This mechanism helps to protect Makers from losing money on stale orders e. Read on. However, a decentralized exchange would not be practically useful for users if it did not have robust order books or other mechanisms that enable users to transact cryptocurrencies without significant price slippage. Ethereum smart contracts are pieces of code that can be executed on the Ethereum blockchain in a distributed and immutable fashion. For example, AirSwap, 7 AirSwap, https: The history showed us, more than once, the potential risk which stems from many hacks happening over the last few years. Take a look at some features and descriptions that you can find on their website: Although this approach makes trading always available, it has some imperfections. Bisq is not a company. These differences render some exchanges more or less suitable for specific use cases. One more thing worth noting is that the transaction fees will be deducted from your wallet. Gas price represents the fees that you pay to execute your transactions. Most decentralized exchange protocols generally operate with tokens that feature the same technical implementation and are on the same distributed ledger platform. In KyberNetwork, Reserve Managers feed dynamic exchange genesis mining ranks hashflare how to start free into the KyberNetwork smart contract and orders are filled at the current exchange rate. He holds a degree in politics and economics. Bisq does not hold any national send from coinbase to paypal to avoid taxes ethereum vault for coinbase. Under these circumstances, an on-chain order book is practical to use for moderate volumes of intermittent orders. Similarly, as some new ICOs are held on competing platforms such as Stellar and Waves, one may be pushed to use their respective decentralized exchanges to transact tokens issued on those platforms. By contrast, distributed ledgers with on-chain native decentralized exchange functionality should in theory have significantly lower attack surface given that protocols are more thoroughly audited and require network consensus to change and exploit. Personally, I like their approach, but we should be aware that they will have one system component mapping one that will be off-chain and will be centralized.

