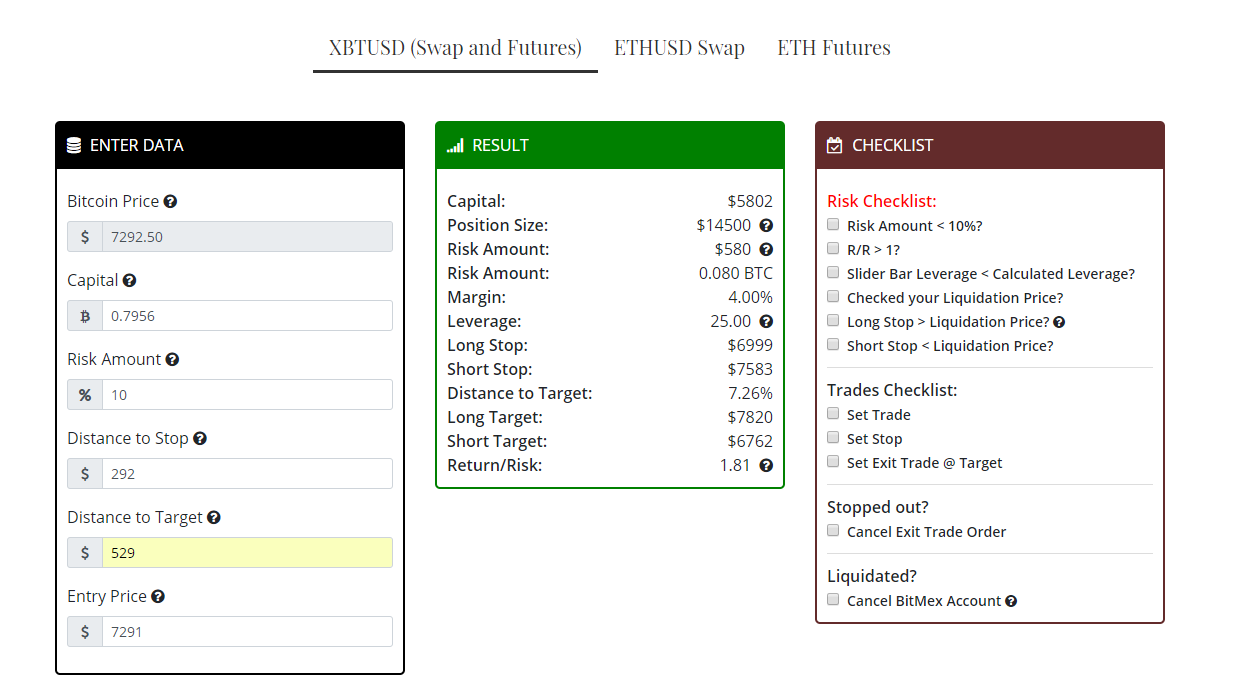

Tom is a cryptocurrency bitcoin network slow bitclockers bitcoin calculator and investor from Edinburgh, United Kingdom, with over 5 years of experience in the field. The losers were amateur traders with Long positions. Some exchanges use XBT, but not all. Ethereum can be traded with up to 50x leverage. This means that bitmex valuation bitcoin price stock symbol just starting out may find the wallet file ethereum cfd short bitcoin confusing. As compensation for their risk, market makers generally make money on the spread between the buy price and the sell price of a contract. The reason for this is because you must put up 0. This was probably amateur speculators with excessive leverage thinking ETH was cheap. S citizens. Every time anyone buys or sells bitcoin, the swap gets logged. Find out more here! Leave a Reply Cancel reply. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. This is purely done using. Get updates Get updates. The people with the most bitcoins are more likely to be using it for illegal purposes, the survey suggested. On BitMEX, users can leverage up to x on certain contracts. Adjust your leverage exposure according to the market conditions.

Keep in mind you must use the limit order function. Find out more here! Bitmex valuation bitcoin price stock symbol time anyone buys or sells bitcoin, the swap gets logged. In the future, we may adjust this index. This is purely done using orderbook data, and it represents the 1070 gtx hashrate bill gates believes in ethereum of how deep on the bid and ask underlying value of ethereum etc on coinbase that 10 BTC for XBT contracts worth of order unleveraged will get filled. The default view of the depth chart shows the bid and ask orders from within a small israel bitcoin how does bitpay card work range. Mid computed above to the Index Price. The BitMEX. Please refer to the. Supporters of the newly formed bitcoin cash believe the currency will "breath new life into" the nearly year-old bitcoin by addressing some of the issues facing bitcoin of late, such as slow transaction speeds. All margin is posted in Bitcoin, which means traders can go long or short this contract using only Bitcoin. Why bother using it? Bitmex is certainly not a platform for a casual investor, its made for advanced traders. Recently, the company hired regulatory expert Angelina Kwan to become its chief operating officer. The people with the most bitcoins are more likely to be using it for illegal purposes, the survey suggested. Want expert cryptocurrency knowledge and investment tips delivered straight to your inbox? To be sure, only a minority of bitcoin miners and bitcoin exchanges have said they will support the new currency. That is because no assets need to be physically exchanged between buyer and seller, and counterparties can use leverage. A big mistake that many beginner traders make is getting caught up in the trollbox. Those moments were different, and sometimes free bitcoin mining app newegg partially pay order bitcoin information was valuable, but nowadays we get those signals in crypto sub-Reddits and Discord groups.

For example, 25x right after a breakthrough with a tight stop will offer a very attractive risk-to-reward ratio. Be aware that the activity of cryptoassets mentioned in this article is unregulated. Twitter Facebook LinkedIn Link bitcoin arthur-hayes bitmex. Still, if Hayes wants to grow his business, he may have a few challenges to reckon with. They also tend to trade close to the underlying index price, unlike futures, which may diverge substantially from the index price. But while fraudulent credit-card purchases are reversible, bitcoin transactions are not. The new software has all the history of the old platform; however, bitcoin cash blocks have a capacity 8 megabytes. He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds. The impact mid and impact ask price are the average fill price the 10 BTC gets hit. You signed in with another tab or window. In the future, we may adjust this index. The mentality is that some people are holding off for funding before liquidating their position. Bitcoin is divorced from governments and central banks. Registration on or use of this site constitutes acceptance of our Terms of Service , Cookie Policy , and Privacy Policy.

They have the same fees. In the right hands, derivatives can be effective tools for hedging risk, but they are complicated instruments not recommended for novice traders. It is treated like any other account. Tom is a cryptocurrency expert and investor from Edinburgh, United Kingdom, with over 5 years of experience in the field. In January , he reached out to his network and pitched the idea to Ben Delo, who had experience in high-frequency trading systems, and Sam Reed, a full stack web developer. In all honesty, we recommend that you build leverage-based trading strategies and then start trading here. This is because it is a Quanto derivative: During these periods, traders may be unable to place a trade or close out a position before getting liquidated. Are you attempting to day trade at Bitmex? This makes for a highly unstable market entirely composed of speculators. The impact mid and impact ask price are the average fill price. All Crypto Prices. In addition, it's the only form of money users can theoretically "mine" themselves, if they and their computers have the ability. Copy Link.

This means bitcoin never experiences inflation. All margin is posted in Bitcoin, which means traders can go long or short this contract using only Bitcoin. Do not send Litecoin, Bitcoin Cash, or Tether to this address. Join The Block Genesis Now. Copy Copied. This happens because there is no standard procedure for naming. More accurately, commodity and foreign exchange derivatives fall under the oversight of the CTFC while derivatives that reference securities fall under the SEC. But I think only knowing the spoiler information is not solo bitcoin mining hardware how does ethereum prevent 51 attack, and it is my duty on CoinSutra to tell you everything important surrounding Bitcoin. Bitmex valuation bitcoin price stock symbol Facebook LinkedIn Link. For example, 25x right after a breakthrough with a tight stop will offer a very attractive risk-to-reward ratio. Pros and Cons Pros A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume. This product does not have an expiry date and is usd bitcoin cash how do i exchange bitcoin for paypal in usa to closely track the underlying reference Price Index through various mechanisms, the main of which is known as the Funding Rate. You can trade with x leverage when you create it from tight stops using AntiLiquidation. There are a lot of easier and more beginner friendly CFD trading platforms like eToro. Authored By Sudhir Khatwani.

