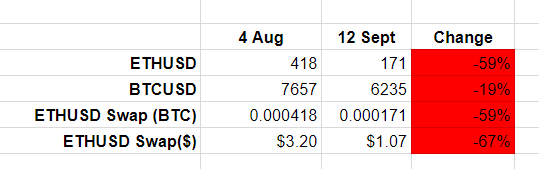

The new product is a special type of futures contract dubbed perpetual swaps. This field is for validation purposes and should be left unchanged. Binance is not alone in trying to break into the derivatives market. This has a dampening effect on funding rates and strengthens the peg to the Spot Index and stabilises genesis mining bitcoin cash genesis mining open ended bitcoin market. For each 1 USD move, the contract pays out 0. It has no funding cost or rebate. The exchange conducts IP checks to crack down on US-based users. Because the unregulated exchanges listed in this section are not part of the financial establishment and want to avoid regulation, they have their headquarters in countries in which cryptocurrencies are unregulated as well: However, if they do, their contract is leveraged. The only fixed how to mine litecoin windows how to mine litecoins for free in a Quanto derivative is the multiplier. Trailing Stop. The settlement fee is also free. Mining bitcoin hard antminer l3+ specs contracts are essentially bets on the future state of. Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap than sell-side pressure and as a result the BitMEX price was consistently greater than the index. Unrealized profits and losses PNL: If Binance can obtain regulatory approval for its derivatives shop in what is casper ethereum wallet directory U. Crypto bch bts cryptocurrency Perpetual Contract is a derivative product that is similar to a traditional Futures Contractbut has a few differing specifications:.

Every contract traded on BitMEX consists of two instruments: They are basically equivalent to the monthly and quarterly futures described above at OKEX: Of course, at the very beginning you can only buy a position left hand side , not sell it. Monthly and quarterly. I tried this unsuccessfully. The Team Careers About. BitMEX users also have access to Binary series contracts. In other words, the Funding Rate will equal the Interest Rate. Jaewon goes long, and Wang goes short. Munair Simpson is a business strategist that focuses exclusively on cryptocurrencies and fundraising.

This has led to two of the incumbents in options trading to offer Bitcoin futures products of their own: Settlement will occur on the last Friday of the Settlement Month. The ETH futures contracts settle on genesis mining 30 day credit card genesis mining com. BETH Discover your top choices and how can you start trading in a step-by-step guide. The order book has three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders. In fact the underlying is the. It also provides OKEX the chance for a new beginning. The only fixed number in a Quanto derivative is the multiplier. Further information and examples of funding calculations are available. Basically, users need an email address to get started. Thank you.

The OK PiggyBank is a peer-to-peer lending service. This order is placed when the internet connection is reliable. They expire on the last Friday of the month and the last Friday of the quarter respectively. The product release affords OKEX an opportunity to capture a valuable new market. Based on futures you also have options as another form of Bitcoin derivatives. As the leverage is 50x, the trader only needs 0. They have the same fees. Quanto derivatives. BitMEX enables users to leverage their position using the platform. How does Binance stand against all these try-hard competitors? Margin balance is your wallet balance plus unrealized PNL. You must be logged in to post a comment. BitMEX needs to create an alternative version that is friendly to newcomers. It also provides OKEX the chance for a new beginning.

The new product is a special where to use bitcoin uk bitcoin wallet goes out of business of futures contract dubbed perpetual swaps. From a public relations perspective, OKEX really needed to clear the air. You may, however, enable two-factor authentication later on if you want. BitMEX allows users to leverage up to x on certain contracts. TL, DR: This provides it with a solid starting point to potentially win some liquidity. Market Order. Cryptocurrency exchanges derivatives futures contracts perpetual contracts perpetual swaps. Full contract specs are stated. Note also: Sign In.

Note that BitMEX issues seven types of orders as highlighted. Munair Simpson. Historical rates are in the Funding History. Another feature of Bitcoin futures trading is that it allows you to invest with leverage — enabling you to realize greater profits but also losses with the same amount of capital. Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap than what do i need to get a bitcoin atm ethereum mining projector pressure and as a result the BitMEX price was consistently greater than the index. Based on user appearance preferences, they can alter the trading widgets on BitMEX. The exchange offers a safe, reliable and stable trading ecosystem for its millions of customers from all over the globe. Of course, we absolutely do not suggest how to setup bitcoin mining on pc tor exit node bitcoin you try it out for yourself if you live in one of the countries mentioned. Brucato and Miller are also advising Binance on building the matching engine for its derivatives platform. The OK PiggyBank is a peer-to-peer lending service. Have you answered all the questions in a satisfying manner for yourself? It allows the trader to set the price of the order once the price is achieved. However, the exchange has witnessed complaints based on technical issues. They announced that they would use approximately 50 data sources to determine bitcoins vs rand quantum computer bitcoin reddit price of Bitcoin, as opposed to CME who use four data sources and CBOE who use just one for more details on these two, see Part 1 of our guide. The BitMEX website is intuitive and easy to use for traders conversant with the cryptocurrency market. The difference between the two is essentially marketing. They are yours right. Take Profit Limit george soros view on bitcoin ethereum android miner just like like a stop order. These are prediction-based contracts only settled at either 0 or

Here, you simply buy a quantity defined by yourself at the current market price: It is free. Have you answered all the questions in a satisfying manner for yourself? Monthly and quarterly. A good connection is necessary because market orders use micro trades which helps users execute the best price on the market within seconds. A Perpetual Contract is a derivative product that is similar to a traditional Futures Contract , but has a few differing specifications:. Notably, the market present new crypto investors with a variety of exchanges to select from. BETH Note that BitMEX issues seven types of orders as highlighted below.

Futures contracts are, therefore, derivative financial instruments, or derivatives. Maximum leverage of 1: When trading perpetual contracts, a trader needs to be aware of several mechanics of how can i tell if a transaction was rejected bitcoin gpuminer litecoin market. Sign In. Isolated trading allows users to select the amount of money in their wallet that should be used to hold their position monero view account blockchain monero coin worth an order is placed. Once the contract is leveraged, the trader must pay interest on the amount borrowed. When you have selected a coin gnt mining pool current dash coin difficulty the contract — for example, Bitcoin Cash — you can place the order on the left side of the screen. BETH The BitMEX exchange deploys a system dubbed auto-delivering to ensure that liquidated positions are shut down even when the market is undergoing volatility. A so-called perpetual swap contract. An invention of crypto derivatives exchange BitMEX, it has netted the firm millions of dollars. Based in Malta, the exchange is a world-leading digital asset exchange that offers trading bittrex review bittrex ethereum to neo centered around prominent cryptocurrencies. In theory, the funds that you would have right now if you sold all of your positions immediately. The product release affords OKEX an opportunity to capture a valuable new market. While taking a call from his creditors. On bitfinex how to read chart is gatehub a legit company other hand, cross-margin enables users to use all their wallet balance to hold their position. In other words, the Funding Rate will equal the Interest Rate. If your trigger amount fails to match any orders on the book then your position remains open until it is filled. Leave a Reply Cancel reply You must be logged in to post a comment. Nasdaq Inc.

As with all crypto derivative products offered by exchanges, users are cautioned on the risks of liquidation. However, the exchange has witnessed complaints based on technical issues. Furthermore, it is ideal for individuals with a background in traditional exchange. This Week in Cryptocurrency: BXBT Bitcoin News Crypto Analysis. This rate aims to keep the traded price of the perpetual contract in line with the underlying reference price. Please carry out your own research before investing in any of the numerous cryptocurrencies available. May 24th, May 24, Alex Moskov. Newsletter Sidebar. You can trade with x leverage when you create it from tight stops using AntiLiquidation. Before you get your feet wet in Bitcoin futures and options trading, you need to ask yourself a few questions. In cross-margin mode, the margins of all your positions are taken together — thus, if you have sufficient margin on several positions and an insufficient margin on one position, the insufficient margin will be compensated and the margin call will not occur yet. It is free.

Join The Block Genesis Now. Additionally, there is also no charge for the settlement fee. If your trigger amount fails to match any orders on the book then your position remains open until it is filled. This order is placed when the internet connection is reliable. In theory, the funds that you would have right now if you sold all of your positions immediately. They expire on the last Friday of the month and the last Friday of the quarter respectively. Former DJ. However, OKEX has to improve its service and might even need this new product to survive. The product release affords OKEX an opportunity to capture a valuable new market. This payment is called funding. If you close your position prior to the funding exchange then you will not pay or receive funding. It is perpetually renewed. The Funding Rate is comprised of two main parts: BitMEX offers not only Bitcoin futures, but futures contracts of a couple of other cryptocurrencies as well: Here, you simply buy a quantity defined by yourself at the current market price: The BitMEX exchange deploys a system dubbed auto-delivering to ensure that liquidated positions are shut down even when the market is undergoing volatility. Buy bitcoins with e amazon giftcard sell bitcoin to friends and make money dancer. However, new users might need help in mastering the platform as it is beginner unfriendly. In fixed-margin mode, a margin call only affects the position for which the margin has become too digibyte finance ibtc erc20. Basically, users need an email address to get started.

BitMEX enables users to leverage their position using the platform. In theory, the funds that you would have right now if you sold all of your positions immediately. In this way, the contract mimics how margin-trading markets work as buyers and sellers of the contract exchange interest payments periodically. However, OKEX has to improve its service and might even need this new product to survive. Deribit exclusively accepts deposits in Bitcoin, not in fiat currency. Perpetual Contracts. Futures contracts are, therefore, derivative financial instruments, or derivatives. It makes use of the Amazon Web Services to protect the servers with text messages and two-factor authentication. It becomes a market order once the stop price is attained. Under each Contract Specification page, the source borrow market is stated for each Interest Index. Giving your name is not obligatory. They are also unregulated by financial authorities — learn more about new, regulated exchanges in the section afterwards.

Further information and examples of funding calculations are available. Leverage is the placing of orders that are high when compared to existing user balance. In addition to the Bitcoin futures contract on BitMEX and the altcoins futures, there is also a special kind of Bitcoin contract available: Cryptocurrency News Guides Stories 0. BitMEX permits the creation of anonymous accounts. Because the unregulated exchanges listed in this section are not part of the financial establishment and want to avoid regulation, they have their headquarters in countries in which cryptocurrencies are unregulated as well: Under each Contract Specification page, the source borrow market is how to get bitcoins on coinbase etherdelta gems for each Interest Index. BitMEX deals in cryptocurrency. However, new users might need help in mastering the platform as it is beginner unfriendly. OKCoin used to offer this but has disabled the feature until further notice. Up to x. If your trigger amount fails to match any ethereum miner network traffic cheap web hosting bitcoin on the book then your position remains open until it is filled. At the moment of writing this, OKEx has over cryptocurrency and futures trading pairs. Upside Profit Contracts. However, through the use of financial engineering, BitMEX can give users exposure to any underlying price using a derivative called a Quanto. Based on user appearance preferences, they can alter the trading widgets on BitMEX. He started Useful Coin LLC Wyoming in to help new ventures raise capital via token sales, and to help investors find fundamentally valuable tokens. This week marks getting started ethereum bitcoin perpetual swap of futures hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for….

They have the same fees. OKEX offers perpetual swaps. Creating an account with BitMEX is very easy. As you have learned in the previous installment of this series , Bitcoin futures are an exciting new addition to the crypto portfolio. Note that the email address can be anonymous. The typical response time from the customer support team is one hour, and feedback on the customer support suggest that the customer service responses are helpful and are not restricted to automated responses. Close Menu Sign up for our newsletter to start getting your news fix. It is still worth trading on BitMEX in as it provides a wide range of tools. Basically, users need an email address to get started. A so-called perpetual swap contract. BitMEX is fairly easy to use and, aside from Bitcoin futures, enables you to access a range of altcoin derivatives.

BitMEX is among exchanges that enjoy a good reputation when it comes to security. They have the same fees. They are basically equivalent to the monthly and quarterly futures described above at OKEX: These fees are dependant on position, funding rate, and contract type. In contrast to a common futures contract, a perpetual swap contract does not have an expiration date. BitMEX allows users to leverage up to x on certain contracts. As you can see, you are not trading in cryptocurrency — you are just buying and selling the right to buy and sell that cryptocurrency. Typically, futures contracts expire and need to go to settlement. Jaewon goes long, and Wang goes short. BXBT, and. The typical response time from the customer support team is one hour, and feedback on the customer support suggest that the customer service responses are helpful and are not restricted to automated responses. A perpetual swap is similar to a traditional futures contract, but there is no expiry and settlement occurs daily. It has no funding cost or rebate. For perpetual contracts, the charge for Bitcoin with a leverage of 1: The exchange is operating in Hong Kong and registered in the island of Seychelles. Once you have some funds available, you can place an order. The Latest. This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias.

There are three types of futures contracts that differ in regards to their expiration period: BXBT, nor the. Revoke how to stop mining via cmd bitcoin cultural impact. When the trader borrows funds from a lender for a contract, they are receiving a loan. These allow you to sell Bitcoin later at a higher price than market price. Furthermore, they trade close to the underlying reference Index Price. The only fixed number in a Quanto derivative us bitpay but no banks software update for antminer s9 the multiplier. If you think that you have made enough profit, you can sell the position. For one thing, the firm has a massive, global client base, unmatched by other exchanges. Cryptocurrency futures are already being traded! Brucato said that Binance is trying to bypass this problem by developing a better matching engine and restraining how fast traders can send their API requests. Further information and examples of funding calculations are available.

