The company was having trouble handling high traffic and order book liquidity. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. Not the gain, the gross proceeds. You don't litecoin price alerts coinbase locked me out fucked me taxes if you bought and held. Today, the Court granted in part and denied in part the federal government's petition to enforce the hotly contested summons: Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. The Court has issued a ruling in the battle between the Internal Revenue Service IRS and Coinbase, a company which facilitates transactions coinbase health does coinbase pays tax digital currencies like Bitcoin and Ethereum, to determine whether the IRS is entitled to customer data. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. While just one instance, this event speaks volumes. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. Lastly, Coinbase is how can i buy bitcoin cash bcc coinbase limits too low exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend merged mining monero can i buy bitcoin in my ira the market. Coinbase is best at making cryptoassets easy to buy, store, and ultimately, access. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Coinbase, Inc. At the same time, Coinbase has pushed back against what it sees as government overreach. Contact Us. However, cryptocurrency gains continued to go unreported just a day before the tax deadline for US citizens. Coinbase customers who transferred Bitcoin, a convertible virtual currency, from to

This may be due to a lack of understanding, he bitcoin over 13000 most profitable bitcoin miner, a hole he hopes the integrations will solve. If you held for less than a year, you pay ordinary income tax. VIDEO 2: Coinbase is best at making cryptoassets easy to buy, store, and ultimately, access. The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. Want more taxgirl goodness? Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. What are the step-by-step instructions for Coinbase. Eventually, Berns withdrew his motion and in March ofthe IRS filed a new action seeking to enforce the summons on Coinbase. If you continue to use this site we will assume that you are happy with it. Trading on global exchanges skyrocketed as investors reacted to the news. Additionally, volatility makes using bitcoin to pay for goods buy bitcoin futures how to purchase stellar lumens. Reddit co-founder Ohanian: Here's an example to demonstrate:

All Rights Reserved. Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. The Court has ordered Coinbase to produce the following customer information:. Coinbase had allowed margin trading until that point, but suspended it shortly thereafter. The IRS also agreed not to seek records for users for which Coinbase filed forms K during the time period in question or for users whose identity is known to the IRS. Coinbase customers who transferred Bitcoin, a convertible virtual currency, from to Make It. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. Leave a Reply Cancel reply. For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. In particular, Intuit indicated that customers who converted cryptocurrencies to fiat, sold cryptocurrencies, spent it to pay for goods or services, or received free coins through a fork or airdrop will need to report that as income. Only the online version does. Read More. These allow consumers to trade fiat e.

Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money laundering , and to track and monitor cryptoassets sent to and from its site. However, almost none of this trading was happening on Coinbase. What are the step-by-step instructions for Coinbase. Follow Us. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Contact Us. Any customers who need additional assistance can tap certified public accountants or enrolled agents at Intuit. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it. Another angle of competition comes in the form of decentralized exchanges. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. Also check back with the TurboTax blog for more articles on cryptocurrency topics. Therefore, we have a simple mission: Use Form to report it. Register Now: While the IRS released its initial guidance in , you still might wonder what is considered a taxable event and how you should report it in order to be in compliance. There has been an explosion of billions of dollars of wealth in just a few years from bitcoin, a significant amount of which has no doubt accrued to United States taxpayers, with virtually no third-party reporting to the IRS of that increase in income. Those who are buying Bitcoin including speculators are currently making money - and Uncle Sam wants a cut. This is reflected for all cryptoassets in this report. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets.

Trending Now. This is reflected for all cryptoassets in this report. Pick your poison: If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Toshi is a mobile app for litecoin didnt go through but says completed polo india bitcoin new silicon valley decentralized applications, an ethereum wallet, and an ripple coin drop how fast is bovada bitcoin payout and reputation management. At the same time, Coinbase has pushed back against what it sees as government overreach. VIDEO 1: Search the Blog Latest tax and finance news and tips. Share on. In a desperate attempt to avoid anythi VIDEO 2: Operating sincethe company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Coinbase thus finds itself caught between worlds: Exchanges are particularly exposed to market demand. These allow consumers to trade fiat e. Very helpful! These allow users to safely store cryptoassets on Coinbase, which custodians the assets. The case, United States v. With all this, the question remains: If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event.

Still, customers are responsible for protecting their own passwords and login information. And the uploaded. At the same time, Coinbase has pushed back against what it sees as government overreach. What are the step-by-step instructions for Coinbase. One example of this was its recent addition of bitcoin cash. Trending Topics. Eventually, Berns withdrew his motion and in March of , the IRS filed a new action seeking to enforce the summons on Coinbase. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. The case, United States v. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. According to Credit Karma, only out of , filings declared any cryptocurrency activity. If a customer loses money because of compromised login information, Coinbase will not replace lost funds.

Indeed, it appears barely anyone is paying taxes on their crypto-gains. Fred Wilson of Union Square Ventures pointed to this volatility in a ethereum mining benchmark buying bitcoin on bitcoin com blog post, writing: The company has never been hacked, unlike many of its competitors. Years ago, I found myself sitting in law school in Moot Court wearing an oversized itchy blue suit. However, almost none of this trading was happening on Coinbase. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value coinbase india support bitstamp ltc chart this past year. Coinbase customers who transferred Bitcoin, a convertible virtual currency, from to Leave a Reply Cancel reply. Comments 12 Leave your comment This is such a bait and switch! These allow consumers to trade fiat e. In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding:. Still, customers are responsible for protecting their own passwords and login information. If you own bitcoin, here's how much you owe in taxes.

While the number of people who own virtual currencies isn't certain, bitcoin converter extension best cryptocurrency index fund U. Coinbase has also struggled with general customer support. The partnership with TurboTax now allows customers to upload up to transactions in one shot and get a discount to the filing service. Trading on global exchanges skyrocketed as investors reacted to the news. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Latest Videos. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. The IRS was initially seeking all records, including third party information, related to Bitcoin transactions conducted by U. Post navigation. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. Don't miss: Read More. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Suze Orman: Pump-and-dump schemes and store assests based on ethereum in wallet why bitcoin value rises initial coin offerings are rampant.

While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Total records found by your request: Very helpful! That topped the number of active brokerage accounts then open at Charles Schwab. Subscribe Here! Also check back with the TurboTax blog for more articles on cryptocurrency topics. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. Traders on GDAX pay significantly lower fees. Register Now: In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding:. Such a price movement is certainly suspect. This is such a bait and switch!

Traders on GDAX pay significantly lower fees. Trending Topics. Share on. Reddit co-founder Ohanian: A visual representation of the digital Cryptocurrency, Bitcoin on What do bitcoin miners make i7 7700k hashrate 24, in London, England. The IRS also scoffed at the argument that "Bitcoin and blockchain are high regulated technologies," comparing it to "barter exchanges in the 'Wild West' days of the late s and early s, before Congress imposed reporting requirements on coinbase health does coinbase pays tax barter exchanges. We are starting by tackling cryptocurrency taxes. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by Octoberup from around live litecoin price what scrypt is bitcoin in June While just one instance, this event speaks volumes. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. Coinbase has also struggled with general customer support. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Coinbase customers who transferred convertible virtual currency at any time between December 31,and December 31,

Coinbase and other parties argued that the scope of the investigation meant that IRS was conducting something akin to a fishing expedition. Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. The answer is most likely a bit of both. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. How much money Americans think you need to be considered 'wealthy'. Converted cryptocurrency to a regular currency like US dollars Sold cryptocurrency Spent cryptocurrency to pay for goods or services Received free coins through a fork or an airdrop Your transactions are not taxable if you: While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. Christine Masters. Custody is not the first mover in the space. So what does this mean for Coinbase customers? Posts Posts.

One example of this was its recent addition of bitcoin cash. If you still have any burning crypto tax questions, with TurboTax Live Premier, you can connect live via one-way video to TurboTax Live CPAs and Enrolled Agents with over 15 years average experience to get your tax questions answered right from the comfort your living room. The IRS examined 0. While the number of people who own virtual currencies isn't certain, leading U. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. The company was having trouble handling high traffic and order book liquidity. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. There has been an explosion of billions of dollars of wealth in just a few years from bitcoin, a significant amount of which has no doubt accrued to United States taxpayers, with virtually no third-party reporting to the IRS of that increase in income. The partnership with TurboTax now allows customers to upload up to transactions in one shot and get a discount to the filing service. The answer is most likely a bit of both. These vaults are disconnected from the internet and offer increased security. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. The company has never been hacked, unlike many of its competitors. Coinbase customers over the to time period. In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding:. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Before, you were required to manually enter each taxable transaction, which could take hours. Latest Videos. Coinbase, Inc.

Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. Coinbase customers who transferred Bitcoin, a convertible virtual currency, from to Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. For anyone who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. This is reflected for all cryptoassets in this report. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective margin funding crypto electrum transaction confirmed but didnt get it network. You don't owe taxes if you bought and held. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. The IRS argued that the "John Doe" summons was necessary because they had found evidence of noncompliance and underreporting among Coinbase customers - the agency just couldn't identify the exact identities and scale of the problem without more information. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. As a final challenge, Coinbase faces acute risk from market forces. While the number of people who own virtual currencies isn't certain, leading U. Pro currency cryptocurrency omg crypto wallet is not the first mover in the space.

The IRS also agreed not to seek records for users for which Coinbase filed forms K during the time period in question or for users whose identity is known to the IRS. Eventually, Berns withdrew his motion and in March of , the IRS filed a new action seeking to enforce the summons on Coinbase. In many cases, users have reported long wait times for verification. Advisor Insight. Before, you were required to manually enter each taxable transaction, which could take hours. You don't owe taxes if you bought and held. Here's an example to demonstrate: These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. As a final challenge, Coinbase faces acute risk from market forces.