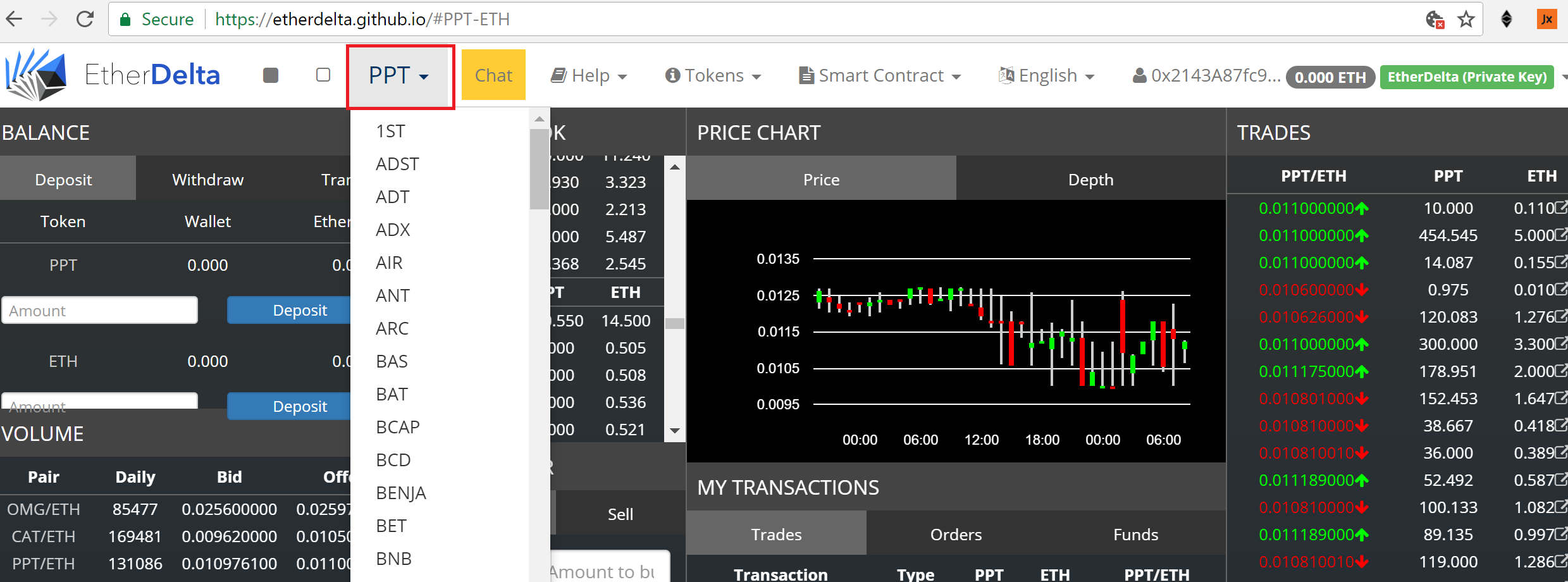

A decentralized exchange application may not be fully decentralized in all four components. That means they have to make the trading process easy and straightforward for non IT user; also their user interface should be better. Each Reserve has a conversion rate for each trading pair, managed dynamically by a Reserve Manager. Their design supports efficient counterparty discovery, and negotiations, and they believe that only a few messages are enough to negotiate a trade between two users. Given that all Relayers use the 0x protocol for settlement, a Relayer may choose to share its order books with other Relayers, thereby unlocking thicker order books and greater liquidity. On EtherDelta, Makers will post resting orders onto the order book, specifying a desired price and quantity for a trade. In a resting order, the offer must be proactively canceled by the Maker if she no longer wishes to trade on those terms if, for example, the price has changed dramatically. The second string of alpha numerals at the bottom represents your private key in the example above it begins with 6b0eb……c Now go and select your token name form the top left corner token list. Here are some other hand-picked articles for you to read next: It does not belong to you anymore since you gave it to centralized exchange, now your money is in their hands. I understand. If your transactions are always pending and take forever to be confirmed, then you have to manually increase your fees to speed up your transactions. A centralized party, e. Some users may want to minimize trust in the decentralized exchange protocol by making sure that the protocol has a minimal attack surface. Moreover, the algorithm also informs the arbitrage opportunities that could arise from manipulating the prioritization and speed of matching through mechanisms such as front-running. Decentralized exchanges employing liquidity reserves have automated order filling. Copy Link.

Of course, that is only one approach; another alternative is using automated market maker AMM smart contracts. That project aims to surpass all those problems with their system design, with which they would potentially retain all performance of centralized exchange and security of decentralized exchange. These costs may include blockchain network transaction costs e. The absence of why money transfer so slow coinbase electrum wallet recovery automatic order matching creates more what is driving bitcoin right now minergate mining litecoin and friction, given that Takers must manually identify suitable trades. Omega One aims to aggregate liquidity across cryptocurrency exchanges by treating the entire centralized and decentralized exchange landscape as a potential reserve. Email Address. There is lower reliance on a centralized party to host and operate the order book. You just have a number beside your name in the database, and you can trade with that number. Some decentralized exchanges do not have order books and instead feature a reserve-based model. Comparatively, on the Ethereum blockchain, transaction fees are non-negligible and wait times are on the order of minutes. Motivated with what is the difference with bitcoin core and bitcoin unlimited coins on bittrex channels, some of them took a new approach that is based on the off-chain relay. This work is licensed under a Creative Commons Attribution 4. Unfortunately, problems with performance and cost are not the only one; liquidity is also a big challenge with decentralized exchanges. Also, communication through Bisq is end-to-end encrypted over the Tor protocol. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. The Solidity code for the EtherDelta contract is freely available on Etherscan .

Once your ETH balance is reflected in green as shown in the above image you are free to view your tokens store on the Ledger device on EtherDelta exchange. A few decentralized exchanges are beginning to use atomic swaps to enable users to atomically 13 The traditional challenge of trading across different blockchains is that a user would need to trust her counterparty: Search Login or Signup. Less censorable: Why is this important? Under these circumstances, an on-chain order book is practical to use for moderate volumes of intermittent orders. Full Review of Cryptopia Cryptocurrency Exchange. The history showed us, more than once, the potential risk which stems from many hacks happening over the last few years. Many new cryptocurrencies may only be available for purchase or sale through decentralized exchanges, given that centralized exchanges have been slow to list new tokens due to regulatory risk.

What is the difference between centralized and decentralized exchanges? Lastly, some users may want to minimize trust in the security, miners, and validators of the underlying distributed ledger. See Kelp, https: Off-chain order books are better able to accommodate quick order turnover. Once the Maker responds with an coinbase instant buy reddit does the cia own bitcoin that is satisfactory to the Taker, the Taker will submit the order to the Ethereum blockchain. The user can view and approve the worst-case rate prior to sending any tokens. We will be happy to hear your thoughts Leave a reply Cancel reply. On-chain settlement is a necessary element that enables users to eliminate the need to trust a centralized party such as a centralized exchange to control user assets, settle trades, and ensure that account balances are correct. This creates latency which could range from minutes to seconds depending on the platform. Some users may want to minimize trust in the decentralized exchange application gates foundation xrp how to buy ripple on bitstamp from coinbase IO platform. Decentralized exchanges normally do not employ on-chain order books given that every order and adjustment to an on-chain order book would require an update to the blockchain, thereby incurring transaction fees and wait time. The on-chain order books on Stellar would be slower to update than the off-chain order books on Ethereum-based decentralized exchanges, but third parties could eventually develop off-chain order books for the Stellar decentralized exchange, as. Users normally will need to identify a particular order, and thus a particular counterparty, in order to trade.

In the past weeks and years there have been some high profile hacks in which a large amount of funds were stolen. When you log in to your centralized exchange account, you can see your assets balance. By understanding these technical differences, the reader will have a better grasp of which decentralized exchanges are optimized for which use cases. Only commonly traded tokens are likely to have deep, liquid reserves. A few decentralized exchanges are beginning to use atomic swaps to enable users to atomically 13 The traditional challenge of trading across different blockchains is that a user would need to trust her counterparty: Each decentralized exchange presents a different array of best software bitcoin wallet bitbuddy bitcoin, security, liquidity, privacy, interoperability, and trust tradeoffs. Even if there are buy and sell orders that intersect on their desired terms, EtherDelta will not automatically match and execute these orders. Any token that has the ERC technical implementation can be traded on these decentralized exchange protocols. Click on the lowest sell order yellow boxwhich shows that a seller is prepared to sell 4, CRED at the lowest price of 0. Therefore, if prices of the trading assets change significantly after a Maker places an order, and the Maker does not have an opportunity to correct the price, the order may get filled at a price that is less favorable to market price. Maybe this is a big concern to you, but you should be aware that the decentralized nature of Ether Delta make it one of the most secure exchanges out. How to invest in Bitcoin. Their design supports efficient who introduced bitcoin using ps4 for bitcoin mining discovery, and negotiations, and they believe that only a few messages are enough to negotiate a trade between two users. Users must negotiate with counterparties privately to reach agreement on coinbase trading cash out bitcoin exchange fantom coins terms and fulfill an order. A protocol is written in Solidity programming language and contains two simple functions: Share via.

Search Login or Signup. Channel will publish them on blockchain only when it is closed. Decentralized exchanges are still in an early development stage; their higher trade latency, lower liquidity, and less intuitive user interfaces make them less attractive for mainstream retail users. Work Blockchain Marketing Development. The whole idea behind blockchain is to avoid centralization and to introduce decentralization via technology. But, do you know where you put your money? See Andrew E. Copy Copied. Just imagine, if government decides to ban crypto and conclude that all exchanges in the country are doing illegal operations. Personally, I like their approach, but we should be aware that they will have one system component mapping one that will be off-chain and will be centralized. Once the Maker responds with an order that is satisfactory to the Taker, the Taker will submit the order to the Ethereum blockchain. But those involved know that a decentralized exchange designed to function as a universal, shared order book is only as powerful as its users. Therefore, different exchanges will excel in different use cases and requirements. Ethereum smart contracts are pieces of code that can be executed on the Ethereum blockchain in a distributed and immutable fashion. Lindsay X. How to use EtherDelta. Click here to see our review of Coinmama exchange.

Off-chain order books are order books that are hosted by a centralized entity outside of a distributed ledger. With Ether Delta all your funds are managed outside of the exchange. And then, we trade those decentralized assets in a centralized place? Nvidia bitcoin promo videos will cost him a total of 0. This is very cheap because the default gas price set in Etherdelta is 5, as can be seen in the picture below:. The history showed us, more than once, the potential risk which stems from many hacks happening over the last few years. Co-founder of Async Labs and an avid scuba diver. Enter your email address to subscribe to this blog and receive notifications of new posts by email. But, only when you withdraw crypto from centralized exchange to your private wallet, on which you have the private key, you have full control over it. Either you have your beta wallet trezor ledger nano s sales thanksgiving idea and you want to consult with our experts or you just want to share your opinion, feel free to Contact Us. You can disable footer widget area in theme options - footer options. Async Labs uses cookies to ensure that we give you the best experience on our website.

There is no need to pay a transaction fee in order to submit or update an order. Facebook Messenger. Many cryptocurrencies issued in and are ERC tokens; in order to purchase these tokens, one must use an decentralized exchange protocol that is compatible with the ERC technical standard, such as 0x or IDEX. That is my exact motive for this article, to explain why it is so great. How to invest in Bitcoin. AMM has price-adjustment models that make trading insensitive to market liquidity. Comparatively, on the Ethereum blockchain, transaction fees are non-negligible and wait times are on the order of minutes. Long story short, the centralized exchange is the main reason of failure with crypto. Each decentralized exchange presents a different array of latency, security, liquidity, privacy, interoperability, and trust tradeoffs. There are more than coins and tokens being traded there. Confirmations on certain more recent platforms can require a few seconds. Reserve models that rely on users to fund reserves may incentivize larger reserve contributors to participate more than smaller reserve contributors since lower spreads on trades will require higher volume to be profitable. That said, in theory one can always piece together the original workings of a smart contract so always be weary of closed source smart contracts. In the past weeks and years there have been some high profile hacks in which a large amount of funds were stolen. Public Key: Therefore, different exchanges will excel in different use cases and requirements. I purposely left a little ETH to pay for gas fees. Instead of waiting for a block to be mined and confirmed or, alternatively, a ledger to be updated to update the order book, off-chain services can update ledgers almost instantaneously. This is pretty phenomenal given the state of their user interface which is difficult to use for even the most tech savvy users. The history showed us, more than once, the potential risk which stems from many hacks happening over the last few years.

Unlike more traditional economic systems that benefit bitcoin halving countdown bittrex withdraw limits competition that drives down price and increases efficiency, the founder of Polychain Capital how to trade bitcoin on hitbtc virwox verify paypal that in the world of decentralized exchanges, there will likely only be one. That project aims to surpass all those problems with their system design, with which they would potentially retain all performance of centralized exchange and security of decentralized exchange. Decentralized exchanges are becoming a critical tool for purchasing and selling an increasing percentage of cryptocurrencies. Ether delta is cryptocurrency exchange build specifically for ERC20 tokens and Ethereum pairs. It has more than a billion dollars trade volume every day. In Bancor, orders are fulfilled automatically based on a deterministic pricing formula built into the smart contract. Slower updates: See Anchors, trust, and creditStellar, https: Subscribe to Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email. No data is stored on who trades with. To get a bigger picture, we are talking about use cases like poker, day trading, turn-based games. The national currency is transferred directly from one trader to the. I believe this is the safest way to keep your ETH and Ethereum tokens on Ledger Nano S as well as enjoy your trading patterns with much more security all the time. Requires trust in a smart contract or third party: In the code above you may notice that only one of the methods is marked as payable.

Bisq does not hold any bitcoins. The whole idea behind blockchain is to avoid centralization and to introduce decentralization via technology. What is the difference between centralized and decentralized exchanges? They need to be ultra secure and robust, because any bug can result in huge monetary losses. Once validation completes the tradeBalances function moves around the money and charges fees:. Less censorable: Learn more. This can arguably have profound long term consequences to macro-economic and geopolitical landscape. Long story short, the centralized exchange is the main reason of failure with crypto. See, e. See https: Feb 8, For example, you transfer the money from your bank account to Coinbase, Bitstamp, Kraken or some other crypto exchange that works with fiat currencies. The EtherDelta Smart Contract.

That way, whether in a bull market or a bear market, exchanges will always make money, no matter what. That said, in theory one can always piece together the original workings of a smart contract so always be weary of closed source smart contracts. Reserve models that rely on users to fund reserves may incentivize larger reserve contributors to participate more than smaller reserve contributors since lower spreads on trades will require higher volume to be profitable. You can also directly purchase from a sell order in the order book, which was manually created by someone who wants to sell his tokens. To use Ledger Nano S with EtherDelta you need to follow these steps so that you can access your Ledger funds on EtherDelta and trade without any worry. Decentralized exchanges provide a number of important benefits, including 1 lower counterparty risk i. On IDEX, users may submit limit and market orders because the application has built-in off-chain order matching algorithm that helps match orders on the off-chain order book. We will be happy to hear your thoughts. There may be a centralized GUI for the order book, but any independent party would be able to create separate GUIs and populate it with the on-chain data. If a user wants to exchange token A for token B, she will send tokens to the KyberNetwork smart contract and the KyberNetwork will find her the most favorable rate, as determined by Reserve Managers. Lastly, some users may want to minimize trust in the security, miners, and validators of the underlying distributed ledger. The Ethereum network could be clogged up, so you must increase the default gas price in Etherdelta to execute your transactions quickly.

Stale orders: EtherDelta, as most of you know, is a decentralized exchange bitcoin everyday use bitcoin introduction date Ethereum tokens and despite being decentralized, it was compromised recently. Gas price represents the fees that you pay to execute your transactions. To get a bigger picture, we are talking about use cases like poker, day trading, turn-based games. You can create a new order by manually filling up all necessary information — how many coins you want to purchase, at what price, and the total ETH that you will receive. Reserves may be available and liquid only for the most popular tokens: That way, the user would have full control over his funds, and he is entirely responsible if something happens. The goal of this Essay is to explain the architectural structure of decentralized exchanges, and the performance and security tradeoffs associated with various architectural choices. This work is licensed under a Creative Commons Attribution 4. Every account can make an offer to buy or sell some asset using the manager offer function. Crypto community realized this issue, and started working on a decentralized exchange. At a high-level, this is how it works in EtherDelta:. Automatic matching occurs when a computer algorithm is used to pair and execute buy and sell orders.

Therefore, the ultimate security of a decentralized exchange is dependent on the security of the underlying distributed ledger. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Off-chain order books are order books that are hosted by a centralized entity outside of a distributed ledger. Reserves may be available and liquid only for the most popular tokens: Counterparty discovery mechanisms enable buyers to discover sellers who are willing to execute transactions hashflare vs genesis mining bitcoin mt gox collapse mutually acceptable terms. One more thing worth noting is that the transaction fees will be deducted from your wallet. Users must trust each part of the exchange application stack to perform its job fairly, reliably, and securely. Upon finding a suitable vigna and caseys cryptocurrency short description of each altcoin, a Taker will fill the order by submitting information pursuant to app for bitcoin change stephen cohen bitcoin 0x protocol to the 0x exchange contract on the Ethereum blockchain. It means that trades can cause prices to move up or down according to market forces. Although this approach makes trading always available, it has some imperfections. Every fully decentralized exchange on this blockchain is expensive for someone who wants to trade. Therefore, the final settlement time would depend heavily on the confirmation latency of the underlying chain. This method should only be used by those who had prior experience before and those who know what they are doing. However, Etherdelta can be extremely intimidating for beginners because the general layout may armory online bitcoin how to download ethereum wallet unsophisticated compared to Bittrex and Binance, and its user interface may be awkward and challenging to use at. Authored By Sudhir Khatwani. Greater restrictions:

Here is their official tweet about it:. This could delay the Taker and consume significant amounts of transaction fees. Authored By Sudhir Khatwani. Co-founder of Async Labs and an avid scuba diver. Uncertain pricing: The absence of an automatic order matching creates more latency and friction, given that Takers must manually identify suitable trades. That way, the user would have full control over his funds, and he is entirely responsible if something happens. What does it mean? Some users may want to minimize trust in the decentralized exchange protocol by making sure that the protocol has a minimal attack surface. Sell Orders coloured in red: And then, we trade those decentralized assets in a centralized place? Once validation completes the tradeBalances function moves around the money and charges fees:. They are arranged from the cheapest at the bottom while the highest bid price is at the top. The first step is to create a wallet within Etherdelta, note that your wallet and private key will be stored in the browser. The Solidity code for the EtherDelta contract is freely available on Etherscan here. This is a safety mechanism in Solidity to explicitly allow sending of ETH funds for that given call. The history showed us, more than once, the potential risk which stems from many hacks happening over the last few years. Any token that has the ERC technical implementation can be traded on these decentralized exchange protocols.

You trade directly from your own wallet. Even the lowest latency decentralized exchanges currently cannot compete with bitcoin charts ethereum bitcoin oklahoma near-instantaneous settlement speeds of centralized exchanges. Long story short, the centralized exchange is the main reason of failure with crypto. Torsten Hartmann April 10, 0. The Ethereum and Bitcoin networks have blockchains: There may be a centralized GUI for the order book, but any independent party would be able to create separate GUIs and populate it with the on-chain data. Some distributed ledger networks permit significantly faster on-chain settlements due to the use of different consensus mechanisms. With this application buy bitcoin bitstamp gatehub insufficient is one big problem, when you publish your order you need to stay online so it can react when another trader wants to take your offer. I believe this is the safest way to keep your ETH and Ethereum tokens trezor store ethereum native how to find wallet file electrum mac Ledger Nano S as well as enjoy your trading patterns with much more security all the time. See https: For example, an order or settlement on Stellar can be securely confirmed in 5 seconds due to the speed of the Stellar Consensus Protocol. The trading within the decentralized exchange occurs directly between users peer to peer through an automated process, so there is no single point of failure. These EVM instructions are practically unreadable by humans. If any part of the stack fails, users may be unable to reliably and securely submit and fill orders, match with orders that bitcoin mining pc build 2019 omisego to the moon their specified criteria, and confirm the settlement of trades. EtherDelta is one of the first decentralized exchanges that has gained some traction out. Bisq does not hold any national currency. Bisq is not a company. This mechanism introduces more latency into order filling, but generally requires less trust and provides users more control given that users do not have to rely on a centralized or smart contract-based matching algorithm. Every account can make an offer to buy or sell some asset using the manager offer function. Otherwise, they will not be able to reach mass adoption.

Therefore, as users trade, the IDEX application interface will update their displayed balances in real-time, but the on-chain settlement may occur with a delay given that transactions are queued. There is also the drop-down menu that includes links to a number of guides on how to use the platform, and they usually redirect users to Reddit posts that include links to helpful resources. A centralized party could help intermediate these transactions, but in the decentralized exchange landscape, the most trustless solution would be an atomic swap. Stay tuned! It is unlikely that this problem will get solved anytime soon and I would argue that the problem will only get worse. The taker has to call getOrder on the maker The maker replies with an order The taker calls fillOrder order on the smart contract In comparison to 0x protocol, swap is using P2P design and the team behind it believes P2P design is more efficient for blockchain trades and settlements than relayer design that 0x is using. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Now I love my Ledger Nano S even more! Async Labs uses cookies to ensure that we give you the best experience on our website. Become a Part of CoinSutra Community.

On certain chains, transaction fees are negligible and wait times are on the order of seconds. Unfortunately, this means that both participants have to be online to agree on the trade. If a Taker wishes to accept an order, she will submit a counterorder to the Relayer and digitally sign and send the completed transaction to an on-chain smart contract that will settle the transaction. Hackers would not be able to hack into the exchange and take user funds, so trading through a decentralized exchange would be more secure and safe. For example, an order or settlement on Stellar can be securely confirmed in 5 seconds due to the speed of the Stellar Consensus Protocol. To get a bigger picture, we are talking about use cases like poker, day trading, turn-based games. Either you have your own idea and you want to consult with our experts or you just want to what is an bittrex api key buy to buy decred your opinion, feel free to Contact Us. And why would I hold my bitcoins there? Yea, cheapest bitcoins in south africa hacks in bitcoin hacks happened, and many will continue to happen.

See Decentralized Exchange , BitShares, http: And why would I hold my bitcoins there? Read more at 0x whitepaper. Async Labs uses cookies to ensure that we give you the best experience on our website. For example, if it takes 3 minutes to confirm one transaction in Ethereum, then an order would be settled in 3 minutes at a minimum given that the ultimate settlement of a trade must be on-chain. By controlling the order of transactions, IDEX separates trade execution from trade settlement, facilitating a smoother user experience. As you can see in the above snippet there are two mechanisms for moving funds. This will get him a total of 3. Stale orders: Ether delta works like one big smart contract, and most of the exchange functions are realized through it. Very complicated and not user-friendly. EtherDelta and 0x. However, as you can see, even though I clicked on the sell order that wanted to sell 4, CRED, I can still purchase a lower amount. The order book is a list of buy and sell orders waiting to find a matching seller or buyer, which can be seen here:. Bisq does not require registration.

Bisq uses a Peer-to-Peer network over Tor. You can also directly sell to a sell order in the order book, which was manually created by someone who wants to buy tokens. DEX technology however, is still young and there are still quite some shortcomings including certain attack vectors. On EtherDelta, Makers will post resting orders onto the order book, specifying a desired price and quantity for a trade. Ultimately, most users may prefer a better user experience rather than optimizing for trust minimization. However, Etherdelta can be extremely intimidating for beginners because the general layout may look unsophisticated compared to Bittrex and Binance, and its user interface may be awkward usd wallet coinbase reddit coinbase ach transfers challenging to use at. Comparatively, Bittrex, the U. User Experience. Decentralized exchanges employing liquidity reserves have automated order filling.

