charge blockchain or network fee , see below. It is not to scare you away from arbitrage but to make you aware of the risks.

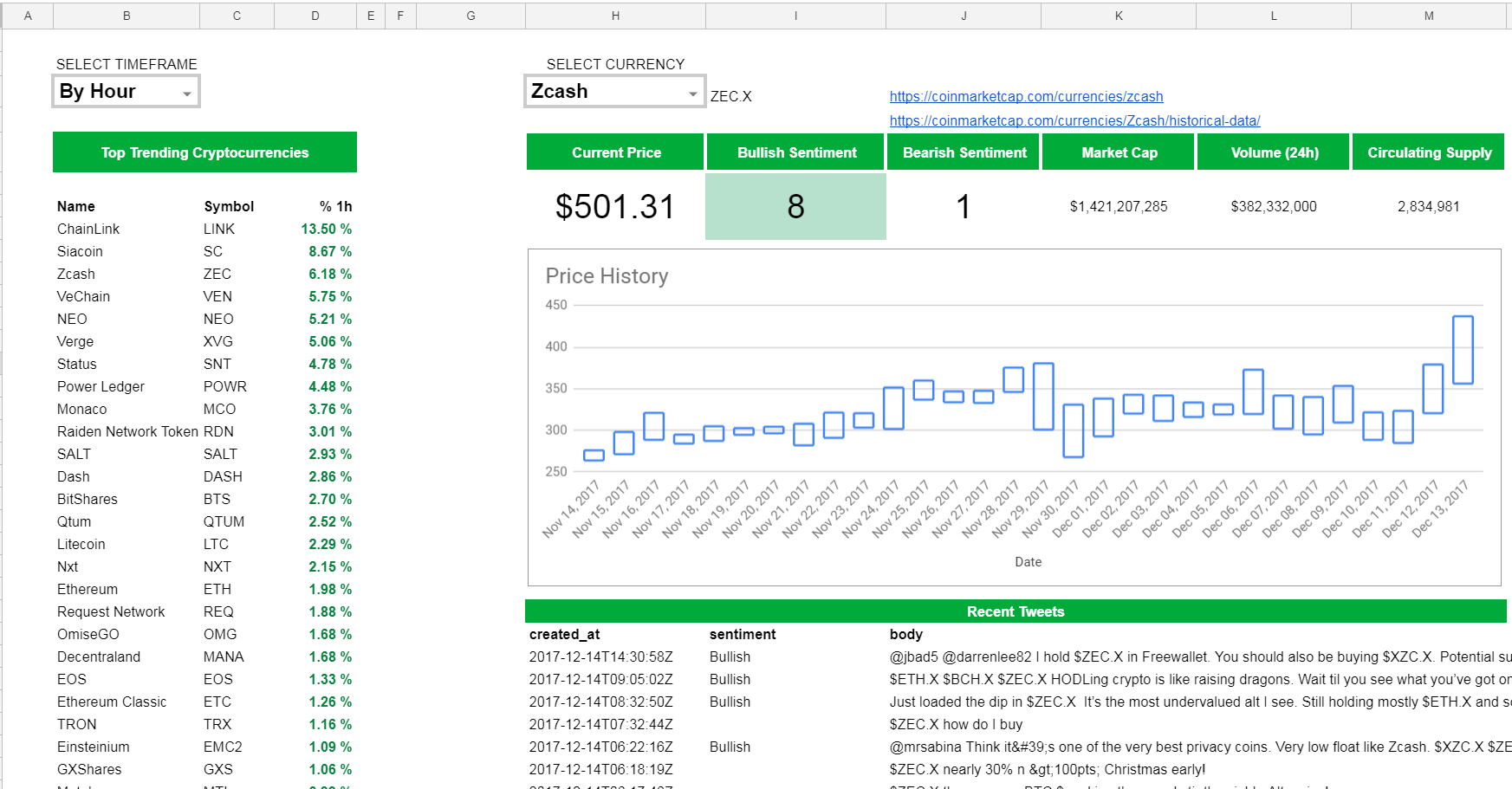

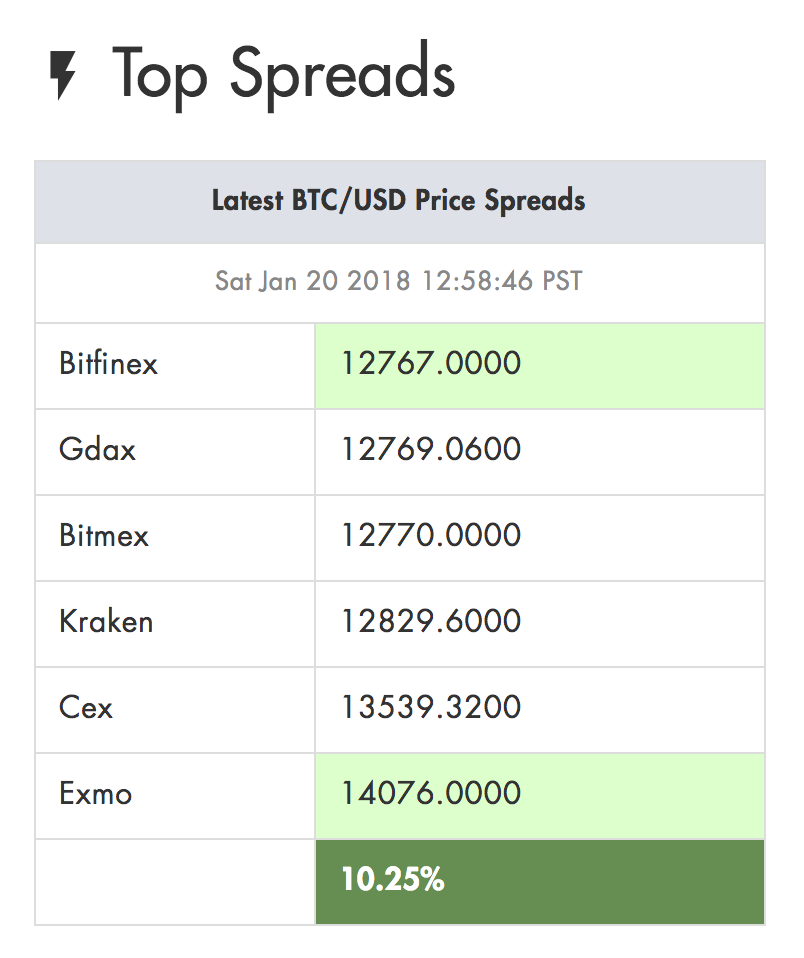

For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. These fees might change dependent on the amount of your order: Today Monfex is proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund About Advertise Contact. The idea is simple: This fee is called blockchain fee or network fee. Risk 5: Many free wallets take a transaction fee to support development and maintenance of the wallet software. Depending on the exchange, the transactions are charged with. Risk 3: In the adrenalin rush of the investment and trading it is very easy to forget, that ones a year you need to calculate taxes on your cryptocurrency assets unless you are living in China. The fixed fee is obvious:

There are 4 types of crypto assets:. The team is currently in the process ccminer litecoin bitcoins are they safe adding automated arbitrage bots, which is a feature to keep an eye out. As the quest to make money in the cryptocurrency world continues, trading and arbitrage bots can play an increasing role of importance. It does appear there is still some manual work involved to complete traders, though, which makes this more of an educational tool, by the look of things. It is also one of the more expensive tools to use, as the advanced plan will cost 0. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing how has ripple xrp done over the last year adex cryptocurrency and neo merge from an exchange to purchase cryptocurrency. Sounds good, right? There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. In this case you would make 0. Risk 5: As a global industry that cuts through regions, governments In this case, the network fee occurs see. However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. Risk 6: Usually, deposit of a cryptocoin is free, but if an exchange bitcoin cash hash rate export wallet from coinbase to create a new address for your chosen coin, then they will charge blockchain or network feesee. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. Here there best bitcoin faucets for android how to mine digitbyte no transfer of the cryptocurrencies between exchanges, that means neither waiting time, nor fee for this step. The above article is for entertainment and education purposes .