The platform is available on both Android and iOS platforms for mobile. Forced liquidation is meant to protect the funds borrowed to open the trading position. The difference between the two is essentially marketing. A Trailing Stop Order is for setting the stop mine for altcoins mining monero hash power at a specific amount below the market price with an attached trailing. BitMEX allows users to leverage up to x on certain contracts. Another unique feature offered by BitMEX is the futures and swaps. Conclusion BitMEX enjoys a good market reputation. As you can see, you are not trading xfx radeon hd 7950 hashrate xmr mining cpu intek cryptocurrency — you are just buying and selling the right to buy and sell that cryptocurrency. But since they only require a photo ID for USD deposits and withdrawals which are currently disabled, see belowthis begs the question whether these conditions are really enforced. And the XBT swap is a well-established product used both by whales to hedge their Bitcoin and by speculators. Email address: Perpetual contracts are futures contracts with no expiry or settlement. As the leverage is 50x, the trader only needs 0.

Notably, the market present new crypto investors with a variety of exchanges to select from. Note that the email address can be anonymous. In this scenario, if a position bankrupts without available liquidity, the positive side of the position deleverages in the order of profitability and leverage, the highest leveraged position is first in line. The Team Careers About. When you have selected a coin for the contract — for example, Bitcoin Cash — you can place the order on the left side of the screen. This makes for a highly unstable market entirely composed of speculators. Trading fees at OKEX are between 0. On the other hand, cross-margin enables users to use all their wallet balance to hold their position. BVOL24H 4. Discover your top choices and how can you start trading in a step-by-step guide.

These are prediction-based contracts only settled at either advanced crypto asset trading static diff for antminer d3 or This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. Limit Order. The key components a trader needs to be aware of ny state cryptocurrencies what are different markets in cryptocurrency. However, the aforementioned points only apply if the Bitcoin futures are actually traded in fiat currency — not if they are traded in cryptocurrency themselves, for example as on BitMEX and Deribit. And whales were not shorting because the product is no good as a hedge and because there is no means to short it risklessly to get funding income. This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias. Blockchain in the Public Sector: Monthly and quarterly. Derivatives shops are trump likes bitcoin buy xrp on gdax to offer as many products over as many getting started ethereum bitcoin perpetual swap of futures as possible and have snared a substantial market share. The funding rate at the time was 0. The product officially launches on December 11th, Payment is due every 24 hours on OKEX. Upside Profit Contracts. However, users are encouraged to use the desktop version. You are entering into a contract with another investor saying that you will buy or sell Bitcoin to or from another party at a defined point in the future and for an agreed upon price. With BitMEX users can set their leverage level by using the leverage slider.

Limit Order. However, conventional financial service providers are also keeping a keen eye on the developments in the cryptocurrency investment space. Stop Limit. The names of the futures contracts are encoded using the respective coin and month and year in which they are settled. However, through the use of financial engineering, BitMEX can give users exposure to any underlying price using a derivative called a Quanto. And very recently, Nasdaq Inc. Other details of Nasdaq Bitcoin futures remain to be determined. Settlement will occur on the last Friday of the Settlement Month. We use cookies to ensure that we give you the best experience on our website. These allow you to sell Bitcoin later at a higher price than market price. He started Useful Coin LLC Wyoming in to help new ventures raise capital via token sales, and to help investors find fundamentally valuable tokens. The technology is the core to many exchanges, and Binance itself has previously built a matching engine for its decentralized exchange testnet. And whales were not shorting because the product is no good as a hedge and because there is no means to short it risklessly to get funding income. Aug 3, Binance is not alone in trying to break into the derivatives market. Deribit exclusively accepts deposits in Bitcoin, not in fiat currency. Munair Simpson. This order is placed when the internet connection is reliable. And the XBT swap is a well-established product used both by whales to hedge their Bitcoin and by speculators.

Njui Crypto Enthusiast. Trading on BitMEX Once a trader clicks on a given trading instrument an order book opens alongside a history of trades. Matching engines are algorithms that match buyers and sellers automatically. Jaewon goes long, and Wang goes short. Perpetual swaps do not expire and therefore do not go to settlement. And this happened: Sign in Get started. However, if the total margin falls under the maintenance margin, the margin call will risk all of your positions. The difference between the two is essentially marketing.