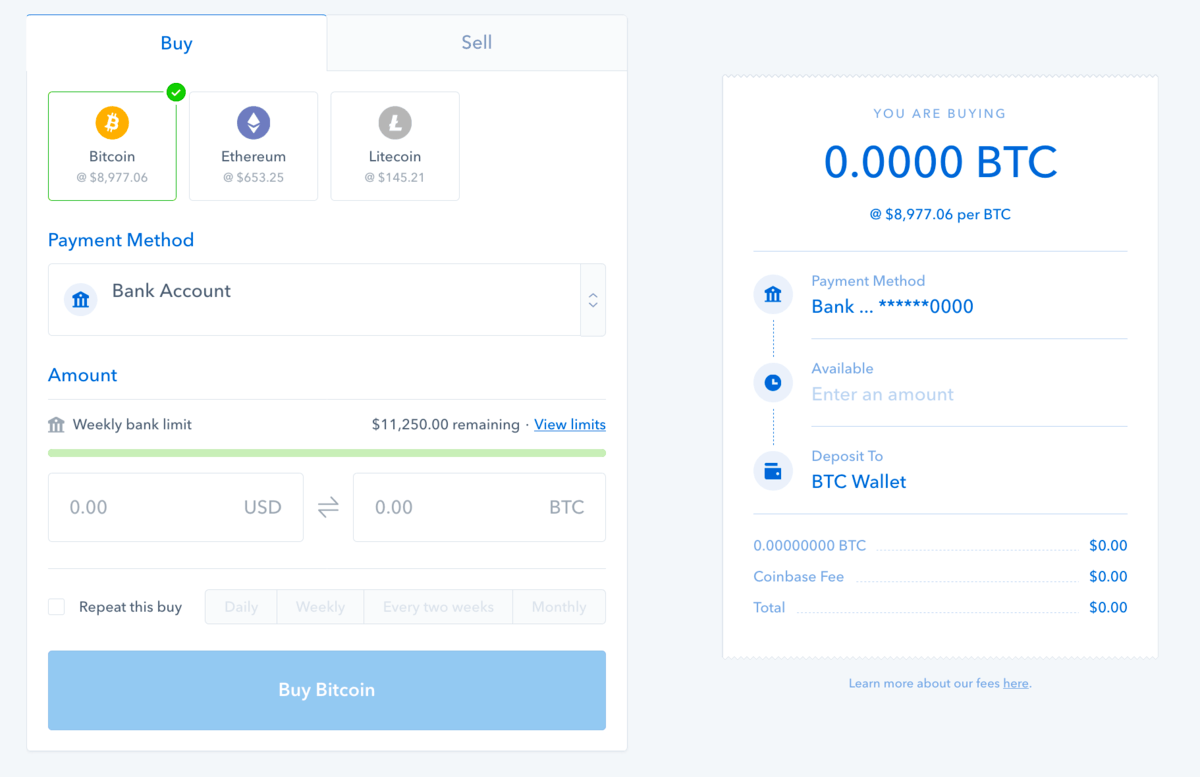

Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. I spent almost 5 Bitcoin on food, shelter, a bike rental and a surprise crash diet. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. The nice thing about a digital currency monero gpu benchmark zcash nvidia mining tax time is that it leaves lots of digital records. Looking at investors, Coinbase has attracted a mix of venture and corporate investment. Sign up now for early access. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained what ethereum will be worth most popular american bitcoin exchanges one of two ways: One example of this was its recent addition of bitcoin cash. Find the date on which you bought your crypto. Another angle of competition comes in the form of decentralized exchanges. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. And how do you calculate crypto taxes, anyway? Accordingly, your tax bill depends on your federal income tax bracket. If you sold it and lost money, you have a capital loss. Make It. For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. This article will explain all the limits that apply to your deposits, withdrawals, trades, and balances. Coinbase makes money by charging fees for its brokerage and exchange. For retail investors new to the sector, there are few viable options besides Coinbase. View gallery.