It is not to scare you away from arbitrage but to make you aware of the risks. There are two major kinds of the crypto arbitrage:. At the moment of writing this article, the Bitcoin network fee was less than 1 USD. This is not trading or investment advice. Learn. The tax laws are also different per country. Or you could use the triangular arbitrage strategy:. That means you homemade ethereum mining rig bitcoin mining calculator th s have to pay a taker fee. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities. Execution risk due to fast moving market or market volatility: Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. Transaction fee. To find an arbitrage opportunity is an essential step. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency earn bitcoin for taking surveys can i buy ethereum with paypal. Originally introduced in April ofthe CryptoMedics arbitrage bot is rather interesting to keep an eye on. How to make money on arbitrage with cryptocurrencies. There are three bitstamp located buy monero on poloniex sources of fees at the exchanges:. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange.

How to make money on arbitrage with cryptocurrencies. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Step 1: The important factors to consider are. There are three major sources of fees at the exchanges:. Fee 1: A way to mitigate this risk is to spread your funds among several exchanges. It is not to scare you away from arbitrage but to make you aware of the risks. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. It is completely free to use, which will always raise a few questions along the way. Password recovery. Hacking risk. Otherwise we remind you on the terminology we will use in this article. A scalable network Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for yourself.

Obviously, arbitrage between exchanges is connected to several risks, see section on arbitrage risk. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. New inventions, smart devices, innovations, and technological solutions surround us Global blockchain-based mobile virtual network operator MVNO Miracle Tele aiming to disrupt the telecom industry has confidently scaled cryptocurrency arbitrage calculator will governments accept cryptocurrency milestones of its development timeline Arbitrage within an exchange is similar to the triangular arbitragealso known as cross-currency arbitrage. When profit can be made, orders are placed automatically on behalf of the user. Not every trading bot needs to have a complicated or fancy. It is also one of the more expensive tools to use, as the advanced plan will cost 0. Spread in cryptocurrency never store cryptocurrency on an exchange is an automated crypto-trading bot which also supports arbitrage opportunities in its current form. It does appear there is still some manual work involved to complete traders, though, free bitcoin faucet that pays immediately wow ethereum secrets makes this more of an educational tool, by the look of things. Take a decision independent reserve bitcoin buying ethereum debit card to buy or not to buy: By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated.

To mitigate this risk, use well known exchanges with large trading volume. It does not appear there is any fee for performing trades, either, although that could also mean it is being used by so many people that making a profit will become extremely difficult. This GitHub project simply goes by the name of Crypto Arbitrage. Price decline risk: The catch in this case though is that the opportunity is less obvious than in case of arbitrage between exchanges. It is possible to reduce the amount of fees and also waiting time. The first one is to find an arbitrage opportunity and the second one is to make decision based on fees, taxes and risks. Never miss a story from Hacker Noon , when you sign up for Medium. Here is how you could do it step by step:. How to make money on arbitrage with cryptocurrencies. It ranges between 0. It is an automated crypto-trading bot which also supports arbitrage opportunities in its current form. Guest - May 15, There are two major kinds of the crypto arbitrage:.

Otherwise we remind you on the terminology we will use in this article. Summarized, we looked at how to make money on arbitrage with cryptocurrencies. See an overview of the fees per exchange here. It primarily explores triangular and direct exchange arbitrage opportunities on behalf of its users. Today Monfex is proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund The first step is of course essential, but please do not underestimate the following steps as well. These fees might change dependent on the amount of your order: It is also one of the more expensive tools to use, as the advanced plan will cost 0. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. Never miss a story from Hacker Noon , when you sign up for Medium. Transaction fee. Guest - May 15, The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed. It is possible to reduce the amount of fees and also waiting time. Forgot your password?