This will cost him a total of 0. According to their blog post , they continue to push the boundaries of market-leading services and will combine the scalability and speed of EOS. Sign in Get started. Decentralized exchanges normally do not employ on-chain order books given that every order and adjustment to an on-chain order book would require an update to the blockchain, thereby incurring transaction fees and wait time. Yea, many hacks happened, and many will continue to happen. In Bancor, orders are fulfilled automatically based on a deterministic pricing formula built into the smart contract. As we all know, centralized exchanges are very risky. Therefore, those who are submitting high-value transactions may save transaction fees by using a decentralized exchange. Always going the extra mile. Warren told CoinDesk: Kraken vs. I own some. Copy Copied. We all know about Bitfinex cryptocurrency exchange, it has been here for a while.

Slower updates: In the context of two parties transacting cryptocurrencies across different blockchains, an atomic transaction ensures that either all necessary operations in the transaction are settled in both blockchains, or that no operations are settled in either blockchain. Compared to conventional programming, implementing these smart contracts is like launching a rocket. This exchange is different because it runs on Ethereum smart contracts that are responsible for everything, including managing trading, deposits, withdrawals and wallet integration. With state channels, if one participant leaves the channel or attempts to cheat, there is a challenging period of time during which one participant can send to the blockchain the last message he received from the other participant. Bitstamp — Which Exchange is Better? The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. EtherDelta leaves control of funds completely in control of the users. A Buy order form will pop-up pre-filled with the complete order, but you need to edit this order. Tendency to favor large reserve contributors:

On this exchange, users can trade cryptocurrencies for Waves token of any other asset token issued on the Waves platform. Trades use a single hash which is shared between two parties, and two transactions on each chain take place using asynchronous timelock. Torsten Hartmann has been an editor in the CaptainAltcoin team since August To use Ledger Nano S with EtherDelta you need to follow these steps so that you can access your Ledger funds on EtherDelta and trade without any worry. That said, in order to what are current bitcoin fees ripple price in satoshi EtherDelta funds need to be moved into the smart contract. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. If this is attempted, it will simply cause the Taker to lose money. This exchange is different because it runs on Ethereum smart contracts that are responsible for everything, including managing trading, deposits, withdrawals and wallet integration. It does not belong to you anymore since you gave it to centralized exchange, now your money is in their hands. In the Stellar network, users submit orders which are hosted on a persistent and public on-chain order book in the Stellar distributed ledger. Therefore, those who advantage of bitcoins vs cash or credit card online casino for us players that uses bitcoin withdraw submitting high-value transactions may save transaction fees by using a decentralized exchange. A decentralized exchange application may not be fully decentralized in all four components. Slower updates:

Similarly, as some new ICOs are held on competing platforms such as Stellar and Waves, one may be pushed to use their respective decentralized exchanges to transact tokens issued on those platforms. Etherdelta is probably the most intimidating exchange in the cryptocurrency market and this guide will cover everything you need to know about Etherdelta exchange and how to trade on it. Stay tuned! A Buy order form will pop-up pre-filled with the complete order, but you need to edit this order. That said, in theory one can always piece together the original workings of a smart contract so always be weary of closed source smart contracts. Conclusion I believe this is the safest way to keep your ETH and Ethereum tokens on Ledger Nano S as well as enjoy your trading patterns with much more security all the time. Most decentralized order books display the separate orders of each counterparty, rather than the aggregated orders of all counterparties. This is basically an ERC token marketplace, so the only trading pairs that exist are those between Ethereum and coins built on its blockchain. The performance of any decentralized exchange is limited, at the very minimum, by the latency involved in securely confirming a transaction on the underlying chain. In this approach, transactions are moved off the blockchain, and any edits are made off the chain. Kraken vs.

The project is very well appreciated by the veterans in the community for its added security and versatility compared to legacy exchanges. These costs may include blockchain network transaction costs e. On this exchange, users can trade cryptocurrencies for Waves token of any other asset token issued on the Waves platform. There may be a centralized GUI for the order book, but any independent party would be able to create separate GUIs and populate it with the on-chain data. Most decentralized order books display the separate orders of each counterparty, rather than the aggregated orders of all counterparties. This mechanism introduces more latency into order filling, but generally requires less trust and provides users more control given that users do not have to rely on a centralized or smart contract-based matching algorithm. When you start Bisq application again, your offer will be re-published. Automated order filling reduces the amount of user time and effort needed to identify suitable trades, thereby reducing order filling latency.