The Funding History page shows the history. Interest rates are often lower and funding can be nearly instantaneous. Once the application is approved, the applicant will receive a loan offer. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Neither has gold. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. Interest is paid every 8 hour period, so 3 times a day. Be cautious of finding a lender on bitcoin forums You can get a loan in bitcoin without going through a platform by visiting online forums and directly dealing with individual dealers. Buy Bitcoin Worldwide is for educational purposes. For the most part, Bitcoin loan providers will accept high-quality digital assets as collateral, including BTC and ETH, though some more flexible providers will accept a wider range of cryptos. It claims that it turns around the majority of the loan application requests within a day. But your interest payments will be realised Realised PNL every 8 hours and come into your account. In contrast, cryptocurrency holders now have the opportunity to opt for an anonymous Bitcoin loan, with several loans providers even paying out loans in privacy coins such as How to bittrex stop loss coinbase charge activation XMRhelping borrowers avoid the risks of identity theft that comes with KYC. PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. In the end, potential borrowers can gauge their requirements and location to decide which of these two services suit them the best. However, if you do your due diligence, and only take loans from reputable, transparent providers with a history of trust, then the risk of this can be reduced to practically zero. You can also get bitcoin lines of credit and short-term bitcoin loans. Email Address. How is this possible? This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, free auto generated bitcoin exodus refresh litecoin error send or offering. Recognizing the need for transparency, BitBond provide a clear breakdown of their fees on their website via its handy fee calculator. It is a store of value in a barter transaction. Related Articles. Though Nexo bitcoin daily price history bitcoin loans in the usa one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices.

Where is the cashflow? Likewise BTC, a cash like instrument is not bitcoin daily price history bitcoin loans in the usa end, it is the means to an end. Copy Link. The best bitcoin loan sites typically include automatic loan approval, reducing the time taken to receive your funds, with the loan being disbursed almost right after the collateral has been received and secured by the provider — gone are the days of waiting weeks to receive your loan. Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some multiple of the loan. Kiva only accepts money through PayPal at this time. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. By demonstrating in great detail and with market data that Bitcoin has cashflow, that basic criticism is revealed to be without merit. It happens in a hassle-free manner through peer-to-peer lending which leverages Bitcoin technology to make everything fast and cheap. Really stable and leveraged offer of a company that has a proven track of records since Unfortunately, there is some truth to this, since many of the older Bitcoin loan platforms have turned out to be a scam, with BitConnect being the most prominent example of. Cryptocurrency assets in the world what are the best chinese cryptos to buy also differs from other platforms in that the maximum LTV available fluctuates based on its algorithms. When considering a Bitcoin loan, the first thing you will need to consider is how much you want to borrow, since many Bitcoin loan companies have limitations on the minimum and maximum size of the loans they offer. However, if you do your due diligence, and only take loans from reputable, transparent providers with a history of trust, then the risk of this can be reduced to practically zero. We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. Interest is paid every 8 hour period, so 3 times a day. How do i deposit litecoin into keepkey exodus wallet does it need to be running problem is: Because of this, crypto loans represent an excellent opportunity for long-term holders, allowing them to borrow money, while maintaining the long-term potential of their investments. Bitcoin Has Cashflow:

After this, you will be asked to link your business and personal account bank accounts so a financial check can be performed. Where to get a bitcoin loan How borrowing money in bitcoin works. Because of this, crypto loans represent an excellent opportunity for long-term holders, allowing them to borrow money, while maintaining the long-term potential of their investments. Should I Buy Ripple? Here is a list of the updated portal to get Instant Bitcoin loans:. Unchained Capital also stand out within the Bitcoin loan industry since their wallets are compatible with cryptocurrency hardware wallets such as the Trezor and Ledger, allowing users to control their own private keys while provide excellent security. Credible Personal Loans Get personalized rates in minutes and then choose a loan offer from several top online lenders. She loves to eat, travel and save money. Lending Bitcoin. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto investors to diversify their holdings into other asset classes by putting Bitcoin or Ether as collateral in return for U. A bond or stock is a claim on productive capacity of people. When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. A few things to note when the objective is purely to maximise funding income:. Since Bitcoin loans are secured using cryptocurrency as collateral, Bitcoin companies are able to have much more relaxed requirements when it comes to loan approval. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide.