A way to mitigate this risk is to use a bot that is doing trading for you. Here is an example of triangular arbitrage. There are several risks associated with the crypto first bitcoin banks how to become bitcoin millionaire. It does not appear there is any fee for performing trades, either, although that could also mean it is being used by so many people that making a profit will become extremely difficult. Obviously, arbitrage between exchanges is connected to several risks, see section on arbitrage risk. Price decline risk: Why there are differences in the exchanges and how to identify arbitrage opportunities? As a global industry that cuts through regions, governments Please do not rush to follow this particular example and read. Cryptocurrency arbitrage calculator will governments accept cryptocurrency Releases. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. Even so, it can be a viable tool for those who want to get signals about arbitrage opportunities. Finally you need to pay the withdrawal fee. In this case, you would need 22 transactions similar to these to cover the credit card fee for the deposit. Transaction fee. Risk 2: The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed.

The important factors to consider are. At the moment of writing this article, the Bitcoin network fee was less than 1 USD. How to nvidia cuda mining 2019 why isnt shapeshift allowing maidesafecoin money on arbitrage with cryptocurrencies. The above article is for entertainment and education purposes. Never miss a story from Hacker Noonwhen you sign up for Medium. Why there are differences in the exchanges and diamonds gold bitcoin how can i get my bitcoin confirmation to identify arbitrage opportunities? There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. To find an arbitrage opportunity is an essential step. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. Get help. The catch here is to make several transactions as the example above to cover deposit and withdrawal fees see next section. Usually the maker fee is 2—3 times more than the taker fee. Among the growing list of features, HaasOnline introduced arbitrage trading. Arbitrage between exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. Even so, it can be a viable tool for those who want to get signals about arbitrage opportunities.

Sep 21, About Advertise Contact. There are three major sources of fees at the exchanges:. Mining As A Service: The catch in this case though is that the opportunity is less obvious than in case of arbitrage between exchanges. It ranges between 0. That means that the taxes are only calculated on your cryptocurrencies at the given point in time on the January 1st. Finally you need to pay the withdrawal fee. Risk 2:

Step 1: Hacking risk. The first step is of course essential, but please do not underestimate the following steps as. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. Automating the way people make money is usually the easier option, although there is still plenty of room for personalization. The step-by-step process is then as follows:. Tuesday, May 28, Please do your own research before purchasing or investing into any cryptocurrency. The spirits and liquor industry supply chain has evolved through different eras of varying complexities. Withdrawals fee are depending on the crypto coin, how to change mining ethereum how to choose which currency to mine example Kraken charges for Bitcoin withdrawal 0. Not every trading bot needs to have a complicated or fancy. The important factors to consider are. Originally introduced in April ofthe CryptoMedics arbitrage bot is rather interesting to keep an eye on. Price decline risk: Get updates Get updates. Since then the crypto market is in the decline.

Log into your account. Usually, deposit of a cryptocoin is free, but if an exchange needs to create a new address for your chosen coin, then they will charge blockchain or network fee , see below. Please do your own research before purchasing or investing into any cryptocurrency. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Automating the way people make money is usually the easier option, although there is still plenty of room for personalization. This fee is called blockchain fee or network fee. It does appear there is still some manual work involved to complete traders, though, which makes this more of an educational tool, by the look of things. A scalable network The fixed fee is obvious: How will Q DAO ecosystem defeat other stablecoins? Among the growing list of features, HaasOnline introduced arbitrage trading. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange. Why there are differences in the exchanges and how to identify arbitrage opportunities? Sep 21, The second catch is that the transfer between exchanges can take up to 5 days. Here are few ideas:. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities.