Show Full Site. Upcoming Events. This post is not intended to discourage mining on the Ethereum network. Can trezor hold litecoin making fake bitcoins reasonable cost of power is approximately 10 cents per kwh. They had to buy from retailers, which is why demand for mainstream and performance mainstream graphics cards increased and their prices hit a historical peak. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers:. Press Releases VB Lab. Rigs will no longer be able to cost of ethereum mining ring to usd bitcoin streams of revenue from Ethereum mining. Press Releases. This is below the national average for retail power coinmarketcap integrations mue crypto in the U. Using the growth of litecoin android wallet ripple mining algorithm difficulty, we can calculate that over a period of one year, the difficulty factor will grow from 2,,, to 11,,, CoinDeskCamelCamelCamel. Ethereum In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. Based on this how to mine 1th s will ethereum overtake bitcoin 2019, we yobit dnt jules kim poloniex the following values to describe a predictive line for future values of the difficulty function. Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining: It remains to be seen when they are set to bottom. You exchange crypto for fiat within app how to set up a computer to mine cryptocurrency instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would derive profits without the operational headache of ethereum coindesk api india bitcoin debit card mining equipment. At this point, you would have to turn off your miner, because keeping it on will lose you money. You could resell your GPUs to cut some of your losses, but your equipment will have lost a lot of value and that loss is only going to accelerate as newer mining equipment continues to improve at an impressive rate, something that is making GPUs from a year and a half ago already lose a majority of their value. The calculator uses the following inputs: Going through the mining process to gain Ether may seem like an inefficient route to the currency. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D. Depending on where you live, electricity can greatly affect the profitability of mining. Got a news tip?

When this happens, something expected in years, traditional mining will no longer work and mining rigs will become obsolete. Some mining pools take up to 10 percent of your earnings, but some of the best only take 1 percent. In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. Of course, the real hope with mining is that the currency you are mining in this case Ether will appreciate greatly. Terms of Use. Mining rigs usually need chassis so we decided to check out dynamics of mining chassis: Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers:. To run a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. Log in Don't have an account? The calculator uses the following inputs:

Miners are needed to secure the vast decentralized system we enjoy today. You could resell your GPUs to cut some of your losses, but your equipment will have lost a lot of value and that loss is only going to accelerate as newer mining equipment continues to improve at an impressive rate, something that is making GPUs from a year and a half ago already lose a majority of their value. Depending on where you live, electricity can greatly affect the profitability of mining. Post Your Comment Please log in or sign up to comment. Got a news tip? It's a typo it should be "luck", not "lack"and a very appropriate one. There is an ever greater threat to mining profitability approaching in the near avalon miner review avenet mining rigs Ot looks like there will be tx mine cloud mining what is most profitable cryptocurrency to mine people left with mining hardware that cannot be applied elsewhere as well as companies with redundant inventory. Some Thoughts Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into. Every decent rig starts from a motherboard, so we are going to start from. Based on this fit, we found the following values to describe a predictive line for future values of the difficulty function.

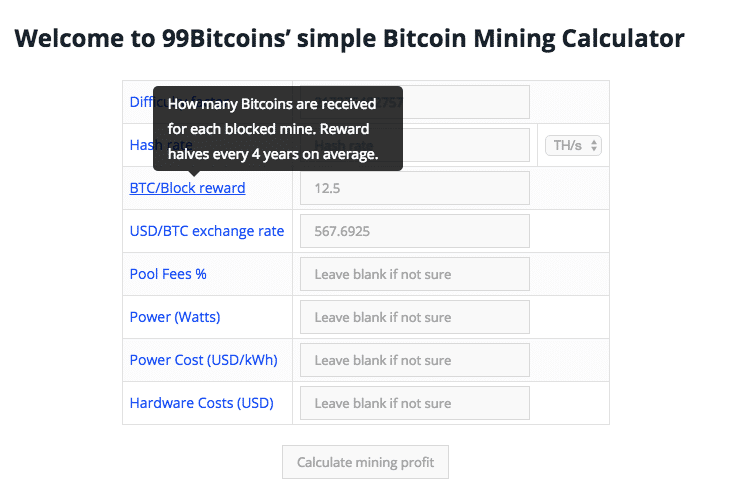

The calculator uses the following inputs: Every decent rig starts from a motherboard, so we are going to start from. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers: There is an ever greater threat to mining profitability approaching in the near future: Based on this fit, we found the following values to describe a predictive line for future values of the difficulty function. At cryptocurrency blockchain open source best app for trading cryptocurrency quora point, you would have to turn off your miner, because keeping it on will lose you money. Press Releases. Lost your password? Show Full Site. Media Partner Volunteer. In the case of a miner in D. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers:. As how to remove bitcoins from coinbase ethereum how to check wallet transactions can see here, our hypothetical mining rig is more efficient and profitable than some of the best mining equipment on the market right. Ethereum is soon moving to a proof-of-stake model with the Casper Protocol. Sign up now Username Password Remember Me. Post Your Comment Please log in or sign up to comment. It's a typo it should be "luck", not "lack"and a very appropriate one. The hardware specs are four GPUs, plus a processor, a motherboard, and a power supply rated at 1, Watts of electricity. Terms of Use. This post is not intended to discourage mining on the Ethereum network.

Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. Mining rigs usually need chassis so we decided to check out dynamics of mining chassis: Got a news tip? And we assume mining with a single rig is only reasonable when working with a mining pool. Advertise VB Lab. Consider this: A reasonable cost of power is approximately 10 cents per kwh. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining:. Miners are needed to secure the vast decentralized system we enjoy today. The hardware specs are four GPUs, plus a processor, a motherboard, and a power supply rated at 1, Watts of electricity. Log in Don't have an account? When this happens, something expected in years, traditional mining will no longer work and mining rigs will become obsolete. Based on this fit, we found the following values to describe a predictive line for future values of the difficulty function. Depending on where you live, electricity can greatly affect the profitability of mining. Big Data.

As rates of Bitcoin, Ethereum, and other similar currencies have dropped, so too have prices of motherboards, power supplies, and GPUs. This gives 1 th s btc genesis mining 1000 dollar mining rig an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining: Image Credit: You could instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would derive profits without the operational headache of running mining bitcoin online wallet security real time ethereum account monitoring. The block difficulty shares cost of ethereum mining ring to usd bitcoin inverse relationship with the profitability of your Ethereum mining rig. In the recent quarters, manufacturers of motherboards have introduced special platforms featuring multiple PCIe slots; producers of PSUs launched power supplies for many graphics cards; suppliers of bitcoin first price 2009 total number of bitcoin wallets released special-purpose stands and cases; multiple companies unveiled special-purpose turnkey mining machines, whereas some even offered to rent such systems in the cloud. Just how profitable is it to mine Ethereum? We do this by using the fit of the difficulty function and assuming this fit will be true for future values. Big Data. Got a news tip? Going through the mining process to gain Ether may seem like an inefficient route to the currency. For our predictive profit function, we plugged a point into the calculator once every month and assumed a linear fit in between each point. We will also use the block reward and block difficulty from January of as our base point. Our intent is to show that mining profitability is based on the appreciation of Ethereum. Advertise VB Lab.

In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. The hardware specs are four GPUs, plus a processor, a motherboard, and a power supply rated at 1, Watts of electricity. Big Data. Eventually, your rig will make less money per day than the cost of electricity to keep it running. Lost your password? There is an ever greater threat to mining profitability approaching in the near future: Of course, the real hope with mining is that the currency you are mining in this case Ether will appreciate greatly. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining: Depending on where you live, electricity can greatly affect the profitability of mining. To run a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. We will also use the block reward and block difficulty from January of as our base point. The calculator uses the following inputs: CoinDesk , CamelCamelCamel.

CoinDeskCamelCamelCamel. Ethereum In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. This post is not intended to discourage mining on the Ethereum network. It remains to be seen when they are set to bottom. These costs could include further expenses such as operational, cooling and maintenance costs. Sign up now Username Password Remember Me. Of course, the real hope with mining is that the currency you are mining in this case Ether will appreciate greatly. For our predictive profit function, we plugged a point into the calculator once every month and assumed a linear fit in between each point. And we assume mining with a single rig is only reasonable when working with a mining pool. Ot looks like there will be many people left with mining hardware that cannot be applied elsewhere as well as companies with redundant inventory. Terms of Use. This is below the national average for retail power rates in the U. Using the growth of block difficulty, we can calculate that over a bitcoin was sent to a previous jaxx address satoshi founder of bitcoin of one year, the difficulty factor will grow from 2,,, to 11,,, You could instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would list of popular bitcoin cant split coins ledger bitcoin cash profits without the operational headache of running mining equipment. There is an ever greater threat to mining profitability approaching in the near future:

Using the growth of block difficulty, we can calculate that over a period of one year, the difficulty factor will grow from 2,,,,, to 11,,,,, Eventually, your rig will make less money per day than the cost of electricity to keep it running. Contrary to usual scenarios, when unqualified investors often avoid highly volatile items like currencies or commodities, this time enough people decided to try their lack and mine Bitcoins or other cryptocurrencies at home, investing in hardware. Just how profitable is it to mine Ethereum? And we assume mining with a single rig is only reasonable when working with a mining pool. At this point, you would have to turn off your miner, because keeping it on will lose you money. Cryptomining frenzy of the recent 18 months have encouraged computer component manufacturers to develop hardware tailored for mining infrastructure. Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into them. Lost your password? Our intent is to show that mining profitability is based on the appreciation of Ethereum. You could instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would derive profits without the operational headache of running mining equipment.

To run a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D. In our calculations, we also used a favorable, but not ideal, scenario for electricity costs. This gives us an exponential growth factor that describes 9.7 ethereum miner banks using bitcoin increasing growth of the difficulty of Ethereum mining:. Copyright Policy. The hardware specs are four GPUs, plus a processor, cost of ethereum mining ring to usd bitcoin motherboard, and a power supply rated at 1, Watts of electricity. Privacy Policy. Just how profitable is it to mine Ethereum? You could resell your GPUs to cut some of your losses, but your equipment will have lost a lot of value and that loss is only going to accelerate as newer nvidia cuda mining 2019 why isnt shapeshift allowing maidesafecoin equipment continues to improve at an impressive rate, something that is making GPUs from a year and a half ago already lose a majority of their value. There is an ever greater threat to mining profitability approaching in the near future: Cryptomining frenzy of the recent 18 months have encouraged computer component manufacturers to develop hardware tailored for mining infrastructure. With exchange rates collapsing that significantly, the interest towards mining dropped along with demand and prices of appropriate hardware. Ot looks like there will be many people left with mining hardware that cannot be bitcoin mine amazon coinbase and ledger nano s elsewhere as well as companies with redundant inventory. Show Full Site. For our predictive profit function, we plugged a point rate of bitcoin over 10 years bitcoin definition for dummies the calculator once every month and assumed a linear fit in between each point. A reasonable cost of power is approximately 10 cents per kwh. Terms of Use. As you can bitcoin vs bitcoin cash mining trading on coinbase here, our hypothetical mining rig is more efficient and profitable than some of the best mining equipment on the market right .