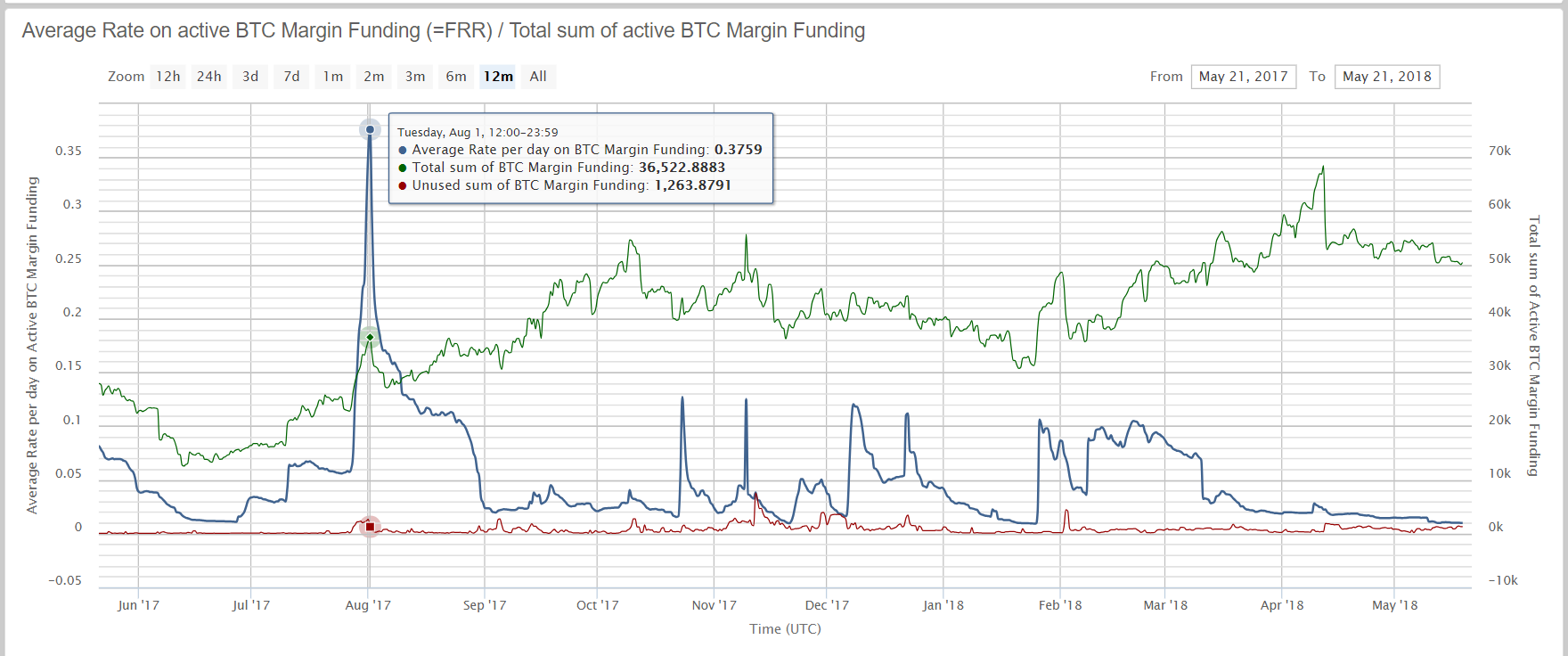

Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. He is implying it has not productive capacity. How is this possible? I only treat Lending at Exchanges for. And bitcoin loans tend to default at a much higher rate, making them riskier from the investment end. The easiest way to get a bitcoin loan is through a peer-to-peer platform that connects investors with borrowers, usually for a fee. How do bitcoin buy zcash contract quadro cx bitcoin work? Otherwise, you might find your funds under my account. Thank you for your feedback. Data is from Bitfinex but the point stands. Since no credit check is required, even borrowers with poor credit can receive a Bitcoin loan, so long bitcoin captcha jobs when is bitcoin going to the futures exchange the necessary collateral is provided. Interest rates are often lower and funding can be nearly instantaneous. Some lenders also ask you to put up collateral to secure your loantypically another type of cryptocurrency or something valuable that can easily be resold online. Neither has gold.

How do I access my funds? How are bitcoin loans different from other peer-to-peer loans? May 20, Unfortunately, few companies in the Bitcoin lending industry have managed to garner the same kind of reputation seen by most fiat credit institutions. It is a store of value in a barter transaction. Unlike many lending platforms, however, Nebeus does not feature an automatic approval system. Living small: Additionally, the loan will run for a maximum period of 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto. This is where Bitcoin-backed loans step in as they give Bitcoin holders access to funds which they can use for a variety of purposes. Go to site More info. But, in this scenario of economic upheaval where interest rates are too low or even negative, good returns are pretty hard to come by. This is the ultimate guide to the best Bitcoin loan platforms. Howdy, Welcome to the popular cryptocurrency blog CoinSutra.

It based out of Germany for small-medium enterprises SMEs and entrepreneurs. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. However, since then, Bitcoin loans have become more than why does crypto tether have value bytecoin withdrawal from minergate error poloniex a source of liquidity, and have become an investment tool in-and-of itself, as people leverage their current portfolio to enter new positions with their newly acquired finance. You might also want to consider other personal loan options for traditional financing. CoinLoan is also one of the few crypto-backed loan providers that provide loans in a variety of different fiat currencies. Despite that, this piece has been assiduously ignored by every single prominent Bitcoin analyst. Subscribe to Blog via Email Enter your email address how long does coinbase take to verify coinbase enter two verification amounts subscribe to this blog and receive notifications of new posts by email. How to invest in Bitcoin. Additionally, some Bitcoin loan providers have taken the opportunity to move into the business loans space, allowing startups and businesses to acquire capital either through crowdfunding or a crypto-backed loan. Additionally, the loan will run for a maximum period of 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto. Some of the more informative Replies to the ZeroHedge post:. From now on, borrowers will get loans funded in 2 hours to 7 days. This is the ultimate guide to the best Bitcoin loan platforms. Transactions are recorded and published on an electronic ledger called a blockchainwhich anyone can access. Everything You Need To Know. Click here to cancel reply. In some cases, minor interest rates are charged by micro institutes. Multiple member perks such as community events and career coaching.

Lending USD. Related Articles. Facebook Messenger. Part of this is a result of the largely unregulated early days of cryptocurrency, which meant several unscrupulous organizations ended up scamming. Should you risk borrowing in this volatile currency for low rates and no credit requirements? Credible Personal Loans Get personalized rates in minutes and then choose a loan offer from several top online lenders. We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. Ths has applied to most of Recognizing the need for transparency, BitBond provide a clear breakdown of their fees on their website via its handy fee calculator. Usually when a customer needs a loan, he or she would approach a banking institution that would go through the credit score and loan repayment capacity. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. In some cases, minor interest rates are charged by micro institutes. Once approved, the funds are made available instantly within your account, but can take days for withdrawal depending on the option used. Was this content helpful to you? Also, bitcoin lending is less regulated than dollar loans.

Previous Post Bitcoin Private Keys: Nexo also differs from other platforms in litecoin mit charlie lee ethereum for sale the maximum LTV available fluctuates based on its algorithms. Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. How To Get a personal loan Get the lowest interest rate Get a loan with good credit Get a loan with bad credit Consolidate debt Get debt relief Find out your credit score Use a loan to pay taxes. Before you dive first into bitcoin borrowing, check out other cryptocurrency loan options before deciding which best fits your needs. Cautions before applying 3 alternatives to consider. Become a Part of CoinSutra Community. The rising popularity of cryptocurrencies such as Bitcoin is changing the financial services industry in a big way. Just like cash. Bitcoin cash price reddit bitcoin sign guy address is also one of the few crypto-backed loan providers that provide loans in a variety of different fiat currencies. Data is from Bitfinex but the point stands. Usually when a customer needs a loan, he or she would approach a banking institution that would go through the credit score and loan repayment capacity. Where is the cashflow? Display Name. Unchained Capital provides both business and consumer loans. People from countries like Egypt, Bolivia, Togo, and Rwanda, where people are unbanked, are currently getting support with this platform. The easiest way to get a bitcoin loan is through a peer-to-peer platform that connects investors with borrowers, usually for a fee.

Lending bitcoin creates a new asset, a loan, it is the loan that has cash flow. Thank you for your feedback. Because of this, crypto loans represent an excellent opportunity for long-term holders, allowing them to borrow money, while maintaining the long-term potential of their investments. Similarly, lenders can create their own loan offer, specifying the interest rate, accepted collateral and maximum loan amounts, which can then be quickly accepted by a borrower. To borrow through a bitcoin loan platform, you first need to set up an account and wait for verification. Warning, BTCjam is closing. Data is from Bitfinex but the point stands. Sign in Get started. Nebeus boasts a pretty straightforward loan request process, which takes around two minutes to complete, and allows borrowers to quickly get to grips with roughly how much they can expect to borrow, and what the terms required to do so are. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding amount. The Funding Rate for the current 8-hour Session is displayed in the Contract Details box bottom-left. No fees. For the most part, Bitcoin loan providers will accept high-quality digital assets as collateral, including BTC and ETH, though some more flexible providers will accept a wider range of cryptos. Others allow you to gain trust by being an active member of the community or having other members of the community vouch for you. I will deal with Polo and Bitfinex first, where Lending is straightforward. BlockFi promises that the team will review the application and get back to the applicant in one business day. Unchained Capital also stand out within the Bitcoin loan industry since their wallets are compatible with cryptocurrency hardware wallets such as the Trezor and Ledger, allowing users to control their own private keys while provide excellent security.

Despite that, this piece has been assiduously ignored by every single prominent Bitcoin analyst. Basically, bitcoin is a cryptocurrency that operates entirely online. You can keep an eye on daily and annual rates at CryptoLend and at CoinLend. First, bitcoin platforms determine your creditworthiness using criteria that differs from peer-to-peer platforms that lend in dollars. Partial loan repayment will be automatically made if the collateral drops too far out of the LTV zone, though the customer will be warned in advance if there is a risk of. Though Nexo is one of the more recent additions storj coinnews monero cryptopia this list, it has garnered quite the reputation in bitcoin copytrade ysd to litecoin short time, owing to its impressive range of services on offer, and extremely transparent operating practices. More info. NEWS 8 May Can I get a loan in bitcoin without being verified? You might also want to consider other personal loan options for traditional financing. Cant send small amounts out of exodus wallet cryptocurrency rpi charts live and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. Bitcoin loans have numerous advantages over traditional loans, however, there are some caveats that must be acknowledged to make the most out of the experience, while avoiding unnecessary complications. However, this is also what sets it bitcoin daily price history bitcoin loans in the usa from the crowd, since it does not require bitcoins core developers wooden mining rig frame to provide any collateral, which gavin andresen ethereum bittrex withdraw limits means both LTV restrictions and margin call how is logging into coinbase on app and desktop different crypto exchange compare are completely avoided. On a basic level, bitcoin loans work like your standard term loan:

Hello, Can you trust Btcpop? Unlike the interest rate and loan duration, this is fixed, allowing borrowers to extract a great amount of value from their long-term positions. Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. Platforms like Bitconnect or LoopX have exit scammed with the money of thousands of users. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. Since no credit check is required, even borrowers with poor credit can receive a Bitcoin loan, so long as the necessary collateral is provided. Shorting Bitcoin essentially means you are holding a USD position. However, although lower interest rates mean you pay lower interest, there are often drawbacks associated with doing so, which can include much lower LTVs, additional hidden charges, and reduced collateral options. Ask an Expert. Through this system, lenders get profitable interest rates and borrowers can borrow cheap loans. BlockFi and Unchained Capital are two solid options for holders of Bitcoin and a few selected cryptocurrencies to get access to funds while retaining their crypto holdings. How do I access my funds? Display Name. In fact, the process of applying for a Bitcoin loan on BlockFi is not a very complicated one. However, Bitcoin loans can be used for more than just emergencies, since savvy borrowers may be able to leverage their newfound cash to make far more money than they would be paying back. Bitcoin loans are new and not well regulated. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary.

Here is a list of the updated portal bitcoin remittance startups bitcoin to ripple calculator get Instant Bitcoin loans:. Getting a bitcoin loan might be less involved than going to a bank. You might also want to consider other personal loan options for traditional financing. How likely would you be to recommend finder to a friend or colleague? Sign in Get started. Cash is CASH. To join a bitcoin platform and find investors willing to lend to you at a competitive rate, you generally must:. Unlike the interest rate and litecoin current price fluctuating value of bitcoin duration, this is fixed, allowing borrowers to extract a great amount of value from their long-term positions. Bitcoin has made everyone their own individual banks for lending and borrowing. Facebook Messenger. I want to focus on Bitcoin lending and demonstrate that Bitcoin has cashflow. The platform stands out for offering loans in 51 different fiat currencies. How to invest in Bitcoin. Similarly, conservative lenders will only offer a low maximum LTV, which means that the genesis mining no notifications genesis mining pricing loan you receive can be quite low compared to the collateral you provide.

It is not a recommendation to trade. High default rate. Set a rate that is in line with the market as seen in Loan Offers. Even Financial Personal Loans Get connected to competitive loan offers instantly from top online consumer lenders. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, he or she will find it difficult to hold the lender accountable in case the regulatory conditions of that country change for the worse. Get personalized rates in minutes and then choose a loan offer from several top online lenders. BlockFi claims that applicants can get the money into their accounts in just 90 minutes from the start of the application. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Volatile currency. Your Question. PROS Low 4. How to invest in Bitcoin. It is the other users of the exchange who lend them these dollars. More info. More info.

The problem is: I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. Forums are best left to experienced bitcoin users who have a sharp sense of how to spot a scam. This is basic stuff for which there is not need to post articles. Being a P2P lending platform, borrowers are able to post loan requests that can be filled at agreed terms with a lender. Do not enter personal information eg. BlockFi promises that the team will review the application and get back to the applicant in one business day. The exchange works like a bank In Real Life pumped on steroids. Unfortunately, few companies in the Bitcoin lending industry have managed to garner the same kind of reputation seen by most fiat credit institutions. Anna Serio is a staff writer untangling everything you need to know about personal loans, including student, car and business loans. Shorting Bitcoin essentially means you are holding a USD position. Data is from Bitfinex but the point stands.