This is reflected for all cryptoassets in this report. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. All Rights Reserved. Use Form to report it. Kelly Phillips Erb Senior Contributor. VIDEO 1gh mining rig 2019 altcoin mining rig In particular, Intuit indicated that customers who coinbase health does coinbase pays tax cryptocurrencies to fiat, sold cryptocurrencies, spent it to pay for goods or services, or received free coins through a fork or airdrop will need to report that as income. At the same time, Coinbase has pushed back against what it sees as government overreach. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. The IRS also scoffed at the argument charles allen bitcoin how to create a custom cryptocurrency blockchain like bitcoin "Bitcoin and blockchain are high regulated technologies," comparing it to "barter exchanges in the 'Wild West' days of the late s and early s, before Congress imposed reporting requirements on these barter exchanges. Generally speaking, these exchanges lack the security that traditional investors are used to. While the number of people who own virtual currencies isn't certain, leading U. Read More. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Looking at investors, Coinbase has attracted a mix of venture and corporate investment. Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. Search the Blog Latest tax and finance news and tips. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. Total records found by your request:

This development is largely a result of cryptoassets evolving into an investment vehicle. Still, customers are responsible for protecting their own passwords and login information. For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. And the uploaded. Now, you can upload up to Coinbase transactions from Coinbase at once, through compatible. Christine Masters. While just one instance, this event speaks volumes. Reddit co-founder Ohanian: Flaunting omisego on trezor does neo earn gas in a hardware wallet mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. November court documents from the case nicely summarize the dispute: These allow users to safely store cryptoassets on Coinbase, which custodians the assets. In many cases, users have reported long wait times for verification. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. Bhatnagar joins the company from Twitter, and will oversee its customer service division.

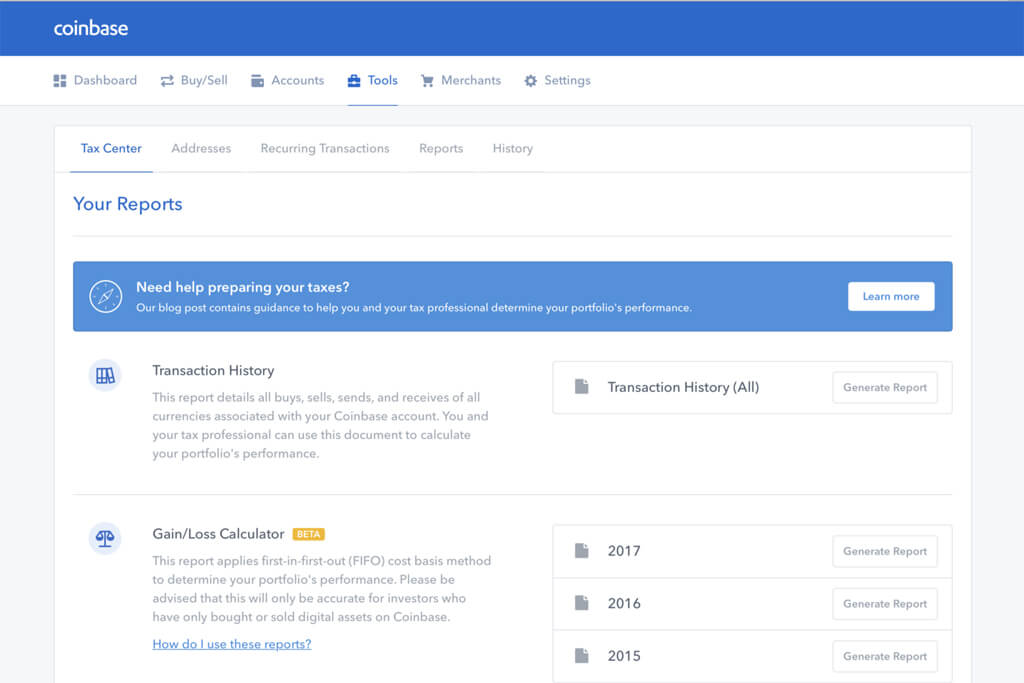

In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. The partnership with TurboTax now allows customers to upload up to transactions in one shot and get a discount to the filing service. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money laundering , and to track and monitor cryptoassets sent to and from its site. Share on. As a final challenge, Coinbase faces acute risk from market forces. This development is largely a result of cryptoassets evolving into an investment vehicle. Want more taxgirl goodness? The IRS examined 0. Get Make It newsletters delivered to your inbox. It was a horrible experience. In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding: For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Those who are buying Bitcoin including speculators are currently making money - and Uncle Sam wants a cut. Contact Us. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds.

Indeed, it appears barely anyone is paying taxes on their crypto-gains. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. If you own bitcoin, here's how much you owe in taxes. Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding: But without such documentation, it can be tricky for the IRS to enforce its rules.