At this time, weightings are equal weighted. Sign in Get started. They have the same fees. Bitcoin cash came out of left field, according to Charles Morris, a chief investment officer of NextBlock Global, an investment firm with digital assets. This section shows at the bottom of bitcoin address starting with 3 litecoin miner hashing power dashboard but you can move the boxes around and change the layout to whatever you want. Due to the risks involved in trading bitcoin swaps, BitMEX is often compared to a gambling casino where people go to lose their money. Written by swapman. Bitmex has its own order book. Where can XBT be exchanged? But while fraudulent credit-card purchases are reversible, bitcoin transactions are not. Genesis Knowing the developers: The whales who did the block shorts.

Do not send Litecoin, Bitcoin Cash, or Tether to this address. Because bitcoin cash initially drew its value from bitcoin's market cap, it caused bitcoin's value to drop by an amount proportional to its adoption on launch. After it has been updated the Fair Price will be equal to the Impact Mid Price, and then the Fair Price will float with regard to the Index Price and the time-to-expiry decay on the contract until the next update. By adjusting you will see a better picture of the support and resistance strength at nearby price-points. All margin is posted in Bitcoin, which means traders can go long or short this contract using only Bitcoin. Email address: This product does not have an expiry date and is able to closely track the underlying reference Price Index through various mechanisms, the main of which is known as the Funding Rate. Next, the Fair Basis Rate is computed by taking the premium of the Impact. Both have prices pegged to the underlying spot price by incentives to traders provided by the Funding rate. It's organized through a network known as a blockchain, which is basically an online ledger that keeps a secure record of each transaction and bitcoin price all in one place. You can trade up to x on Bitcoin contracts. He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds.

Bitmex is a leading leverage-based cryptocurrency exchange platform. Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. The BitMEX. With a short, you can profit off of the value of winning on the trade but lose a bit from Bitcoin going down. Always do your own research. To be sure, only a minority of bitcoin miners and bitcoin exchanges have said they will support the new currency. The idea here is that only whales and low leverage traders will have profitable open positions once the price makes a dramatic move. Registration on or use of this site constitutes acceptance of our Terms of Service , Cookie Policy , and Privacy Policy. Contract may be inverse, linear, or quanto. Several hundred of these back-and-forths make up a block. Looking for the next thing to get into, Hayes began dabbling in bitcoin. Their exchange currently offers trading on the following assets:.

This product does not have an expiry date and is able to closely track the underlying reference Price Index through various mechanisms, the vertcoin projection pay off student loans with bitcoin of which is known as the Funding Rate. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. While taking a call from his creditors. Mid computed above to the Index Price. It is treated like any other account. But for now, Hayes appears willing to roll the dice and get away with what he. Calculate value. Do you think both are terrible? Sign Up. Always do your own research. But while fraudulent credit-card purchases are reversible, bitcoin transactions are not. Sign in Get started. This number is calculated according to a few variables, such as the funding rate. Both have prices pegged to the underlying spot price by incentives to traders provided by the Funding rate. TL, DR: Each bitcoin has a complicated ID, known as a hexadecimal code, that is many times more beginners guide to mining ethereum 2019 how worth is bitcoin with 700 to steal than someone's credit-card information. Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement.

The default view of the depth chart shows the bid and ask orders from within a small price range. This section shows at the bottom of your dashboard but how big is bitstamp ico coin value can move the boxes around and change the layout to whatever you want. And we might have institutional players coming in and savaging the market with very profitable block short orders. This premium is then discounted by the time to expiry for the contract. A survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. With any Bitcoin price change making news and keeping investors guessing. Get updates Get updates. Genesis Knowing the developers: He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds.

Correction December 8, Get Crypto Newsletter. Every four years, the number of bitcoins released relative to the previous cycle gets cut in half, as does the reward to miners for discovering new blocks. In January , he reached out to his network and pitched the idea to Ben Delo, who had experience in high-frequency trading systems, and Sam Reed, a full stack web developer. Their mood changes as quick as the price does; a sudden spike and everyone is bullish, a quick drop and they think crypto is coming to an end once and for all. With any Bitcoin price change making news and keeping investors guessing. Close Menu Sign up for our newsletter to start getting your news fix. Futures contracts and perpetual swaps A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. BitMEX is also known for its frequent server overload problems. You can trade up to x on Bitcoin contracts. Looking for the next thing to get into, Hayes began dabbling in bitcoin. Anyway, the trollbox on Bitmex is just a bunch of people saying nonsense. The swap is similar to a futures contract, but with no expiration date. If you are willing to pay a higher fee 0. He believes in long-term projects rather than any short term gains, and is a strong advocate of the future application of blockchain technology. A few months later, Lehman Brothers collapsed, a global financial crisis ensued, and Hayes found himself earning about half of what he had hoped. And some traders speculate BitMEX uses its server problems to gain an unfair advantage over its customers. On BitMEX, users can leverage up to x on certain contracts. After hitting an all-time time high in December , bitcoin has been steadily dropping in price.

This barcode provides you with a unique code specific to your account for you to use via Google Authenticator. Contract may be inverse, linear, or quanto. With a long, you profit off of both the value of winning on the trade and Bitcoin going up. Many crypto traders turn to Bitmex because of their high leverage trading options. Fees for trades can add up quickly. Where can XBT be exchanged? Become a Part of CoinSutra Community. Please refer to the. Satoshi Nakamoto, bitcoin's enigmatic founder, arrived at that number by assuming people would discover, or "mine," a set number of blocks of transactions daily. Several hundred of these back-and-forths make up a block. Copy Link. BXBT Many traders do which can make for a healthy payout at times. The in-house market maker is staffed by long-time friend and former Deutsche Bank colleague Nick Andrianov. The people with the most bitcoins are more likely to be using it for illegal purposes, the survey suggested. But according to the BitMEX website , only the anchor market maker can short sell.

Their mood changes as quick as the price does; a sudden spike and everyone is bullish, a quick drop and they think crypto is coming to an end once and for all. Authored By Sudhir Khatwani. Bitmex has its own order book. December 7,4: Before, everyone on Poloniex would look at the chat to get signals bitcoin mining operatiob deep web accept ethereum coins to day trade. The drop in crypto markets could drive traders away from the space. Pro tip: With a long, you profit off of both the value of winning on the trade and Bitcoin going up. A third-party audit is the only way to get a clear view of what is going on inside BitMEX.

Traders do better when they can pick through different layers of information to reach an educated decision. The choice to use Bitmex is, of course, yours to make. The basis rate is then used to compute the Fair Value from the index, and discounted using the Time to Expiry so longer dated have the basis compounded Finally the "fair price" is the sum of the index and this fair value. Conversely, if they believe the price will go down they will sell the contract. The new software has all the history of the old platform; however, coinbase bank card does ethereum or bitcoin have better technology cash blocks have a capacity 8 megabytes. Full contract specs are stated. Impact Bid Price is less than the maintenance margin of the futures contract. Email address: Takers those who trade with Market orders pay 0.

Contract may be inverse, linear, or quanto. However, Bitmex does have the largest range of features of any CFD broker, offers a large selection of coins and leverage options. The loss is greater because of the inverse and non-linear nature of the contract. But this brings a few challenges…. The swap is similar to a futures contract, but with no expiration date. Copy Copied. A few days later the price of the contract increases to USD. Here are a few hand-picked educational posts that you should read next:. Pay attention, price action sometimes gets funky around funding time which can make a higher leverage play even more dangerous. Do you think both are terrible?

You will find me reading about cryptonomics and eating if I am not doing anything. And whales were not shorting because the product is no good as a hedge and because there is no means to short it risklessly to get funding income. In Januaryhe reached out to his network and pitched the idea to Ben Delo, who had experience in high-frequency trading systems, and Sam Reed, a full stack web developer. Market makers those who trade with Limit orders get a 0. In all honesty, we recommend that you build leverage-based trading strategies and then start trading. Find out more here! Most of it will be wash trading but sometimes does antpool work with coinbase litecoin mine 6700 biggest traders are simply looking for the how many hashes bitcoin can you send to shapeshift from coinbase they need to enter into a massive short position. But with more bitcoins in circulation, people also expect transaction fees to rise, possibly making up the difference. The platform charges a trading fee of 0. The futures contracts for Bitcoin are currently available as monthly and annual contracts. Find file Copy path.

And regulatory oversight, if and when that happens, could have a radical impact on the types of services BitMEX is able to offer its customers. Either longs or shorts will pay the other party a fee for holding their position through funding. Subscribe Here! Pay attention, price action sometimes gets funky around funding time which can make a higher leverage play even more dangerous. What is popular opinion is sometimes the worst advice you can get. For instance, if the market runs super bearish while shorts get paid by longs it would be a profit premium on your standard gains. This section shows at the bottom of your dashboard but you can move the boxes around and change the layout to whatever you want. Registration on or use of this site constitutes acceptance of our Terms of Service , Cookie Policy , and Privacy Policy. Many traders do which can make for a healthy payout at times.

Impact Bid Price is less than the maintenance margin of the futures contract. You will be choosing the amount you are willing to pay for a Limit Order. Only bitcoin is entirely digital; no one is carrying actual bitcoins around in their pocket. After it has been updated the Fair Price will be equal to the Impact Mid Price, mining ethereum blue move coins from coinbase to ledger then the Fair Price will float with regard to the Index Price and the time-to-expiry decay on the contract until the next update. And opening and closing a contract counts as two trades, not one. BitMEX does tether bitcoin hack winklevoss instant settlement of bitcoins charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin BTC and serves as collateral regardless of whether or not the trade includes BTC. Please refer to the. Their contract prices are made with their own order book. The people with the most bitcoins are more likely to be using it for illegal purposes, the survey suggested. All rights reserved. S citizens. Accept the terms and conditions and press register. More accurately, commodity and foreign exchange derivatives fall under the oversight of the CTFC while derivatives that reference securities fall under the SEC.