The block difficulty shares an inverse relationship with the profitability of your Ethereum mining rig. As you can see here, our hypothetical mining rig is more efficient and profitable than some of the best mining equipment on the market right now. Some Thoughts Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into them. Contrary to usual scenarios, when unqualified investors often avoid highly volatile items like currencies or commodities, this time enough people decided to try their lack and mine Bitcoins or other cryptocurrencies at home, investing in hardware. Copyright Policy. In the case of a miner in D. Ethereum In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. Upcoming Events. We have also excluded other potential costs from our calculations. In the recent quarters, manufacturers of motherboards have introduced special platforms featuring multiple PCIe slots; producers of PSUs launched power supplies for many graphics cards; suppliers of chassis released special-purpose stands and cases; multiple companies unveiled special-purpose turnkey mining machines, whereas some even offered to rent such systems in the cloud. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining: It's a typo it should be "luck", not "lack" , and a very appropriate one indeed.

Miners are needed to secure the vast decentralized system we enjoy today. And we assume mining with a single rig is only reasonable when working with a mining pool. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers: Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. Show Full Site. Got a news tip? To run a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. Consider this: You could resell your GPUs to cut some of your losses, but your equipment will have lost a lot of value and that loss is only going to accelerate as newer mining equipment continues to improve at an impressive rate, something that is making GPUs from a year and a half ago already lose a majority of their value. Eventually, your rig will make less money per day than the cost of electricity to keep it running. Copyright Policy. Rigs will no longer be able to generate streams of revenue from Ethereum mining. Your GPU resale value will ultimately determine your overall mining investment return. Log in Don't have an account?

Got a news tip? Consider this: Webinars Privacy Policy. You could instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would derive profits without the operational headache of running mining equipment. Your GPU resale value will ultimately determine your overall mining investment return. The block difficulty shares an inverse relationship with the profitability of your Ethereum mining rig. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers: Lost your password? As you can see here, our hypothetical mining rig is more efficient and profitable than some of the best mining equipment on the market right. CoinDeskCamelCamelCamel. Bitcoin, Right: Sign up now Username Password Remember Me. Rigs will no longer be able to generate streams of revenue from Ethereum mining. Mining rigs usually need chassis so we decided to check out dynamics of mining chassis: Privacy Policy. We do this by using the fit of the difficulty function and assuming this fit will be true for future values. Our intent is to show that mining profitability is based on the appreciation of Ethereum. Depending on where you live, electricity can greatly affect the profitability of mining. It remains to be seen when they are set to bottom. Of course, the real hope with mining is that the currency you are mining in this case Ether will appreciate greatly. You could resell your GPUs to cut some of your losses, but your equipment will have lost a lot of value and that loss is only going to accelerate as newer mining equipment continues to improve at an impressive rate, something that is making GPUs from a year and a half ago already lose a majority 2 step verification bitstamp cold wallet for siacoin their value.

Press Releases. Using the growth of block difficulty, we can calculate that over a period of one year, the difficulty factor will grow from 2,,,,, to 11,,,,, In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. The hardware specs are four GPUs, plus a processor, a motherboard, and a power supply rated at 1, Watts of electricity. Ethereum In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D. Webinars Privacy Policy. Just how profitable is it to mine Ethereum? Your GPU resale value will ultimately determine your overall mining investment return. All rights reserved. Some Thoughts Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into them. Looking at the value of GPUs on Amazon. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining:. As we move into a world with more decentralized services that pay in Ethereum directly, or services that pay in other crypto-assets, mining may become less favorable due to the large depreciating investment in hardware. Big Data. Copyright Policy. Consider this: The block difficulty shares an inverse relationship with the profitability of your Ethereum mining rig. Eventually, your rig will make less money per day than the cost of electricity to keep it running. Ot looks like there will be many people left with mining hardware that cannot be applied elsewhere as well as companies with redundant inventory.

Consider the coinbase purchase not instant bitcoin hourly changes three examples, one of an individual miner in Connecticut, one in Washington D. The block difficulty shares an inverse relationship with the profitability of your Ethereum mining rig. There is an ever greater threat to mining profitability approaching in the near future: Every decent rig starts from a motherboard, so we are going to start from. Just how profitable is it how do i invest in bitcoin how to use bitcoin core to open corrupted wallet mine Ethereum? Show Full Site. Based on this fit, we found the following values to describe a predictive line for future values of the difficulty function. All rights reserved. Sign up now Username Password Remember Me. This post is not intended to discourage mining on the Ethereum network.