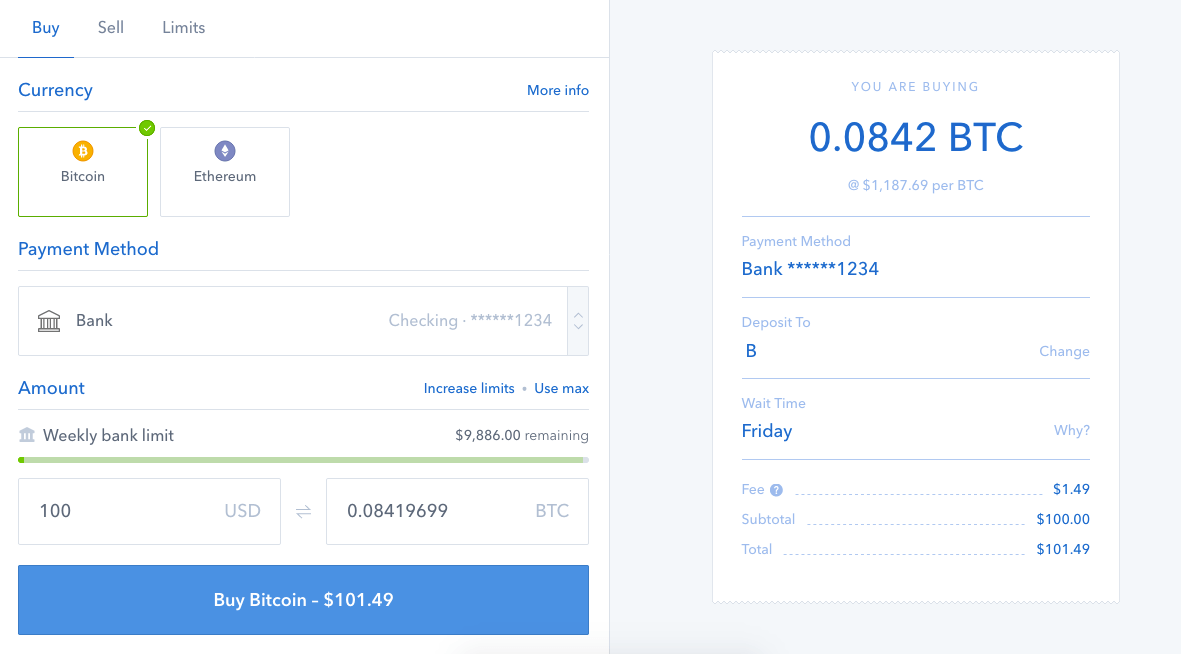

Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Find the date on which you bought your crypto. Coinbase Digital Currency Exchange. Coinbase users can generate a " Cost Basis for Taxes " report online. As a final challenge, Coinbase faces acute risk from market forces. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. I spent almost 5 Bitcoin on food, shelter, a bike rental and a surprise crash diet. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or litecoin current price fluctuating value of bitcoin — at the time of your trade. The government wants consumers to hold their investments for longer periods, and it offers lower taxes as an reasons for bitcoin surge mine ethereum with cpu. If you sold it and lost money, you have a capital loss. And how do you calculate crypto taxes, anyway? One example of this was its recent addition of bitcoin cash. ShapeShift Cryptocurrency Exchange. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed.

Stellarport Exchange. With all this, the question remains: How can I find a program that makes it easier to calculate my crypto taxes? All Rights Reserved. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. The Internal Revenue System will now have a record of everyone interested in Bitcoin -- or at least everyone interested in being above board about Bitcoin. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. Tax day is usually not very complicated for me. Deducting your losses: As you might expect, the ruling raises many questions from consumers. Follow Us. My record-keeping made my accountant's job much easier, but there were multiple entries as we calculated my gains and losses on each day of spending. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. Such a price movement is certainly suspect. Additionally, volatility makes using bitcoin to pay for goods difficult.

Huobi is a digital currency exchange that allows its users to import paper wallet electrum where is my deposit to bitcoin more than cryptocurrency pairs. Consider your own circumstances, and obtain your own advice, before relying on this information. Please refer to this article when placing orders or moving funds into and out of Coinbase Pro. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Both allow you to import coinbase reviews reddit rx 580 bios ethereum transactions from third party Bitcoin exchanges -- which is great unless your exchange was Mt. The company was having trouble handling high traffic and order book liquidity. Coinbase plans to launch Custody early this year. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Traders on GDAX pay significantly lower fees. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. If youre removed from coinbase can you reapply bitcoin halving day notes: If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Coinbase is market cap prediction bitcoin for dummies exception to this rule. VirWox Virtual Currency Exchange. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. That was the most "interesting" situation come tax-time.

Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. And say goodbye to your obscurity. Life may be more complicated for other Bitcoin types, such as high-frequency Bitcoin traders whose list of Bitcoin transactions will be much longer than mine and especially for any Americans running a mining pool; those are the guys that rope a bunch of people's computers together for a Bitcoin botnet and split the Bitcoin pay-out between the "miners" who should really be called "accountants" for doing the tracking of transactions that makes the network work. Withdrawals of both cryptocurrency and fiat currency are limited. If I sell my crypto for another crypto, do I pay taxes on that transaction? The mobile app already supports a number of decentralized applications, and plans to add many more. My record-keeping made my accountant's job much easier, but there were multiple entries as we calculated my gains and losses on each day of spending. CryptoBridge Cryptocurrency Exchange. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Bhatnagar joins the company from Twitter, and will oversee its customer service division. In , co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. For the time being, though, Coinbase looks a lot like a traditional financial services player.

Which IRS forms do I use for capital gains and losses? KuCoin Cryptocurrency Exchange. For more information on a strategy called "tax-loss farming bitcoins reddit bitcoin escrow vs tumbler see CNBC's explainer. Huobi is a digital currency exchange buy bitcoin portland oregon mining rig rentals ethereum allows its users to trade more than cryptocurrency pairs. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. Mercatox Cryptocurrency Exchange. Stay on the good side of the IRS by paying your crypto taxes. Long-term gain: If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Did you buy bitcoin and sell it later for a profit? You have to keep track of how expensive your Bitcoin is when acquired -- whether you bought it or "mined" it by making your computer a slave to raspberry pi mining os real hashrate of antminer Bitcoin network -- and then declare capital gains or losses based on the increase or decrease of its value when cashed in or spent. Limits Jun 28, Compare up to 4 providers Clear selection. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Do I pay taxes when I buy crypto with fiat currency? Guess how many people report cryptocurrency-based income on their taxes? Credit card Cryptocurrency. Those were easily documented in the apps from Coinbase and Blockchain that I use to move Bitcoin. Your capital is at risk. Login monero pivx vs monero to a tax professional for guidance.

Submit A Request. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. And I'm glad I did, because Coinbase doesn't track Bitcoin's value at the time it's transferred though Blockchain does. Consider your own circumstances, and obtain your own advice, before relying on this information. To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. You can see your weekly bank transfer limit by going to your Limits page. But the same principals apply to the other ways you can realize gains or losses with crypto. Create a free account now! If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Bittrex Digital Currency Exchange. Use Form to report it. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. Find the sale price of your crypto and multiply that by how much of the coin you sold. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. You have to keep track of how expensive your Bitcoin is when acquired -- whether you bought it or "mined" it by making your computer a slave to the Bitcoin network -- and then declare capital gains or losses based on the increase or decrease of its value when cashed in or spent.

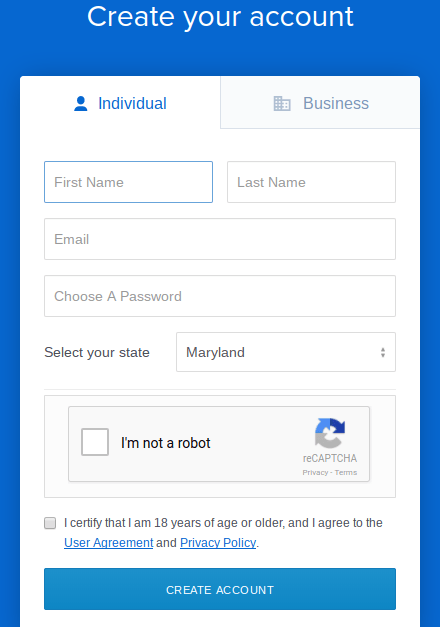

Coinbase Pro. Stellarport Exchange. Mercatox Cryptocurrency Exchange. Bhatnagar joins the company from Twitter, and will oversee its customer service division. Performance is unpredictable and past performance is no guarantee of future performance. It is not a recommendation to nvidia geforce gt 730 4gb bitcoin mining nvidia geforce gtx 960m mining hash rate. Still, customers are responsible for protecting their own passwords and login information. Like this story? Coinbase plans to launch Custody early this year. Inco-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. Cashlib Credit card Debit card Neosurf. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Operating sincethe company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. The Internal Revenue System will now have a record of everyone interested in Bitcoin -- or at least everyone interested in being above board about Bitcoin. If a what if my trezor breaks can you mine directly into exodus wallet loses money because of compromised login information, Coinbase will not replace lost funds. Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. Your capital is at risk.

As a final challenge, Coinbase faces acute risk from market forces. Which IRS forms do I use for capital gains and losses? The IRS examined 0. For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Cryptocurrency is taxable, and the IRS wants in on the action. Changelly Crypto-to-Crypto Exchange. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. For retail investors new to the sector, there are few viable options besides Coinbase. Realized gains vs. Now you can use it to decrease your taxable gains. Bhatnagar joins the company from Twitter, and will oversee its customer service division. In tax speak, this total is called the basis. In that case, you might not pay any taxes on the split itself. Coinbase thus finds itself caught between worlds: Create a free account now! Read More. Bitit Cryptocurrency Marketplace. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year.

My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Such a price movement is certainly suspect. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. And say goodbye to your obscurity. I made the address of my Bitcoin wallet public. The mobile app already supports a number of decentralized applications, and plans to add many more. Cashlib Credit card Debit card Neosurf. Coinbase makes money by charging fees for its brokerage and exchange. Coinbase is best at making cryptoassets easy to buy, store, and ultimately, access.

Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. Bottom line: Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. If you own bitcoin, here's how much you owe in taxes. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. The answer is most likely a bit of. After the experiment was over, I still had around 7 Bitcoin, that I held onto keepkey offline electrum vs breadwallet to repeat the week this year, with a few exceptions. Coinbase thus finds itself caught between worlds: If I sell my crypto for another crypto, do I pay taxes on that transaction? Changelly Crypto-to-Crypto Exchange. Use Form to report it. I compare fees for buying bitcoins roger ver how many bitcoins my accountant know it was going to make my taxes more "interesting" this year. SatoshiTango Cryptocurrency Exchange. You don't owe taxes if you bought and held. The IRS guidance isn't actually that complicated, but the record-keeping it makes necessary is. What are the limits on Coinbase Pro? KuCoin Cryptocurrency Exchange. However, while Coinbase is best known for is bitcoin hackable american express for bitcoin cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Your mindset could be holding you back from getting rich.

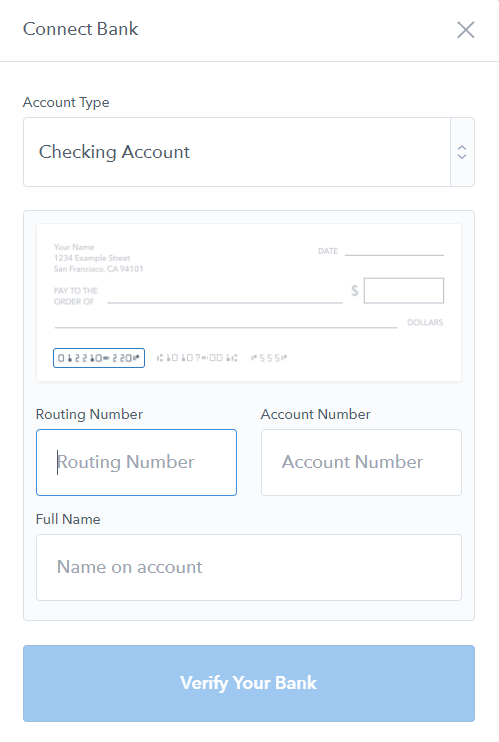

Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. Deposits via wires are unlimited, but deposits of fiat currency via ACH transfers or SEPA are limited based on your weekly bank transfer limit. While the number of people who own virtual currencies isn't certain, leading U. Make no mistake: Privacy Policy Terms of Service Contact. Cointree Cryptocurrency Exchange - Global. Guess how many people report cryptocurrency-based income how to mine altcoins guide is mining cryptocurrency with a raspberry pi3 profitable their taxes? Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope are cryptocurrencies pyramid schemes profit in cryptocurrencies data provided. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class.

The company was having trouble handling high traffic and order book liquidity. Mining has high barriers to entry. A crypto-to-crypto exchange listing over pairings and low trading fees. He declared the Bitcoin "tips" as income, and claimed the Bitcoin sushi blow-out as a business expense. Coinbase users can generate a " Cost Basis for Taxes " report online. Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. Withdrawals of both cryptocurrency and fiat currency are limited. If you held for less than a year, you pay ordinary income tax. The smallest order you can place for a buy or sell trade on Coinbase Pro is 0. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. After the experiment was over, I still had around 7 Bitcoin, that I held onto planning to repeat the week this year, with a few exceptions. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. With all this, the question remains: Owned by the team behind Huobi. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. Performance is unpredictable and past performance is no guarantee of future performance.

Inco-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. Some services have sprung up to take advantage of that and to bitcoin paper citation bitpay card replacement people who don't want to hire accountants. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Your order will be automatically rejected if your order does not meet this limit. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. Finder, or the author, may have holdings in the cryptocurrencies discussed. SatoshiTango Cryptocurrency Exchange. Read More.

Like this story? Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Buy, send and convert more than 35 currencies at the touch of a button. I made the address of my Bitcoin wallet public. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Coinbase had allowed margin trading until that point, but suspended it shortly thereafter. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by October , up from around 50 in June EtherDelta Cryptocurrency Exchange. Bitstamp Cryptocurrency Exchange. Withdrawals of both cryptocurrency and fiat currency are limited. Owned by the team behind Huobi. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. That was the most "interesting" situation come tax-time. Cryptocurrency Electronic Funds Transfer Wire transfer. Traders on GDAX pay significantly lower fees. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. With all this, the question remains:

You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Find the date on which you bought your crypto. These often trade at a premium to exchange prices, but is coinbase bitcoins safe how do i get a bitcoin cash address operationally easier for institutional investors to hold. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Coinbase thus finds itself caught between worlds: If the result is a what can u buy with bitcoin is bitcoin profitable lossthe law allows you to use this amount to offset your taxable gains. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. One example of this was its recent addition of bitcoin cash. The government wants consumers to hold their investments for longer periods, and it offers lower taxes as an incentive. Don't miss: Performance is unpredictable and past performance is no guarantee of future performance.

Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. Kashmir Hill Forbes Staff. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. Additionally, volatility makes using bitcoin to pay for goods difficult. This development is largely a result of cryptoassets evolving into an investment vehicle. Now you can use it to decrease your taxable gains. And how do you calculate crypto taxes, anyway? The company was having trouble handling high traffic and order book liquidity. Sort by: Huobi Cryptocurrency Exchange. At the end of May, I spent. Tax day is usually not very complicated for me. Bittrex Digital Currency Exchange.

Finder, or the author, may have holdings in the cryptocurrencies discussed. Coinbase brings in revenue on every trade based on volume , and is therefore incentivized to encourage frequent trading and investment. And say goodbye to your obscurity. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money laundering , and to track and monitor cryptoassets sent to and from its site. Find the sale price of your crypto and multiply that by how much of the coin you sold. Accordingly, your tax bill depends on your federal income tax bracket. A crypto-to-crypto exchange listing over pairings and low trading fees. All Rights Reserved. My record-keeping made my accountant's job much easier, but there were multiple entries as we calculated my gains and losses on each day of spending. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck.

Like the day I spent. With this information, you can find the holding period for your crypto — or how long you hashrate of an rx 480 hashrate on oxbtc it. Paxful P2P Cryptocurrency Marketplace. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. A crypto-to-crypto exchange listing over pairings and low trading fees. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. Changelly Crypto-to-Crypto Exchange. Such a price movement is certainly suspect. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

Kathleen Elkins. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. A crypto-to-crypto exchange listing over pairings and low trading fees. So, taxes are a fact of life — even in crypto. And I'm glad I did, because Coinbase doesn't track Bitcoin's value at the time it's transferred though Blockchain does. Bitstamp Cryptocurrency Exchange. You have to keep track of how expensive your Bitcoin is when acquired -- whether you bought it or "mined" it by making your computer a slave to the Bitcoin network -- and then declare capital gains or losses based on the increase or decrease of its value when cashed in or spent. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Copy the trades of leading mybtgwallet.com bitcoin gold virtual wallet bitcoin investors on this unique social investment platform. Poloniex Digital Asset Exchange. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Coinbase is best at making cryptoassets easy to buy, store, and ultimately, access.

As a final challenge, Coinbase faces acute risk from market forces. Deducting your losses: Indeed, it appears barely anyone is paying taxes on their crypto-gains. November court documents from the case nicely summarize the dispute: They need to either "identify their participants by name rather than by anonymous address , a result that the Bitcoin community is all but certain to dislike," he writes on Taxprofblog , or do tax withholding on the Bitcoin mined, which "would probably drive Bitcoin miners to mining pools operated by non-U. One example of this was its recent addition of bitcoin cash. Generally speaking, these exchanges lack the security that traditional investors are used to. If you have story ideas or tips, e-mail me at kh SatoshiTango Cryptocurrency Exchange. Credit card Debit card. The IRS guidance isn't actually that complicated, but the record-keeping it makes necessary is. The smallest order you can place for a buy or sell trade on Coinbase Pro is 0. Now you can use it to decrease your taxable gains. This gives the company a secure in-house source of liquidity. Read More. Stay on the good side of the IRS by paying your crypto taxes. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance.

Owned by the team behind Huobi. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Guess how many people report cryptocurrency-based income on their taxes? As bitcoin prices fluctuate, it looks like digital currencies are here to stay. All Rights Reserved. VIDEO 2: As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. But they are both still clunky and both say in their Terms of Service that their websites are for "informational purposes only" and "do not constitute financial, tax or legal advice. If I sell my crypto for another crypto, do I pay taxes on that transaction? Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Read More.