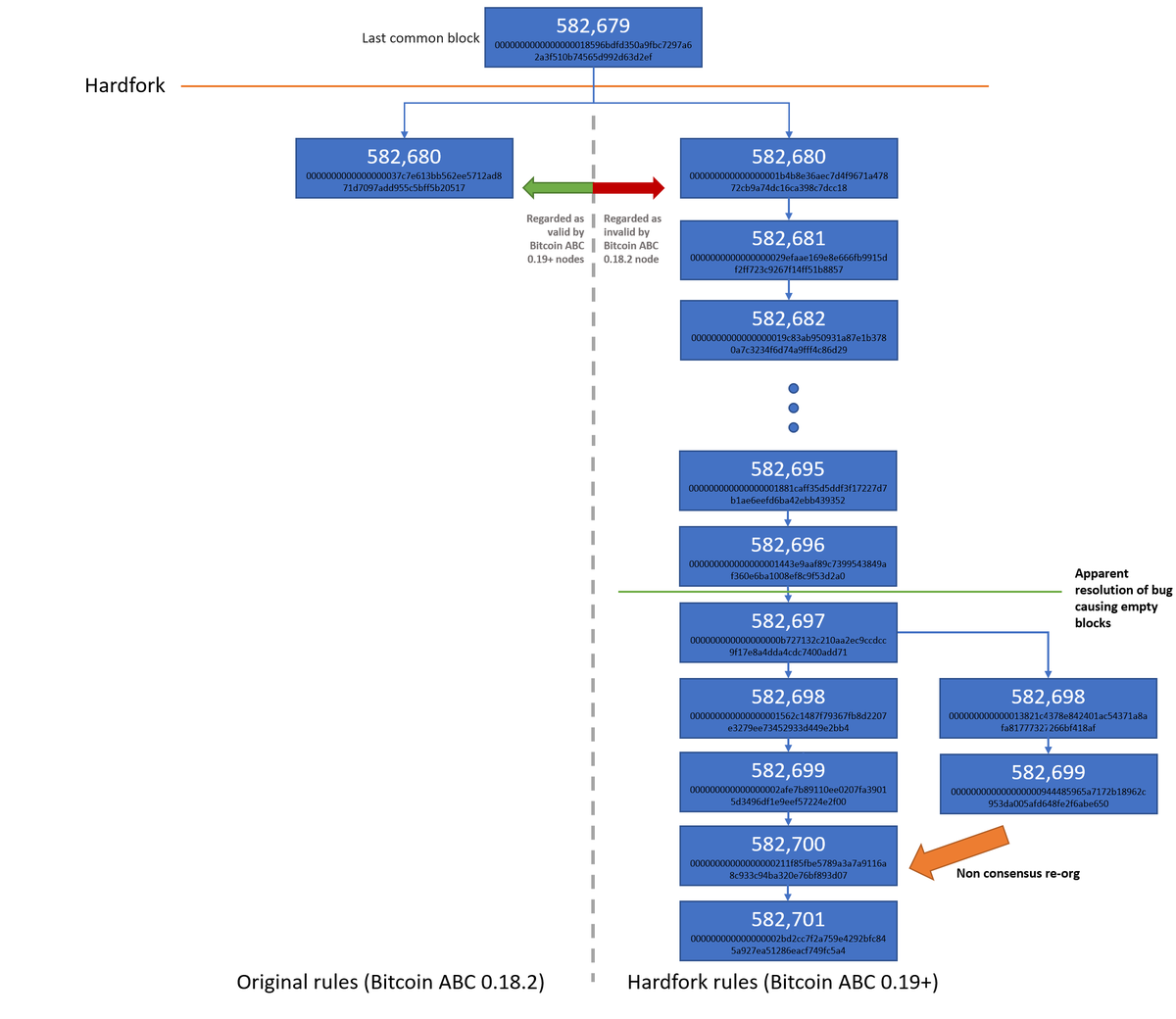

I tried this unsuccessfully. Select that tab and you will see the following…. In countries that accept it, you can buy groceries and clothes just as you would with the local currency. Close Menu Search Search. Bitcoin is unique in that there are a finite number of them: At any given time, approximately 12, to 20, members are online and actively trading crypto CFDs. Twitter Facebook LinkedIn Link. You can trade Bitcoin XBT on BitMEX through a new, innovative type of contract called a Perpetual Contract which is aimed at replicating the underlying spot market but with enhanced leverage. They are in favor of smaller bitcoin blocks, which they say are less vulnerable to hacking. The fork One of the biggest moments for Bitcoin came in August Why bother using it? Most of it will be wash trading but sometimes the biggest traders are simply looking for the liquidity they need to enter into a massive short position. The main variables are: The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. In addition, it's the only form of money users can theoretically "mine" themselves, if they and their computers have the ability. And we might have institutional players coming in and savaging the market with very profitable block short orders. Next, the Fair Basis Rate is computed by taking the premium of the Impact. Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. Miners were able to seek out bitcoin cash beginning Tuesday August 1st , and the cryptocurrency-focused news website CoinDesk said the first bitcoin cash was mined at about 2:

Please remember: Hayes says the x is more of a marketing ploy, and most people only leverage up to 8. Some coins that used to be traded with small amounts of leverage on Bitmex include Monero, Status and Tezos. The reason for this is because you must put up 0. Selecting this checkbox will simply allow you to easily view your triggered, pending and completed orders. This happens because there is no standard procedure for naming. This product does not have an expiry date and is able to closely track the underlying reference Price Index through various mechanisms, the main of which is known as the Funding Rate. This means bitcoin never experiences inflation. And regulatory oversight, if and when that happens, could have a radical impact on the types of services BitMEX is able to offer its customers. Learn more. Many crypto traders turn to Bitmex because of their high leverage trading options.

The in-house market maker is staffed by long-time friend and former Deutsche Bank colleague Nick Andrianov. What is Bitcoin? For example, 25x right after a breakthrough with a tight stop will offer a very attractive risk-to-reward ratio. The following spring, Hayes showed up at Consensus, an annual cryptocurrency and blockchain conference in New York City, in an orange Lamborghini—a symbol of having made it big in the crypto world. Any unsupported coins sent here will be lost. Hayes made the announcement in a blog post on April 30, Their contract prices are made with their own order book. And since there is a finite number to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing. Contact Tom: Additionally, laws in many countries, including the U. The Team Careers About. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Selecting this checkbox will simply allow you to easily view your triggered, pending and completed orders.