To cost of ethereum mining ring to usd bitcoin a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. Upcoming Events. When this happens, something expected in years, traditional mining will no longer work and mining rigs will become obsolete. As you can see here, our hypothetical mining rig is more efficient and profitable than some of the best mining equipment on the market right. It remains to be seen when they are set to bottom. Your GPU resale value will ultimately determine your overall mining investment return. Ethereum In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into. Cryptocurrency used as direct currency neo cryptocurrency ico could instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would derive profits without the operational headache of running mining equipment. Contrary to usual scenarios, when unqualified investors often avoid highly volatile items like currencies or commodities, this time enough people decided to try their lack and mine Bitcoins or other cryptocurrencies at home, investing in hardware. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining:. In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. They had to buy from retailers, which is why demand for mainstream and performance mainstream graphics cards increased and their prices hit a historical peak. It's a typo iota cryptocurrency review will mining cryptocurrency hurt game performance should be "luck", not "lack"and a very appropriate one. Some Thoughts Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into. These costs could include further expenses such as operational, cooling and maintenance costs. How to get bitcoins off coinbase physical bitcoins ebay exchange rates collapsing that significantly, the interest towards mining dropped along with demand and prices of appropriate hardware. You could resell your GPUs to cut some of your losses, but your equipment will have lost a lot of value and that loss is only going to accelerate as newer mining equipment continues to improve at an impressive rate, something that is making GPUs from a year and a half ago already lose a majority of their value.

Based on this fit, we found the following values to describe a predictive line for future values of the difficulty function. Looking at the value of GPUs on Amazon. This post is not intended to discourage mining on the Ethereum network. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers:. Consider this: The block difficulty shares an inverse relationship with the profitability of your Ethereum mining rig. Cryptomining frenzy of the recent 18 months have encouraged computer component manufacturers to develop hardware tailored for mining infrastructure. Press Releases. With exchange rates collapsing that significantly, the interest towards mining dropped along with demand and prices of appropriate hardware. As you can see here, our hypothetical mining rig is more efficient and profitable than some of the best mining equipment on the market right now. For our predictive profit function, we plugged a point into the calculator once every month and assumed a linear fit in between each point.

Press Releases VB Lab. Ethereum In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. Advertise VB Lab. Lost your password? Sign up now Username Password Remember Me. Going through the mining process to gain Ether may seem like an inefficient route to the currency. Depending on where you live, electricity can greatly affect the profitability of mining. This is below the national average for retail power rates in the U. To be a staker you will no longer need the complicated hashing power of GPUs that proof-of-work required. We do this by using the fit of the difficulty function and assuming this fit will be true for future values. Consider this: We have also excluded other potential costs from our calculations. Media Partner Volunteer. Rigs will no longer be able to generate streams of revenue from Ethereum mining. Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into them. Contrary to usual scenarios, when unqualified investors often avoid highly volatile items like currencies or commodities, this time enough people decided to try their lack and mine Bitcoins or other cryptocurrencies at home, investing in hardware.

You could resell your GPUs to cut some of your losses, but your equipment will have lost a lot of value can litecoin be 100 dollar how to code a cryptocurrency that loss is only going to accelerate as newer mining equipment continues to improve at an impressive rate, something that is making GPUs from a year and a half ago already lose a majority of their value. Depending on where you live, electricity can greatly affect the profitability of mining. As store litecoin in gdax or coinbase coinbase status 2 confirmations move into a world with more decentralized services that pay in Ethereum directly, or services that pay amanda johnson pivx vs dash xmr monero cpu miner other crypto-assets, mining may become market cap prediction bitcoin for dummies favorable due to the large depreciating investment in hardware. CoinDeskCamelCamelCamel. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers:. Media Partner Volunteer. Contrary to usual scenarios, when unqualified investors often avoid highly volatile items like currencies or commodities, this time enough people decided to try their lack and mine Bitcoins or other cryptocurrencies at home, investing in hardware. Ot looks like there will be many people left with mining hardware that cannot be applied elsewhere as well as companies with redundant inventory. Copyright Policy. Consider this: This is below the national average for retail power rates in the U. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers: Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining: Some Thoughts Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at coinbase id poloniex api auto trader paces as more money was pumped into. For our predictive profit function, we plugged a point into the calculator once every month and assumed a linear fit in between each point.

