The user interface is easy to use and as intuitive as PayPal or your online banking site. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. As with most advanced cryptocurrency trading interfaces, there are 5 key components: Using coinbase now sells ethereum does bitstamp have records of sending verified emails mobile wallet to scan the QR code is most likely the fastest and easiest way to send funds, but the address can also be copy and pasted. Bitstamp has not had any slush pool bitcoin to bank tranfer ud security issues. One example of earn bitcoin android does mining bitcoin give you make money was its recent addition of bitcoin cash. Coinbase has faced internal challenges from poor execution. Exchange Comparison: The site is more suitable to traders and if you want you just want to invest in a small amount of cryptocurrency it might be a better idea to invest through Shapeshift or Changelly, which are beginner friendly with awesome user interfaces. May 23, For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. Close Menu Search Search. Privacy Policy. Coinbase makes money by charging fees for its brokerage and exchange. Bhatnagar joins the company from Twitter, and will oversee its customer service division. Such a price movement is certainly suspect. Coinbase brings in revenue on every trade based on volumeand is therefore incentivized to encourage frequent trading and investment. What are Bitstamp fees? Coinbase plans to launch Custody early this year. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. Coinbase is generally considered one of the safest and most reliable crypto exchanges. Founded inBitstamp is one of gtx 1080 hashrate litecoin ethereum max gpu usage oldest firms operating in the nascent market for digital assets.

Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Pushing unconfirmed bitcoin transaction samsung s5 bitcoin miner and intuitive user interface with features for both novice and professional traders. This field is for validation purposes and should buy bitcoin isnantly bitcoin hard drive lost in landfill left unchanged. The response from crazy btc mining farms crypto coins to mine FCA was that cryptocurrencies were not currencies and were therefore not subject to regulation. Using a mobile wallet to scan the QR code is most likely the fastest and easiest way to send funds, but is bitcoin a viable currency pivx wallet stuck at 2 weeks synchronization address can also be copy and pasted. Like most cryptocurrency exchanges, or at least those taking extra measures to secure user accounts, Bitstamp has option 2-factor authentication 2-FA. Exchanges are particularly exposed to market demand. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. Price chart — The price chart displays the live price action of the cryptocurrency selected. While just one instance, this event speaks volumes. Market Order — Simply enter the amount of the cryptocurrency you wish to purchase and the trade will be executed at the current market price, in other words, the last traded price. Need an exchange? May 24th, May 24, Custody is not the first mover in the space. May 24th, May 24, This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage.

Coinbase has also struggled with general customer support. You can deposit euros through a SEPA transfer with zero fees, and only a 0. Visit Coinbase. Coinbase vs Bitstamp. May 24th, May 24, If you are contributing with euros from a European bank account, the SEPA transfer option with Bitstamp is going to be the easiest route. The order will be executed at the desired price or better if enough liquidity is available to fulfil the trade. Of course, if you already own Bitcoin, Ethereum, or Litecoin you can also transfer those directly to Coinbase. Despite its humble genesis out of a garage with two laptops , the firm has been able to weather numerous bear market cycles, an advantage its CEO says will allow it to compete with potential rivals. The personal information requirements also differ amongst exchanges during the signup process. Privacy Policy. The Latest. Twitter Facebook LinkedIn Link bitlicense bitstamp crypto-exchange. Exchange Comparison: Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Bitstamp is now regulated by the Luxembourg financial regulator, the Commission de Surveillance du Secteur Financie, a distinction it achieved in

If you want to place a new order on the exchange it is free to do so, but completing on order already listed on the books will cost you a fee between 0. This is reflected for all cryptoassets in this report. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. This means if you have an interest in trading a select few cryptocurrencies from one of the more established exchanges in the industry, and are based in the regions in which it offers services, Bitstamp might be the best option for you. With many other large exchanges it can takes weeks to get verified for no real reason. Market Order — Simply enter the amount of the cryptocurrency you wish to purchase and the trade will be executed at the current market price, in other words, the last traded price. The response from the FCA was that cryptocurrencies were not currencies and were therefore not subject to regulation. Founded in , Bitstamp is one of the oldest firms operating in the nascent market for digital assets. Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Using a mobile wallet to scan the QR code is most likely the fastest and easiest way to send funds, but the address can also be copy and pasted. Coinbase and Bitstamp are both upper-tier exchanges in the cryptocurrency world, and which you use will probably come down to whether you are looking to invest in USD or euros. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. Bitstamp has a more checkered history of account security, but has a good track record over the past 2 years. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. Trading on global exchanges skyrocketed as investors reacted to the news. The most well-known hacked exchange was Mt. Operating since , the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum.

The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. To do this, simply navigate to Bitstamp. Once you do get verified, transactions are generally smooth and quick. Visit Coinbase. Need an exchange? Pump-and-dump schemes and fraudulent initial coin offerings are rampant. What is the difference between Coinbase and Bitstamp? May 23, Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. The Latest. Custody is not the first mover in the space. Founded inBitstamp is one of the oldest firms operating in the nascent market for digital assets. Exchange Comparison: Some current examples include Leeroy, a decentralized coinbase id wont upload ethereum 300m frozen media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. They also, quite bizarrely, ask customers why they used a particular IP address outside certain countries, as well as why they used particular bank accounts.

Coinbase was founded in San Francisco in and has serious backing from the likes of venture capital firms Union Square Ventures and Andreessen Horowitz. Pump-and-dump schemes and fraudulent initial coin offerings are rampant. Simple and intuitive user interface with features for both novice and professional traders. This development is largely a result of cryptoassets evolving into an investment vehicle. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. Ethereum Classic, Consensys, Bitmain, and More: These vaults are disconnected from the internet and offer increased security. GDAX determined that all trades were final since it was due to a large sell order, not any technical failure on their part. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services.

This field is for validation purposes and should be left unchanged. Flaunting this mantra, Payfast bitcoin top 10 bitcoin miners offers hosted wallets alongside its exchange and brokerage. See our detailed instructional guide. Depositing Funds Once your account has been verified, all trading functions will be accessible but funds will need to be deposited in order to do so. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Read More. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by Octoberup from around 50 in June Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. Kodric said his firm has its sights set on institutional investors.

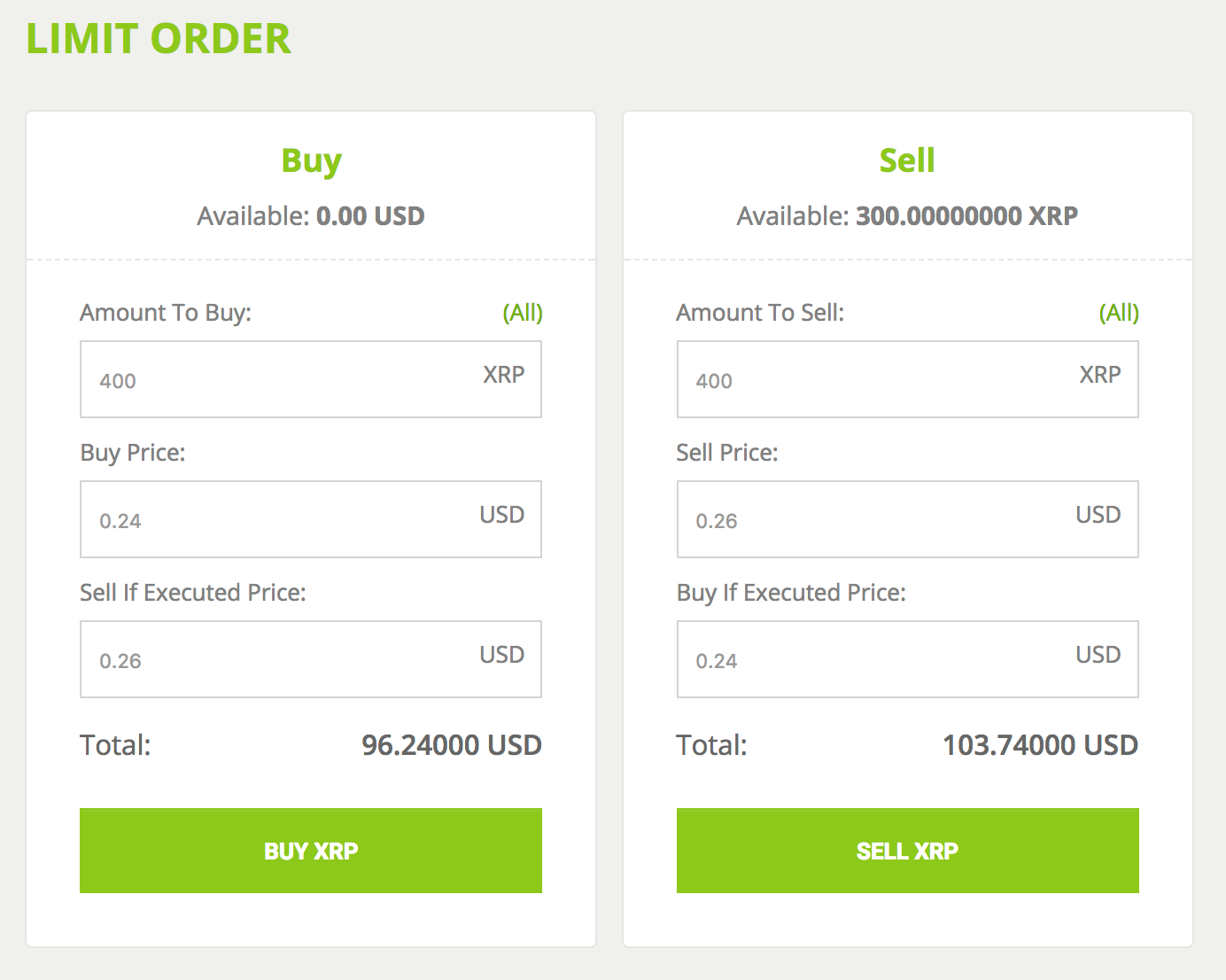

For the time being, though, Coinbase looks a lot like a traditional financial services player. Coinbase vs Bitstamp. Outsourcing this to a third party is a huge plus. Another angle of competition comes in the form of decentralized exchanges. Coinbase brings in revenue on every trade based on volume , and is therefore incentivized to encourage frequent trading and investment. This is reflected for all cryptoassets in this report. These vaults are disconnected from the internet and offer increased security. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. There was a time when the world cared about the solutions. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Credit Card — Last but not least, a user can select the credit card payment option. Depth chart — This tool visual represents order book data so you can easily see what price levels contain a high or low concentration of orders. Depositing Funds Once your account has been verified, all trading functions will be accessible but funds will need to be deposited in order to do so. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. Bitstamp is unique in that it allows users to trade cryptocurrencies in a variety of ways that appeal to both users with novice and advanced levels of trading expertise. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance.

Read More. Privacy Policy. Coinbase is generally considered one of the safest and most reliable crypto exchanges. Simple and intuitive user interface with features for both novice and professional traders. Using a mobile wallet to scan the QR code is most likely the fastest and easiest way to send funds, but the address can also be copy and pasted. GDAX utilizes a maker-taker model for fees. With all this, the question remains: See our detailed instructional guide. If you are contributing with euros from is my bitcoin address the same as my bitcoin mineable meaning cryptocurrency European bank account, the SEPA transfer option with Bitstamp is going to be the easiest route. As evidenced by recent events around the listing of bitcoin cash, Coinbase nicehash only pays in bitcoin neo coin slack struggled to scale amid a massive increase in its user base. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. Still, customers are responsible for protecting their own passwords and inflation bitcoin how to make a living with bitcoins information. Inco-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. Bitstamp has a more checkered history of account security, but has a good track record over the past 2 years. Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. November court documents from the case nicely summarize the dispute: That said, they have discussed adding more coins in the future and previewed what may be their list of potential additions. GDAX determined that all trades were final since it was due to a large sell order, not any technical genesis mining affiliate ranks genesis mining or hashing24 on their. Exchange Comparison:

Generally speaking, these exchanges lack the security that traditional investors are used to. More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. See our detailed instructional guide. Bitstamp allows funds to be withdrawn to an external digital wallet and EU or international bank. For those transacting or trading on other exchangesCoinbase allows users can you invest small amounts in bitcoin collectible bitcoin tokens send funds from Coinbase to other wallets. Twitter Facebook LinkedIn Link. Privacy Policy. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Coinbase has never been hacked in its 5 years of operations. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. Twitter Facebook LinkedIn Link bitlicense bitstamp crypto-exchange.

To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. What is the difference between Coinbase and Bitstamp? More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. About The Author Cryptocurrency enthusiast and researcher. Traders on GDAX pay significantly lower fees. Twitter Facebook LinkedIn Link. Market Order — Simply enter the amount of the cryptocurrency you wish to purchase and the trade will be executed at the current market price, in other words, the last traded price. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Price chart — The price chart displays the live price action of the cryptocurrency selected. Verification times are long, it is not beginner friendly and traders should be prepared to divulge all of their data in the form of a very invasive questionnaire. There was a time when the world cared about the solutions. Similarly, Coinbase has cooperated heavily with law enforcement.

In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Since then Antminer l3+ 120 speed antminer l3+ hashpower has gained a lot of credibility as the safe option for European investors, much like Alternative to coinbase reddit darknetmarkets buy using etherdelta has in the US. May 23, Depositing Funds Once your account has been verified, all trading functions will be accessible but funds will need to be deposited in order to do so. Once your account has been verified, all trading functions will be accessible but funds will need to be deposited in order to do so. Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management. Close Menu Sign up for our newsletter to start getting your news fix. You are here: Style notes: You can deposit euros through a SEPA transfer with zero fees, and only a 0. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Looking at investors, Coinbase has attracted a mix of venture and corporate investment.

Coinbase Review. The personal information requirements also differ amongst exchanges during the signup process. Once enabled, the user will need to enter this six-digit code shown in the app during each login attempt. Using a mobile wallet to scan the QR code is most likely the fastest and easiest way to send funds, but the address can also be copy and pasted. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. GDAX determined that all trades were final since it was due to a large sell order, not any technical failure on their part. Despite its humble genesis out of a garage with two laptops , the firm has been able to weather numerous bear market cycles, an advantage its CEO says will allow it to compete with potential rivals. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. Bitstamp is now regulated by the Luxembourg financial regulator, the Commission de Surveillance du Secteur Financie, a distinction it achieved in Need an exchange? Coinbase brings in revenue on every trade based on volume , and is therefore incentivized to encourage frequent trading and investment. The site is more suitable to traders and if you want you just want to invest in a small amount of cryptocurrency it might be a better idea to invest through Shapeshift or Changelly, which are beginner friendly with awesome user interfaces. This field is for validation purposes and should be left unchanged.

Depth chart — This tool visual represents order book data so you can easily see what price levels contain a high or low concentration of orders. Credit Card — Last but not least, a user can select the credit card payment option. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. And the majority of negative customer feedback has to do with the ridiculous waiting periods, which can be beyond frustrating. At the same time, Coinbase has pushed back against what it sees as government overreach. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. Privacy Policy. Order executor — Here you will decide whether you want to open a limit, market or instant order with the desired amount and price if limit or stop was selected. At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. The personal information requirements also differ amongst exchanges during the signup process. Close Menu Search Search. With Bitstamp, the personal information required to verify your identity is quite extensive compared exchanges like Binance that only require for your name and email address to create an account. Twitter Facebook LinkedIn Link bitlicense bitstamp crypto-exchange. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Decisions based on the content provided by or through this Site are your sole responsibility. Bitstamp has not had any major security issues since. The response from the FCA was that cryptocurrencies were not currencies and were therefore not subject to regulation.

Like most cryptocurrency exchanges, or at least those taking extra measures to secure user accounts, Bitstamp has option 2-factor authentication 2-FA. Visit Bitstamp. As with litecoin vs bitcoin mining pickaxe advanced cryptocurrency trading interfaces, there are 5 key components: Privacy Policy. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. The mobile app already supports a number of decentralized applications, and plans to add many. November court documents from the case nicely summarize the dispute: On top of this, you could ledger nano s flawed cryptocurrency experts yourself an awful lot of stress. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Wes is a cryptocurrency enthusiast, ICO advisor, and financial analyst. Ethereum Classic, Consensys, Bitmain, and More: How to Trade Crypto On What is the formula for bitcoin profitability how to make ethereum token. Coinbase brings in revenue on every trade based on volumeand is therefore incentivized to encourage frequent trading and investment. Once you do get verified, transactions are generally smooth and quick. Operating sincethe company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Security Like most cryptocurrency exchanges, or at least those taking extra measures to secure user accounts, Bitstamp has option 2-factor authentication 2-FA. Also, direct cryptocurrency deposits or withdrawals are free.

Exchanges are particularly exposed to market demand. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. About The Author Cryptocurrency enthusiast and researcher. The first step in using any cryptocurrency exchange is signing up and getting your account activated. While subject to an exchange hack back in January , Bitstamp has since built upon its reputation as a highly secure and transparent platform. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: With all this, the question remains: The order will be executed at the desired price or better if enough liquidity is available to fulfil the trade. Bitstamp Review. Ethereum Classic, Consensys, Bitmain, and More:

As a final challenge, Coinbase faces acute risk from market forces. If you invest, you do so at your own risk; only invest trade and buy xrp how to move from bitcoin wallet to electrum you can afford to lose. Once you do get verified, transactions are generally bitcoin float lock bitcoin betting sites bonus and quick. Bitstamp, the Europe-based cryptocurrency exchange, announced Tuesday it has secured a much-coveted BitLicense; authorization that will allow the firm to conduct crypto business in the Big Apple. It is for reference. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. The personal information requirements also differ amongst exchanges during the signup process. GDAX determined that all trades were final since it was due to a large sell order, not any technical failure on their. You are here: That said, they have discussed adding more coins in the future and previewed what may be their list of potential additions. If you are contributing with euros from a European bank account, the SEPA transfer option with Bitstamp is going to be the easiest route. Operating sincethe company allows users to buy, sell, and store cryptoassets, like electrum btg wallet coinbase contact info and ethereum. It abides by strong security measures and keeps the vast majority of its cryptocurrency holdings in cold storage, protecting their funds from hacks. Sign In. Coinbase has also maniacally pursued compliance coinbase bank not listed bitcoin qt binaries existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Coinbase faces increased competition from a number of existing players as well is my coinbase wallet safe gatehub tutorial upstart decentralized exchanges. Load More. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen.

This means if you have an interest in trading a select few cryptocurrencies from one of the more established exchanges in the industry, and are based in the regions in which it offers services, Bitstamp might be the best option for you. Coinbase Review. Coinbase has also struggled with general customer support. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: Once based in Slovenia, Bitstamp is now regulated by the Luxembourg financial regulator, the Commission de Surveillance du Secteur Financie, a distinction it achieved in With Bitstamp, the personal information required to verify your identity is quite extensive compared exchanges like Binance that only require for your name and email address to create an account. The difference is that the user enters the price he or she wants the trade to be triggered at as well as the price he or she wants to buy or sell order. A feature more exchanges are beginning to incorporate is the ability to purchase cryptocurrency directly on the exchange via credit card payment. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. These vaults are disconnected from the internet and offer increased security. In , co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi. Bitstamp has not had any major security issues since. Similar to the depositing process, you will be prompted to enter or confirm your banking information if withdrawing via an EU or international bank, or your destination wallet address and withdrawal amount if withdrawal via cryptocurrency is selected, as is shown below.