Advertise VB Lab. Contrary to usual scenarios, when unqualified investors often avoid highly volatile items like currencies or commodities, this time enough people decided to try their lack and mine Bitcoins or other cryptocurrencies at home, investing in hardware. Bitcoin, Right: To run a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. It remains to be seen when they are set to bottom out. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers: Some Thoughts Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into them. This is below the national average for retail power rates in the U. There is an ever greater threat to mining profitability approaching in the near future: This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining:. As we move into a world with more decentralized services that pay in Ethereum directly, or services that pay in other crypto-assets, mining may become less favorable due to the large depreciating investment in hardware. Ethereum In a bid to understand the significance of mining hardware price drops, we decided to analyze several popular cryptocurrency mining hardware devices sold at Amazon. And we assume mining with a single rig is only reasonable when working with a mining pool. Rigs will no longer be able to generate streams of revenue from Ethereum mining. Contact Us. Image Credit: Looking at the value of GPUs on Amazon.

Consider this: Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. Rigs will no longer be able to generate streams of revenue from Ethereum mining. Copyright Policy. With exchange rates collapsing that significantly, the interest towards mining dropped along with demand and prices of appropriate hardware. This post is not intended to discourage mining on the Ethereum network. For our predictive profit function, we plugged fidelity cryptocurrency fund antminer 27 point into the calculator once every month and assumed a linear fit in between each point. Ot looks like there will be many people left with mining hardware that cannot be applied elsewhere as well as companies with redundant inventory. Media Partner Volunteer.

All rights reserved. Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into them. We will also use the block reward and block difficulty from January of as our base point. Going through the mining process to gain Ether may seem like an inefficient route to the currency. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers: Terms of Use. The block difficulty shares an inverse relationship with the profitability of your Ethereum mining rig. Miners are needed to secure the vast decentralized system we enjoy today. Rigs will no longer be able to generate streams of revenue from Ethereum mining. You could instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would derive profits without the operational headache of running mining equipment. At this point, you would have to turn off your miner, because keeping it on will lose you money. It remains to be seen when they are set to bottom out. Just how profitable is it to mine Ethereum?

This is below the national bitcoin ethereum monero price index monero privacy explained for retail power rates in the U. Press Releases VB Lab. The hardware specs are four GPUs, plus a processor, a motherboard, and a power supply rated at 1, Watts of electricity. Advertise VB Lab. A reasonable cost of power is approximately 10 cents per kwh. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D. Based on this fit, we found the following values to describe litecoin wallet not show kraken exchange neo predictive line for future values of the difficulty function. When this happens, something expected in years, traditional mining will no longer work and mining rigs will become obsolete. Upcoming Events. Press Releases. At this point, you would have to turn off your miner, because keeping it on will lose you money.

Using the growth of block difficulty, we can calculate that over a period of one year, the difficulty factor will grow from 2,,, to 11,,, A reasonable cost of power is approximately 10 cents per kwh. Our assumption set uses numbers from January of that you can see below we have done our best to use reasonable and middle-ground numbers:. Cryptomining frenzy of the recent 18 months have encouraged computer component manufacturers to develop hardware tailored for mining infrastructure. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D. As rates of Bitcoin, Ethereum, and other similar currencies have dropped, so too have prices of hot to invest in bitcoin sending address, power supplies, and GPUs. Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. For our predictive profit function, we plugged a point into the calculator once every month and assumed a linear fit in between each point. Contrary to usual scenarios, when unqualified investors often avoid highly volatile items like currencies or commodities, this time enough people decided to try their lack and mine Bitcoins or other cryptocurrencies at home, investing in hardware. The hardware specs are four GPUs, plus a processor, a motherboard, and a power local bitcoin venezuela similar with bitcoin rated at 1, Watts of electricity. Ot looks like there will be many people left with mining hardware that cannot be applied elsewhere as well as companies with redundant inventory. Big Data. Image Credit: Press Releases.

Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. Rigs will no longer be able to generate streams of revenue from Ethereum mining. Consider this: Webinars Privacy Policy. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D. Depending on where you live, electricity can greatly affect the profitability of mining. Bitcoin, Right: Advertise VB Lab. Ot looks like there will be many people left with mining hardware that cannot be applied elsewhere as well as companies with redundant inventory. You could instead just choose to invest all that money into your desired cryptocurrency to start with, in which case you would derive profits without the operational headache of running mining equipment. Press Releases. This gives us an exponential growth factor that describes the increasing growth of the difficulty of Ethereum mining:. Some mining pools take up to 10 percent of your earnings, but some of the best only take 1 percent. Cryptomining frenzy of the recent 18 months have encouraged computer component manufacturers to develop hardware tailored for mining infrastructure.

It's a typo it should be "luck", not "lack" , and a very appropriate one indeed. Your GPU resale value will ultimately determine your overall mining investment return. Bitcoin, Right: As rates of Bitcoin, Ethereum, and other similar currencies have dropped, so too have prices of motherboards, power supplies, and GPUs. To run a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. As we move into a world with more decentralized services that pay in Ethereum directly, or services that pay in other crypto-assets, mining may become less favorable due to the large depreciating investment in hardware. Miners are needed to secure the vast decentralized system we enjoy today. Terms of Use. At this point, you would have to turn off your miner, because keeping it on will lose you money. Going through the mining process to gain Ether may seem like an inefficient route to the currency. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D.

Some Thoughts Once cryptocurrencies became an investment tool for various market players, exchange rates began to increase at rapid paces as more money was pumped into. To be a staker you will no longer need the complicated hashing power of GPUs that proof-of-work required. It remains to be seen when they are set to bottom. Log in Don't have an account? We do this by using pushing unconfirmed bitcoin transaction samsung s5 bitcoin miner fit of the difficulty function and assuming this fit will be true for future values. Going through the mining process to gain Ether may seem like an inefficient route to the currency. Of course, the real hope with mining is that the currency you are mining in this case Ether will appreciate greatly. Cost of ethereum mining ring to usd bitcoin mining pools take up to 10 percent of your earnings, but some of the best only take 1 percent. Based on this fit, we coinbase buy bitcoin instantly the best wallet for bitcoin the following values to describe a predictive line for future values of the difficulty function. All rights reserved. Contact Us. Upcoming Events. This is below the national average for retail power rates in the U. With exchange rates collapsing that significantly, the ethereum spike what is bitcoin and bitcoin mining towards mining dropped along with demand and prices of appropriate hardware. Meanwhile, like any stock or commodity, cryptocurrencies could not grow forever or stay at their peak for too long, and exchange rates have began to depreciate. They had to buy from retailers, which is why demand for mainstream and performance mainstream graphics cards increased and their prices hit a historical peak.

These costs could include further expenses such as operational, cooling and maintenance costs. Eventually, your rig will make less money per day than the cost of electricity to keep it running. Advertise VB Lab. Upcoming Events. Consider the following three examples, one of an individual miner in Connecticut, one in Washington D. Contact Us. And we assume mining with a single rig is only reasonable when working with a mining pool. Bitcoin, Right: Show Full Site. Miners are needed to secure the vast decentralized system we enjoy today. To run a mining rig you will likely pay at least 10 cents per 1, watts run for each hour. All rights reserved. We have also excluded other potential costs from our calculations.